We had a great debate at the Financial

Services Club last night, picking up on that perennial debating point: do banks

need branches?

In the pro-branch corner were Anthony

Thomson, co-founder of Metrobank and Ron Whatford, former Chief Experience

Officer with Lloyds Banking Group; in the anti-branch corner were Mark Mullen,

CEO of First Direct and Brett King, author of Bank 2.0 and founder of

Movenbank.

It proved a highly enjoyable discussion,

with many strong points made for why branches matter.

Branches are where most accounts are opened

for example.

According to various research, Forrester in particular, 80% of all current accounts are opened in branches, 75% of Gen Y

customers conclude their product purchases in a branch, and 67% of all product

sales are made in branch.

This is regardless of the fact that many

customers are visiting branches less, and bear in mind this varies by

country. For example, only 7% of banking

customers in the Netherlands visit a bank branch at least once a month, down

from 9% in 2011 while, in Spain, 49% of banking customers still visit a branch

once a month.

Why the branch is so key is because it

provides a physical point of interaction.

That physicality acts as a security blanket

as, when push comes to shove, you want a place to go and see someone and talk.

A branch provides a place for service, and

that is key when you need service. For

example, when a family suffers a bereavement, the branch is a key support

mechanism to sort out the financial affairs of the deceased.

And it’s also a case of choice. Some people may not want to visit branches,

but they want them to be available. For

example, 88% of customers are more likely to choose a bank with multichannel

capabilities including branch.

This is all well and

good, the anti-bank brigade cried, but you’ve got to realise that branches are

not a good place anymore. They were

designed in the 18th century for a market of three hundred years ago

and are not fit for purpose today.

For example, a basic

metric of banking is that a branch is a high cost overhead that is

city-focused.

The city customer is in

fact subsidising the rural customer by supporting low traffic branches in more

suburban areas to be provided at the cost of the high traffic branch in downtown

Main Street.

We are also in an industry

today that is in terminal decline.

Bankers are viewed as being worse than estate agents, lawyers, journalists

and politicians combined, which is why most banks are afraid of meeting customers

in branch, because there’s no audit trail of what happens. This is why remote digital service is so much

better as you can keep a full audit trail of the telephone calls and

clickstream of the customer.

Add on to this that you

can delight a customer through a remote digital experience, and that is the

reason why you find the advocacy of banks like First Direct being far higher

than the branch based banks.

Yea, yea, yea, retorted

the pro branch team, we’ve heard all of that before.

You can claim greater

advocacy but it’s a false number. A bit

like lies, damned lies and statistics, I could show you greater advocacy for

our branch structure than your numbers, but our overall result will be lower

because we are multichannel and the other channels can bring that number down,

so don’t quote advocacy numbers at us.

Cross-subsidisation

between rural and city locations is also a non-argument as we move branches to

where the traffic is focused, so don’t give us that argument either.

The real reason why

branches are required is the reason that everyone is here tonight: because you

want to engage in a human dialogue.

You could all be sitting

at home eating dinner right now, watching this via video stream or webinar, but

you don’t want that. You want to sit and

talk and network and engage.

So do customers.

That’s why they want

branches.

In particular, they want

branches because dealing with money is frightening. It’s not an easy thing. It’s scary.

People need help with managing their money and for them, the branch is

the place to go.

And don’t think that

everyone will do this online and remote these days, as they’re not all like

you.

Most of us are educated,

financially aware, confident consumers, but 90% of the population are not.

They want to have someone

to talk to about money, not serve themselves, and tha’ts what the branch gives

them.

It is the reason why

Virgin bought Northern Rocks branches and the Cooperative bought Lloyds branches. It is the reason why Marks & Spencer is

opening branches with HSBC and why MBNA pulled out of the UK when they failed

to buy branches.

Without branches you

cannot grow a banking business, and you wouldn’t pay millions for bricks and

mortar branches if the bricks and mortar branches did not matter.

OK you guys, argued the

anti-branch lobby, you say a lot of stuff about branches are where customers

go, they want face-to-face interaction and that we are the exception to the

general population, but you are out of touch.

The next generation

customer just does not think this way.

In fact, most of the

points you’ve raised are purely about bank-regulated rules.

Customers, for example,

only go to branches because you need them for AML and KYC purposes to turn up

there and show you their passport and utility bills for account opening.

So banking is only difficult

to transact because we have made it difficult.

The truth is that you only need to see a banker because we’ve made the

rules and access hard. If you stripped

away a lot of the rules, then no one would particularly wake up and say: “ooh,

I’ve got to go into my branch today”.

In fact most people would

avoid the branch, given the chance.

For example, you mention

that the branch is there for advice and information, but we live in a world of information

overload.

There is no information

scarcity.

“There were 5 exabytes of

information created between the dawn of civilization through 2003, but that

much information is now created every 2 days, and the pace is increasing.” Eric Schmidt, Google

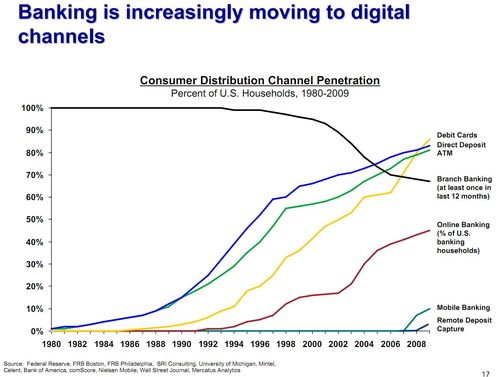

That’s why all the stats

show that the number of transactions and value of services in branches are

falling rapidly, being displaced by online and telephone services.

But don’t get us wrong.

We are not saying that

all bank branches are going to disappear overnight but, like music and video stores,

they are going to shrink massively because most are not needed.

At this point, the debate

opened to the floor for questions, and many were based around what a branch

really is there for.

Questions were raised

about whether you really need to see and talk to a banker, or whether the

remote relationship serviced better.

The fact that a person in

a bank branch is often a low paid teller and not a highly informed advisor

being one critical issue.

Questions were asked

about whether there really is a need for an intermediary channel between the

customer and the product, and the panel argued to and fro on these points.

For example, we may not

have information scarcity but we do have an information tsunami, and you need a

broker to interpret the information between the product and the purchaser.

But then the alternative

view is that banking is not somewhere we go, but something we do, and therefore

it is far better to have access to finance and financial advice anytime,

anywhere.

After all, we don’t want

to make a payment, we want to buy a product; we don’t want credit, we want

money; we don’t want a car loan, we want a car; we don’t want a mortgage, we

want a home; and so on and so forth.

The debate was lively and

heated, to say the least, ending with the inevitable vote: does this house believe

banks need branches?

The vote was yes, but it

was close with around 55% in favour versus 45% against.

When asked a subsequent

question: does this house believe banks will still need branches ten years from

now, the vote turned around with 55% voting the bank will NOT need branches in

ten years.

In conclusion, one

comment stood out above all for me: “this debate is not about whether banks

need branches, but about whether customers want branches; that should be the

core of our discussion”.

Very true.

All in all this is

obviously a debate that will not be disappearing in the near-term, so continue

to watch this space for more debate about the future ebank and future bank

branch.

If you want to see more of the debate, then checkout our Facebook Page.

Useful reports to

download:

- Cap Gemini Report, Trends in Retail Banking Channels: Improving Client Service and Operating Costs

- Infosys, Branch Bank of the Future

- Wipro, The Future US Branch Banking

The is part two of a five-part series:

- Part One: One banker knows his industry is trashed, and here's his plan

- Part Two: Do banks need branches?

- Part Three: Why you really need a bank branch

- Part Four: Building a customer advisory bank

- Part Five: A truly social bank advisor is key

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...