I’ve been on travels lately and found myself seriously questioning cash.

It began on the journey out to Iceland when I decided ot get some cash from the AMEX office at Heathrow airport.

First, the AMEX office wouldn’t take my personal BA-AMEX card, but would accept my AMEX corporate card. No explanation, rhyme or reason.

I should have given up there and then as when the surly AMEX assistant – Heathrow Terminal 1 assistant, name of Prakash fyi – handed over the cash, it was all in ISK500 notes.

ISK500 is worth about £2:50 (€3, $4), so over 100 ISK500 notes was really appreciated.

It was also at a seriously rubbish exchange rate, but I was drawn in by the promise of no commission and a free stress ball. I never got the stress ball, even though the exchange stressed me out.

I then landed in Iceland only to be told that no-one uses cash anymore.

Like many of the Scandinavian countries, cash has been replaced by card and everyone accepts cards from taxis to buses to newspaper kiosks to geysers in bars. So no cash needed.

As a result, I felt like the most uncool person in Iceland as I wandered around paying for things with ISK500 notes that raised surprised eyebrows everywhere.

I therefore made a decision that on my next trip I would go cashless.

This was to Denmark and Germany last week, and turned out to be surprisingly easy. Well, in Denmark anyway.

Everywhere I went, I got out my trusty piece of plastic and everyone smiled and happily took the payment via their cellphones and terminals. Most taxis had a payments app they used easily to process payments, and even offering the card in exchange for a beer was no problem.

Germany was slightly more difficult.

Arriving at the hotel and offering the taxi driver the card in payment resulted in a “oh, you want to pay by card?” as though I was causing a problem.

I think I was as it took the driver about ten minutes to boot up his phone app but, eventually, payment processed no problem.

I made sure that, on the return taxi, they were aware that I wanted to pay by card beforehand.

Now the travails and travels of a cashless European may be of little interest or surprise to those of you more on the leading edge of mobile payments and cards but, for a grumpy old Brit, this was a bit of a revelation for me.

You see I live in a world where most stores have signs saying “no cards accepted for payments under £20” and the sight of card in payment for a beer or newspaper would be viewed with incredible suspicion.

No such challenge in most of Europe and, in Scandinavia, the sight of someone with wads of cash is seen as being of more suspicion.

This then got me thinking about cash, cashless and competitiveness.

According to most of the research I’ve seen, the minimum a country can get cash down to is around 4% of all payments by value and around 30% of all payments transactions.

Cash is still used for predominantly small payment exchanges between individuals as a value exchange that is trusted, immediate and anonymous.

This may not be the case for the long-term as smartphone apps allow P2P payments to be made easily, but it is certainly the case in economies that are cash minimised.

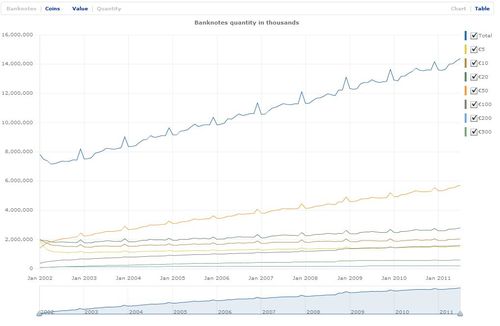

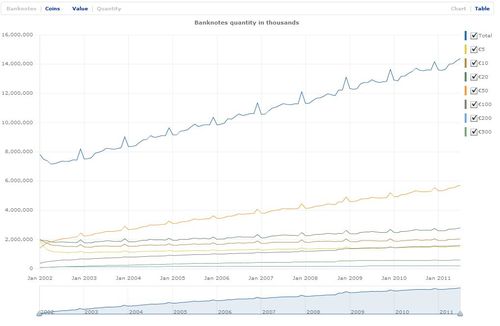

Even in cash-based economies, cash is reducing at an increasing rate. For example, the Royal Mint tell me that new coins have halved in production in the UK over the past 15 years, and the ECB say that euro note production is still increasing but a decreasing rate too (see chart at end of entry).

There’s then the argument that cashless creates competitiveness, with Singapore, Finland and other nations believing that their high ranking in the World Economic Forum’s annual global competitiveness league is due to their highly electronic payment oriented economies.

Whether true or not, there is certainly something to be said for economies that make the electronic transaction process simple for commerce and, above all of these things, it tells me that the world will be reducing physical cash flows rapidly over the next decade.

Will these lead to a cashless society?

No.

Cash is still an essential source of commercial flow for most economies as it still has the trust for an immediate exchange of value anonymously.

But it will lead to a less cash society.

Equally, as mobile apps take off and replace cards and cash flows, it wouldn’t surprise me if cash reduced to under half of its current volume even in the most electronic societies of the Scandinavia’s, Singapore’s and similar.

That could mean cash reducing to under one percent of payments by value and less than 20 percent of payments transactions in the near term.

Now that would truly be a cash less society.

Postnote:

Worth a look at the ECB’s trends for Euro notes (double click image to see larger version):

And it costs more to print a dollar bill than it’s worth, even though cash in America is unlikely to disappear in the near term. As discovered in a recent research note by friend Ron Shevlin at Aite Group:

“Despite forecasts of a cashless society, the United States is nowhere near the realization of this vision. In fact, if the use of cash were to decline by 17% every five years—our forecast for 2015—the use of cash in the United States wouldn’t fall below US$1 billion before the year 2205, roughly 200 years from now.”

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...