I discovered a fascinating report from Mobey Forum this morning.

It was released this week, and says that “providing consumers with the convenience and functionality of mobile wallet technology will not be sufficient to drive mass-market adoption”.

Mobey Forum – which describes itself as “the global bank-led industry association defining a prosperous mobile financial services ecosystem” (try saying that one at a drinks party and enjoy drinking on your own) – make it clear that simply taking a traditional wallet and sticking it into a mobile app is a waste of space.

They assert that, instead, the mobile wallet needs to leverage value through loyalty schemes, coupons and offers to be more relevant to the consumer than their old wallet.

In fact, the paper claims that of the three factors that motivate mobile wallets – convenience, security and value – it is the last one that is the most important, even though it is the last well defined.

They also note the confusion created by terminology, with most of using phrases like mobile money, virtual or digitised or electronic or mobile “wallets” or “purses”, and make a clear definition of what is a mobile wallet.

“A mobile wallet is functionality on a mobile device that can securely interact with digitised valuables. Mobile wallet may reside on a phone or on a remote network / secure servers. It may be only accessed via a mobile device, and also managed and used with it. Most importantly, it is controlled by the user of the wallet.”

They also make clear that “a mobile wallet without payments means is not a working wallet”.

They then make a call to ensure that mobile wallets are offered as open platforms where the user is in control, rather than anything system limited by the provider. An interesting concept, and one that will be intriguing to see how it plays out, e.g. will Citi, BNP, Deutsche, HSBC et al be happy to co-reside in an open platform ecosystem?

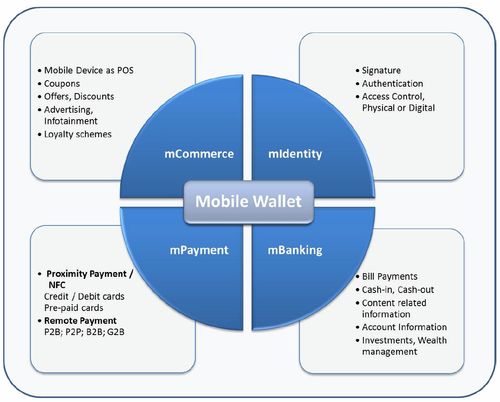

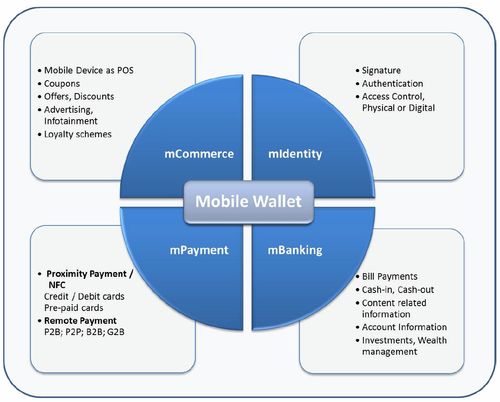

Finally, they have a lovely little chart in there that shows the mobile wallet ecosystem and attributes (doubleclick chart for bigger verson):

Here’s the full paper for a download if you’re interested, and this is the first in a series of papers from Mobey Forum to “provide the industry with a new level of thinking on what is required of stakeholders to facilitate widespread market adoption of the mobile wallet”.

The other papers will look at the control points, industry stakeholders, security and value propositions for mobile wallets, all of which will be found at www.mobeyforum.org.

Meanwhile, I’ve been receiving a few more nudges of mobile videos of financial apps, so here’s a few of my favourites.

This is the best lifestyle version I’ve seen lately, from my mates at Banco Sabadell, Spain:

This one, from OCBC in Singapore, allows you to scan your bills to pay them with a swipe (checkout one minute into the video):

But my favourite is this one ‘cos it’s incredibly cheesy:

If you like these, then you can find more of the best mobile financial videos on the web here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...