After the Tudors, England went through a period of massive turmoil under the new Royal Household of the Stuarts.

Throughout the 17th Century, the Royal Household (the Crown) and Government (Parliament) were at war, both figuratively and literally.

The 1640s saw a massive revolution in the country, with the execution of King Charles I, and was followed by another in 1688.

This tension between the Crown and Parliament was only resolved at the end of the century and led specifically to the creation of the Bank of England and many other financial reforms, most of them under the leadership of the hedonistic King, Charles II.

For example, Charles’s household laid the core tenets of today’s Treasury, Exchequer and Central Bank operations.

The core of these changes were around the separation of the Treasury from the Exchequer.

The Exchequer was established in England in the 12th century during the reign of Henry I. Its original purpose was for collecting and issuing money, and to audit money paid to the Crown. Part of the Exchequer was the Treasury, the place used to keep the King’s treasures.

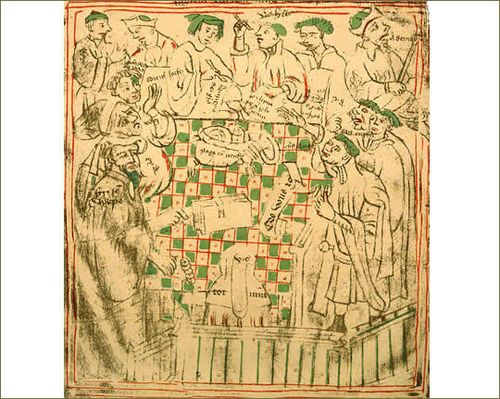

The Exchequer gradually took on other functions, such as the collection of taxes, and acted as a court of law to decide what was legally owed to the Crown, and was named after the chequered cloth on the table where the treasurer inspected the accounts of the sheriffs, the men responsible for the king's interests in the counties.

For most of the medieval and Tudor period, the office of the Treasurer was part of the Exchequer but it became clear during their period that the Exchequer wasn’t very good at its job.

For example, England’s war with France had led to a deficit of £30,000 in 1433, the equivalent of over £100 billion today, which caused the collapse of many Italian banks.

You would think the banks would learn their lesson but, by the 1670s, the Royal Household was in dire straits once again.

This was down to the Stuarts – the Royal Household for England, Scotland and Ireland during the 17th century – undergoing a time of extremes.

In particular, England’s Civil War (1642-1651), the Great Plague (1663) and the Great Fire of London (1666) had left the King’s finances in a poor state.

This dire situation with the King’s finances is easily illustrated by the fact that the English Navy was so seriously underfunded that its flagship, the Royal Charles, was seized by the Dutch in 1667.

Arrival of the English Flagship Royal Charles, painting by Jeronymus van Diest II from the Rijksmuseum Amsterdam (note the Dutch flag at the rear and English flag flying upside down from the main mast)

Charles decided to do something about it and appointed a Commission to replace the Treasurer.

George Downing, who built Downing Street, was appointed Secretary to that Commission and was instrumental in major reforms which led to the Treasury breaking away from the Exchequer.

This was in June 1667, when it was determined that all money voted for by Parliament must also have specific Treasury approval before it can be given. This rule still holds today, and is the reason why Parliament, the Chancellor and the Treasury release an annual budget statement.

It was during the Stuarts reign that goldsmiths ran England’s banking system.

As mentioned previously, it was during the Tudor period that goldsmiths changed from passive deposit takers, offering physical security for the wealth of their clients, to offering credit on the security of the assets at this disposal.

By the mid-17th century, the goldsmith bankers had a virtual monopoly on banking and had made extensive loans to King Charles II.

In 1672 however, Charles II had become so heavily indebted that he could not pay, and announcement that he would suspend repayments of loans to his bankers for a year.

This resulted in five of the leading goldsmith banks going bust.

There was obviously unease about the situation, with more talk of Civil War, unless some form of guarantee was put into play for Royal, or rather governmental loans.

This was when George Downing – who was looking after the Treasury separating from the Exchequer, working with several other people including Isaac Newton who was Master of the Mint – introduced the idea of raising money by selling marketable Treasury orders with a guaranteed repayment date.

Today, these are known as government bonds and eased the pressure a little on the Royal office for funding the Anglo-Dutch war.

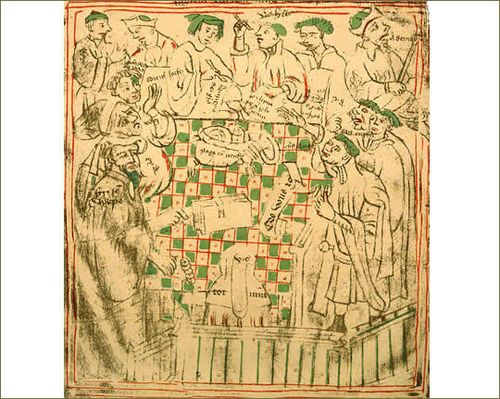

It didn’t solve the situation however, as the King once again defaulted on loans with this speech given to his bankers on February 8th 1676:

Gentlemen,

I have always resolved to show myself an honest man in paying my debts, and its not my fault that I cannot repay you with the same frankness you used ... in lending it, but having been so honestly dealt with by you, I will pay it as well as possibly I can. And to that purpose tomorrow will pass an Order in Council for the Settling ye Interest of it, till I can pay the principall and according to your owne desires too, upon the Excise.

Speech plate as shown in the Bank of England Museum

Some say that his debt difficulties weren't just due to war, as the King regularly dipped into the country's purse to fund his hedonism.

The financial issues, combined with disagreement over foreign and religious policies, meant that the Crown and Parliament had more arguments for years to come until Parliament was dissolved in 1681 and King Charles ruled alone.

These actions led to Revolution once more, with William and Mary taking the throne in 1688.

The new monarchs represented a far more stable political environment, but their finances were still deteriorating badly due to war with France.

By 1694, King William III was spending over £2½ million a year on the army alone, and were in desperate times.

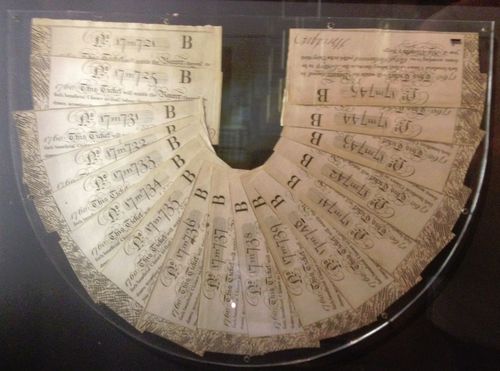

Times were so desperate they launched a lottery to raise £1 million, with large cash prizes on offer.

Lottery tickets dated 1769, as shown in the Bank of England Museum. The tickets are signed by John Bridger, Chief Cashier at the Bank of England and lotteries were used regularly from the late 17th century to the 19th century as a fast way of raising money to meet state expenditure needs. The Bank acted as registrar and received subscriptions on behalf of the government.

It was in this moment that the Bank of England was born.

More about that in the next part of How the City Developed.

Previous entries include:

- Part One: The Romans

- Part Two: The Vikings

- Part Three: Medieval Times

- Part Four: The Tudors

- Part Five: The Stuarts

- Part Six: The Bank of England

- Part Seven: Lloyd's of London

- Part Eight: The London Stock Exchange

- Part Nine: The 1700s

- Part Ten: The Victorians

- Part Eleven: World Wars

- Part Twelve: After World War II

- Part Thirteen: The Big Bang

- Part Fourteen: Crisis

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...