I was at TradeTech the other day, one of the largest conferences and exhibitions focused upon buy and sell side technologies.

It had a good attendance and agenda, although I did wonder why it was sponsored by Virgin Money.

As I walked into the London Excel Centre, where this year’s TradeTech was held (next year it looks like being back in Paris), I was amazed at the over-the-top Virgin branding all over the walkways.

Maybe this is the new ploy of Jayne-Anne Ghardia, the Virgin Money CEO, who has decided to take on Goldman Sachs rather than easier targets like NatWest.

But no!

In a BBC interview this weekend, Jayne-Anne makes it quite clear what their strategy is:

The five big banks are much of a muchness, so people can't understand what difference in service they'd get if they went from bank A to bank B.

Transparency would help with that. They feel they could have their standing orders and direct debit left behind, because it's not straight-forward to transfer your account from one bank to another.

I have been pushing to have a portable account number, like one national insurance number for every employer, and one telephone number you can take with you whichever provider.

As she only mentions five banks in that quote, it's obvious they are more interested in retail than investment banking.

Oh, and then I get into the Excel Centre and find that the London Marathon registration desk is there sponsored by Virgin Money, and nothing to do with TradeTech at all … ah well.

Then I find there’s a bunch of folks shouting and chanting.

They’re protesting about something to do with BP.

Banker’s Pay?

Banks’ Profits?

Banking Panaphobia?

Oh no, it’s something far more mundane … Broken Pipe … sorry, no scrub that. It’s just the BP Oil Company, suffering from lots of protestors who seem to dislike them for some reason.

Their AGM happened to be taking place the same day as I’m walking into TradeTech.

Wow!

It’s a busy morning already and I haven’t even got into the show yet.

Then I do and it’s the usual TradeTech with lots of buzz about the flash crash and concerns about the future.

The main reason I came along was to hear Baroness Eliza Manningham-Buller, former head of MI5.

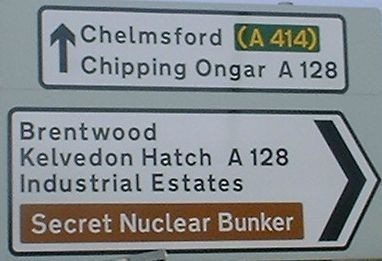

A bit like Britain’s “Secret Nuclear Bunker” …

… you do wonder why the head of MI5 is so well-known to the world, but then it’s no longer the secret service. Instead it’s just another government department or, as chair for the day John Humphreys kept saying, it’s all about Spooks.

In this case, the Spooks are the ghosts of the secret service who quietly target terrorists all the time and generally keeping the bad guys at bay, day after day.

It’s not MI6. That’s James Bond, M and Q. They keep the bad guys out overseas. MI5 target the bad guys in the UK, but it’s much the same line of work.

What’s this got to do with trading strategies you wonder?

A lot as it turned out, as her theme was all about dealing with challenge and making difficult decisions under pressure.

We are “sifting through a torrent of information all the time, looking for the one bit that might indicate when something will happen”, she began.

Wow! That’s what traders do, using technology to sift through thousands of bids and offers all day to find the ones that match.

Baroness Eliza was head of MI5 from October 2002 to April 2007, during the period of the shoe bomber, the bottle bombers at Heathrow, the 7/7 tube bombings of 2005 and the follow up shortly after on 21/7 when the bombs luckily didn’t ignite.

A dangerous period.

The issue, she stated, is that you have all this data but “if you go too soon, there’s not enough evidence to charge; go too late, and the bomb’s gone off.”

This was the issue of 9/11 apparently, where “we knew a bomb was going to go off – just didn’t know where or when.”

What was worrying is that “if the plot at Heathrow had worked, it would have been far bigger than 9/11.”

This was the 2006 terrorist plot to detonate liquid explosives on at least ten airliners travelling from the United Kingdom to the United States and Canada.

MI5 intelligence caught the plan before it was executed, but it resulted in the introduction of these dreadful restrictions of 100ml bottles as a limit on all carry-on luggage.

She was asked if that was really necessary during the Q&A, and said that “the liquid bombers had drilled a hole in the bottom of a drinks bottle. They had then taken the drink out, filled the bottle with liquid explosives and the bottle looked unused because the seal on the top of the bottle was unbroken. They then had disposable hammers that would act as the detonator by hitting the bottle from underneath. It was easy if they had got away with it. For these reasons, removing shoes and liquids at airports does make sense.”

You may or may not agree, but the scariest part of her presentation was probably the bit where she said that “7/7, 21/7 and the shoe bomber were all under my watch, and two out of three failed due to the incompetence of the terrorists. However, there were 12 other attempts you didn’t see …”

It’s all about finding needles in haystacks using intelligence and technology.

Isn’t that what trading is all about?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...