The first proper bridge in London was built in 1176 and completed in 1209.

There had been other bridges built by the Romans and Vikings, but these were always of wood and generally got burnt and pulled down.

The bridge of 1209 was built of stone, and had longevity.

In fact, it was the only bridge in London until 1750, and was believed to be a wonder.

Even before it was completed, houses were being built on the bridge up to seven storeys high. It was 900 feet long and twenty feet wide, and had 138 shops as well as dwellings according to a survey of 1358.

The bridge stood between Southwark Cathedral on the South of the River across to where Cannon Street the Monument is today at Old Fish Street Hill.

View of London Bridge from the Southwark side by Visscher, 1616

Interestingly, when another King Edward battled and lost to the Scottish at Bannockburn, the traitor William Wallace – otherwise known as Braveheart – was captured, and brought to London to face charges of treason.

Found guilty, he was hung, drawn and quartered, and then his head cut off and placed on a stake at the southern gate of the London Bridge. It stayed there from 1305 until 1678, as the head was parboiled and tarred to stop scavenging birds from stripping the head of its features.

In this way, Wallace was joined by many other traitors’ heads with, by the 1590s, about thirty of them staked above the gate including Thomas Cromwell and Sir Thomas More. You can see the heads above the gate entrance in Visscher's painting above.

The bridge had a few issues during its life – it was damaged by fire in 1212, 1633 and 1666 when the Great Fire burnt a third of the bridge – and was demolished in 1760 to build new bridges, as London was now a sea faring centre and larger ships needed access.

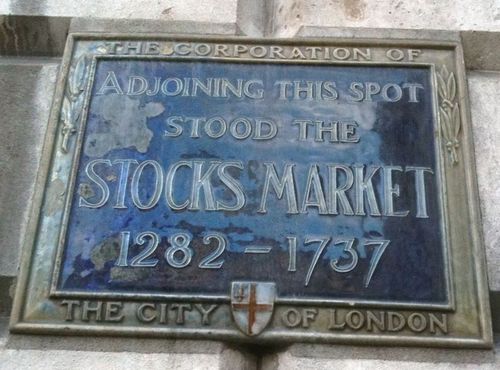

It was due to the fire damage of 1212 that the London Stocks Market was created in 1282.

The Stocks Market was established on the site of where the London Mansion House sits today.

The Mansion House is the home of the Lord Mayor of London, as discussed on this blog before, and can be found just by Bank tube, next to the Bank of England.

Before the Mansion House was built, the site was where the Stocks Market operated from 1282, the invention of the then Lord Mayor of London, Henry le Walleis or Waleys.

The Stocks Market was a centre for the selling of livestock and other goods from ‘trusted’ merchants – anyone selling rotten fish and fruit were driven away from the site by the market managers – and Henry le Walleis gave the lease income from the market for the funding of repairs and maintenance of the London Bridge.

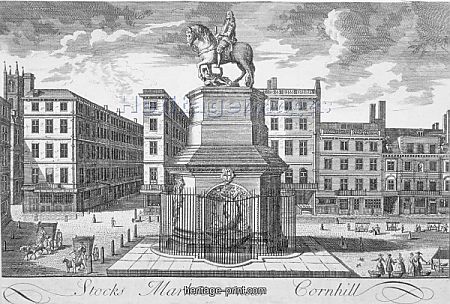

The London Stocks Market was rebuilt many times and, by 1675, was a major hub for trade and life in London, particularly financial trade.

A view of the Stocks Market, Poultry, looking from the west, City of London, 1700. In the centre is the equestrian statue of King Charles II.

The Stocks market ended in 1737 to make way for the Mansion House.

Meanwhile, during this period, the main reason why London had become such a hub of finance is largely thanks to the vision of Sir Thomas Gresham, 1519 – 1579, banker to Queen Elizabeth I.

More about him tomorrow.

Previous entries include:

- Part One: The Romans

- Part Two: The Vikings

- Part Three: Medieval Times

- Part Four: The Tudors

- Part Five: The Stuarts

- Part Six: The Bank of England

- Part Seven: Lloyd's of London

- Part Eight: The London Stock Exchange

- Part Nine: The 1700s

- Part Ten: The Victorians

- Part Eleven: World Wars

- Part Twelve: After World War II

- Part Thirteen: The Big Bang

- Part Fourteen: Crisis

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...