For years, marketing and market research firms have talked about demographics, using job, age and location as a way of targeting customers.

We talk about ACORN and MOSAIC, two classification systems for targeting consumers with offers.

MOSAIC is used by Experian to classify UK households, with the current version structuring the 61,838, 154 individuals in the UK into 15 main socio-economic groups and, within this, 67 different types. ACORN divides the population into five categories from Wealthy Achievers (25.1%) to Hard Pressed (22.4%). Within this, we have a heavy dose of age demographic categorisation too, with categories such as “Affluent Greys” – old folks with money – and “Burdened Singles” – young folks without money.

Such things are meant to determine what people will buy and use, their attitudes towards offers and firms, their education and sophistication, and so on and so forth.

From a marketing perspective, they are useful.

From a banks perspective, they are good indicators of wealth, affordability and income.

The trouble is that it leads us down the road of ignorance, because we often use such classifications to stereotype.

As a result, we think of people in these buckets of lifestyle, and you can never believe what you think.

Two examples.

When all of the new media has arisen of recent times, most of my time was spent either (a) explaining what it was, (b) talking about who uses it, and (c) educating why it is relevant to a bank.

During 2005 through 2008, I spent almost every day asking if anyone used Facebook or had heard of Twitter.

Now, of course, we all know what these things are although I still struggle to explain why it’s relevant to a bank as many people, even now, say to me: “oh, that’s for the young people isn’t it?”

No!

It’s not!

It’s not even for anyone who wants to socialise online.

It’s for anyone who wants to COMMUNICATE online.

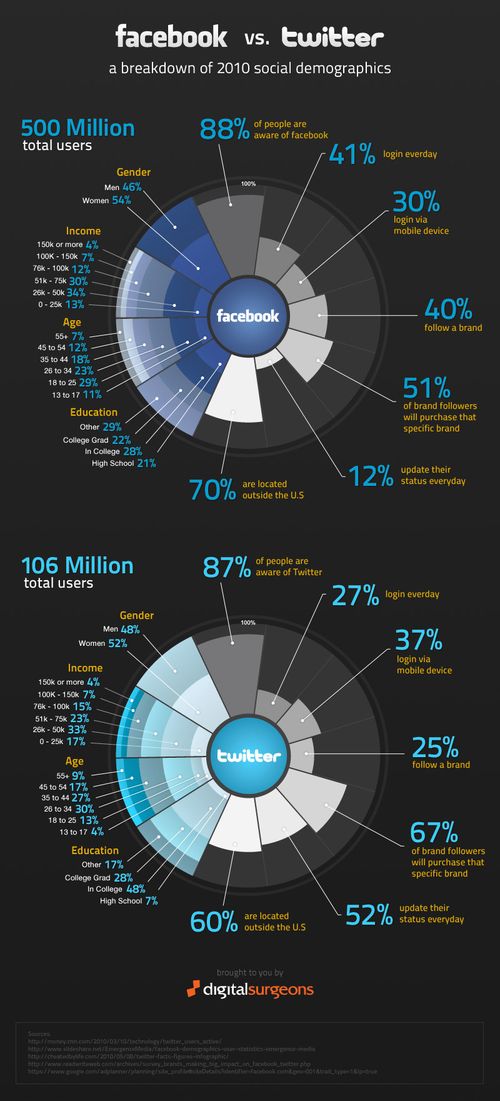

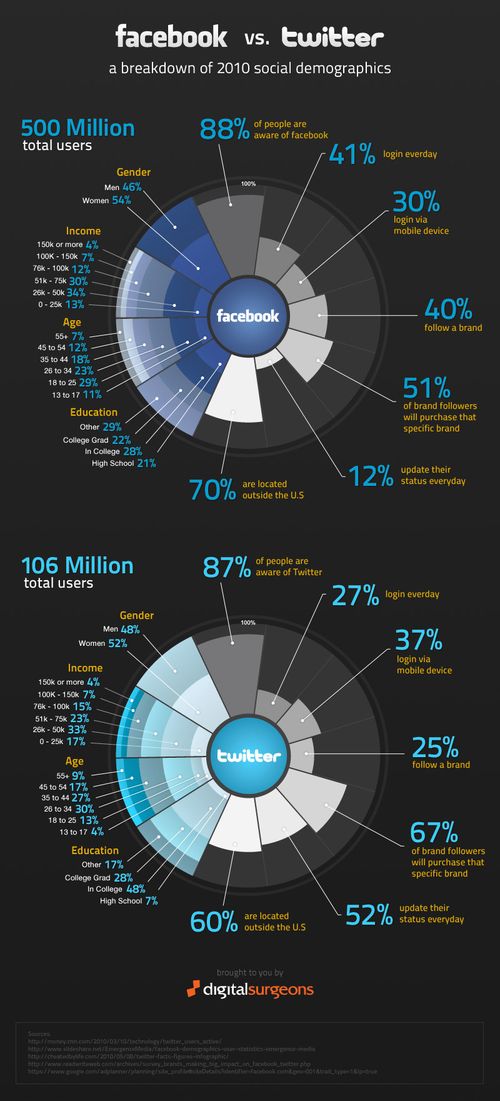

It is why Facebook has far more users http://www.checkfacebook.com/ over the age of 25 than under, and Twitter even more so …

Most social media users are wealthy, educated, in employment and mature, so this is your target audience.

However, going back to our stereotypes and demographics, the belief that such media was for youth stems from our sterotype of new technology that is hip and cool being for those who adapt the fastest: youth.

It's not.

It's for those who enjoy the way technology improves their lives, which can be almost anyone.

Stop believing that tech is for youth.

You can never believe what you think.

Second example.

I spent some time with a bank a little while ago, who were proud of their new branch layout.

The branches had several conference room areas for private consultations.

In particular, they had designed two rooms for high net worth individual dialogue.

The Senator Room is a lavish, leather and oak room, styled as an old library with deep pile carpeting. It is for the affluent senior to talk about their investment portfolio and retirement needs.

The iPod Room is all plastic and cool bucket seats, styled like some sort of hip thing from Space 1999, it was targeted at the youth audience who would want to be hip and cool as they talked about their needs.

When the branch opened, the young folks naturally went to meet their bank advisors in the Senator Room, whilst the old folks wanted to talk in the iPod Room.

The reason?

Young people want their bankers to be serious, capable and to have gravitas; old folks want to regain their youth, and feel that they’re hip and cool by being in the youth area.

Stop believing that tech is for youth.

You can never believe what you think.

FYI, here are the 55 ACORN categories of consumer demographic:

Wealthy Achievers

Wealthy Executives

- 01 - Affluent mature professionals, large houses

- 02 - Affluent working families with mortgages

- 03 - Villages with wealthy commuters

- 04 - Well-off managers, larger houses

Affluent Greys

- 05 - Older affluent professionals

- 06 - Farming communities

- 07 - Old people, detached houses

- 08 - Mature couples, smaller detached houses

Flourishing Families

- 09 - Larger families, prosperous suburbs

- 10 - Well-off working families with mortgages

- 11 - Well-off managers, detached houses

- 12 - Large families & houses in rural areas

Urban Prosperity

Prosperous Professionals

- 13 - Well-off professionals, larger houses and converted flats

- 14 - Older Professionals in detached houses and apartments

Educated Urbanites

- 15 - Affluent urban professionals, flats

- 16 - Prosperous young professionals, flats

- 17 - Young educated workers, flats

- 18 - Multi-ethnic young, converted flats

- 19 - Suburban privately renting professionals

Aspiring Singles

- 20 - Student flats and cosmopolitan sharers

- 21 - Singles & sharers, multi-ethnic areas

- 22 - Low income singles, small rented flats

- 23 - Student Terraces

Comfortably Off

Starting Out

- 24 - Young couples, flats and terraces

- 25 - White collar singles/sharers, terraces

Secure Families

- 26 - Younger white-collar couples with mortgages

- 27 - Middle income, home owning areas

- 28 - Working families with mortgages

- 29 - Mature families in suburban semis

- 30 - Established home owning workers

- 31 - Home owning Asian family areas

Settled Suburbia

- 32 - Retired home owners

- 33 - Middle income, older couples

- 34 - Lower income people, semis

Prudent Pensioners

- 35 - Elderly singles, purpose built flats

- 36 - Older people, flats

Moderate Means

Asian Communities

- 37 - Crowded Asian terraces

- 38 - Low income Asian families

Post Industrial Families

- 39 - Skilled older family terraces

- 40 - Young family workers

Blue Collar Roots

- 41 - Skilled workers, semis and terraces

- 42 - Home owning, terraces

- 43 - Older rented terraces

Hard Pressed

Struggling Families

- 44 - Low income larger families, semis

- 45 - Older people, low income, small semis

- 46 - Low income, routine jobs, unemployment

- 47 - Low rise terraced estates of poorly-off workers

- 48 - Low incomes, high unemployment, single parents

- 49 - Large families, many children, poorly educated

Burdened Singles

- 50 - Council flats, single elderly people

- 51 - Council terraces, unemployment, many singles

- 52 - Council flats, single parents, unemployment

High Rise Hardship

- 53 - Old people in high rise flats

- 54 - Singles & single parents, high rise estates

Inner City Adversity

- 55 - Multi-ethnic purpose built estates

- 56 - Multi-ethnic, crowded flats

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...