Sir David King (see end of blog for bio) provided a short summary at the end of the two day Re|Source 2012 conference.

It provided a good summary of all the issues these global leaders are facing, and provides some pointers towards the role of the financial community.

First, there is a population explosion.

The global population recently hit seven billion people on this planet, with forecasts of this rising to over ten billion by the end of the century.

In fact, the growth of humanity is smothering this planet:

Year Population

1 200 million

1000 275 million

1500 450 million

1650 500 million

1750 700 million

1804 1 billion

1850 1.2 billion

1900 1.6 billion

1927 2 billion

1950 2.55 billion

1955 2.8 billion

1960 3 billion

1965 3.3 billion

1970 3.7 billion

1975 4 billion

1980 4.5 billion

1985 4.85 billion

1990 5.3 billion

1995 5.7 billion

1999 6 billion

2006 6.5 billion

2009 6.8 billion

2011 7 billion

2025 8 billion

2043 9 billion

2083 10 billion

Source: About.com

The issue lies with the basic human needs – food, shelter and clothing – and the basic human rights – education, protection from torture and other abuses and freedom of speech.

Providing such succour to 2.5 to 3 billion people is far easier than guaranteeing such rights to 8 or 10 billion as all of this puts undue pressure on the planet’s resources.

This is why Re|Source spent a lot of time discussing the implications of population growth on the use of minerals, food production, water, energy and the provision of health services. This also has impacts on other part of the ecosystem as such practices must be managed or you end up with planetary abuse and climate change. For example, the biggest issue some believe we face today is the rapid rise of air conditioning units amongst middle class people in India, and the fact that many of these units do not meet international emission standards.

Certainly water trading as a scarce resource is something I’ve blogged about on many occasion, and McKinsey even has a practice around Water Resources (see their report Charting our Water Future).

Hence, you can see why the financial community has a key role here as the scarcer a resource becomes, the more demand; the more demand, the more money to be made.

Financial services can either ease the flow, manage the flow or strangle the flow of our scarce planetary resources.

This has been a key concern and you only have to look at the rise in prices of basic commodities and food over the past decade to realise how the financial community can trash or build our world.

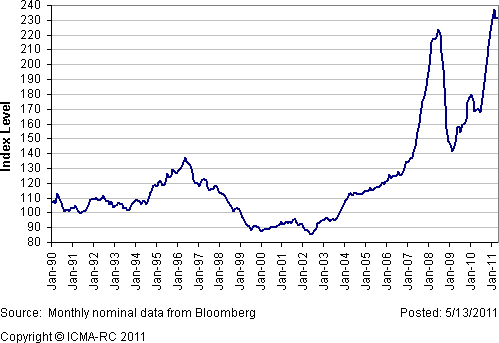

This was swell illustrated by cocoa trader Anthony Ward, who cornered the market for chocolate recently, and you only have to look at the food price index charts to realise that something is screwy:

Source: ICMA-RC

What is screwy is that, like LIBOR and derivatives, too much focus has been placed on shorting the food and commodities markets and not enough on the long-term sustainability for this planet’s health, and the health of our peoples.

Or so these charts and debates would imply.

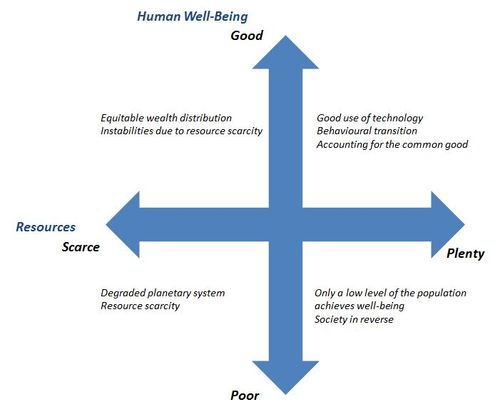

In fact, Sir David made a key point around future scenarios which paint a picture of either a planet that is sustainable and healthy, or one that is failing and unhealthy.

Which would you rather live in?

This is the second of three blog posts about Re|Source 2012 (part one here). The final post will summarise Bill Clinton’s speech, which is well worth a hearing.

Sir David King is the Director of the Smith School of Enterprise and the Environment at the University of Oxford, Director of Research in Physical Chemistry at the University of Cambridge, Director of the Collegio Carlo Alberto, Chancellor of the University of Liverpool and a senior scientific adviser to UBS.

He was the Chief Scientific Adviser to H.M. Government under both Tony Blair and Gordon Brown and Head of the Government Office for Science from October 2000 to 31 December 2007. In that time, he raised the profile of the need for governments to act on climate change and was instrumental in creating the new £1 billion Energy Technologies Institute.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...