For most of my life, I’ve been aligned to the financial services industry as a supplier of technology.

Throughout this time, my role has been as a solutions person, providing technologies that solve financial processing problems.

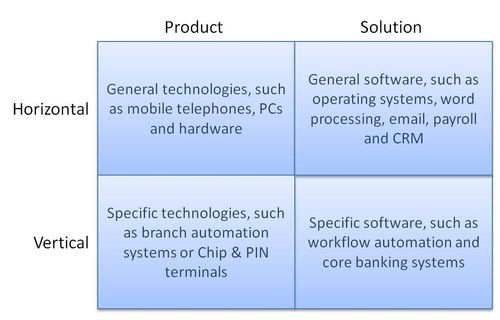

And, throughout this time, I’ve dealt with technology companies that struggle with moving from being horizontal to vertical, from generic to specific, from platform to solution.

It cropped up again yesterday, where a company that is well established has now realised they need to be vertically aligned to the financial industry rather than generically offering products.

Before I go any further, I should point to the differences between solution versus product from an earlier blog:

Product people are myopic. They are short on everything. Short-sighted, short term, short on time and short on developing relationships ... Solutions sellers are different, as by their very nature they want to know your problems first.

The discussion went from horizontal providers offering generic products to the need for vertically aligned firms providing specific solutions to specific markets, and the challenges of how to get from A to B.

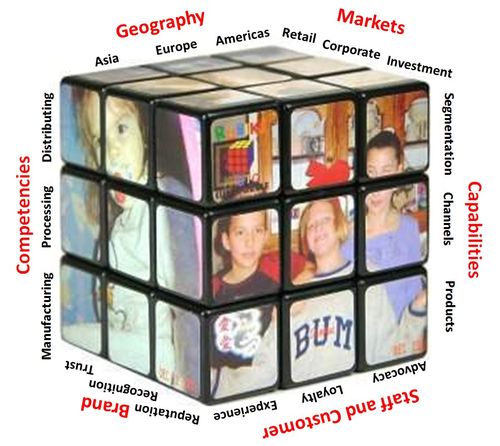

Banks provide a specific challenge in this context as they are so complex, with so many lines of business and so many regions of interest, that nothing can provide a single solution to all the problems of the bank worldwide.

They are not one-dimensional, which an enterprise solution would imply. They’re not even two- or three- dimensional. A bank is more like a Rubik’s Cube, with so many dimensions, facets, structures and operations.

That is why there is no such thing as an enterprise approach … unless it’s one-dimensional.

What is one-dimensional?

The rollout of an operating system or a communications tool, such as a mobile telephone.

Once the central decision is made, a bank can roll-out a standard single dimensional product to all people.

Other examples include email, word processing, payroll and more.

This is well illustrated by the decision by one bank to adopt Google cloud services for example.

The headline states that “Spanish banking giant BBVA is switching its 110,000 staff to use Google's range of enterprise software.”

It’s Google’s biggest deal for cloud computing ever, but Google aren’t vertical.

They’re a horizontal product company.

So you read further and find that all the bank specific things in BBVA stay within the bank. It’s just the horizontal collaboration tools such as email, calendar, docs, chat and video conferencing, that are moving to the enterprise cloud.

It illustrates the point well that enterprise solutions are purely standardised tools – like email, spread sheets, telephones – as well as systems that can be used in shared service operations like HR, Marketing and IT.

This is why I would say that payroll and CRM are enterprise solutions, as they can be implemented without alignment to the industry specific needs.

Anything that needs to be tailored, organised or deployed in a specific way to suit a line of business or regional operation, is not enterprise.

It’s not horizontal; it’s vertical.

That’s why firms find they have to move to vertical when they move away from a generic, mass market offering to a specific offer aligned to a specific need in a specific industry.

Then it gets challenging.

The best way to illustrate this is through personal experience.

I worked for a firm that offered an office automaton system.

It integrated word processing, spreadsheets, presentations and more into a standard desktop application.

Call it Microsoft Office if you like.

Once a bank decided it wanted Office, it could rollout the product easily to all staff worldwide.

No major tailoring, change or adaptation needed.

This company then came up with a system that provided process automation and workflow as part of the Office suite.

As soon as they did this, their product was no longer generic but specific.

As a result, they rapidly had to move from product pushers to solutions sellers, and from horizontal to vertical market alignment.

That proved incredibly difficult, as the sales organisation was geared towards short-term targets for product sales, had no knowledge of their customer’s business practices or processes for that matter, and typically spoke to middle management in IT.

The process automation system needed solution sellers who were intimate with the whys and wherefores of their client’s businesses and could engage in a decent conversation with C-level people within the lines of business.

As can be seen, there is a complete dichotomy of approach between these worlds of sales and structure, and is the reason why technology firms struggle between their horizontal and vertical alignments.

In conclusion, it is also clear that enterprise is generic and horizontal, whilst any change to that generic offer to make it industry focused turns it into specific and vertical.

The challenge is that firms don't always realise when they've taken their generic products and solutions into specific offers and, when they do, they don't realise how difficult it is to turn their generic product sellers into specific solutions advisors.

If anyone's interested, we can spend days talking about this as, you guessed it, I've got a few solutions ;-)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...