The

eighth World Payments Report (WPR) has just come out and, last

week, we provided a summary of the first section on non-cash trends. Here’s a summary of section two: regulatory trends.

Ability to Innovate is Challenged Amid Sea of Key

Regulatory and Industry Initiatives

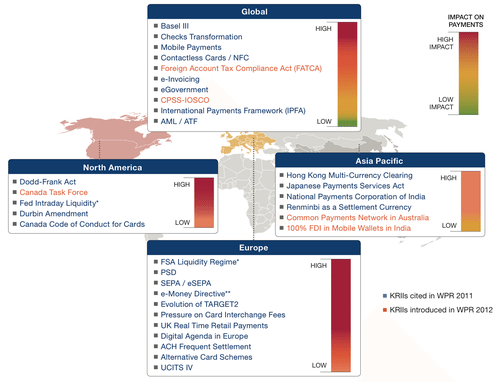

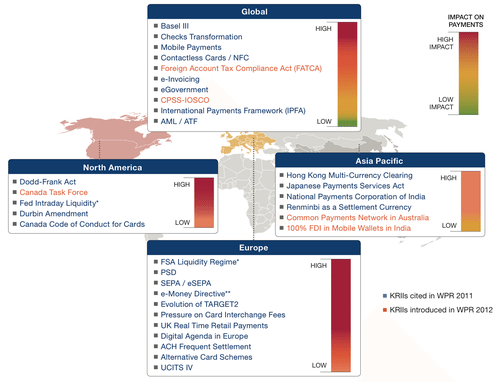

Regulators have continued to implement the

Key Regulatory and Industry Initiatives (KRIIs) discussed in WPR 2011, and new

initiatives have been introduced.

The Eurozone debt crisis has accelerated

the impetus behind certain KRII objectives, such as Basel III, and that urgency

is prompting European banks to comply faster than originally expected.

This is challenging their ability to

innovate since meeting the considerable imperative to comply dominates time,

energy, and financial resources, leaving less bandwidth for innovation.

Payment service providers (PSPs), especially

banks, are feeling intense pressure from the regulatory focus in payments, not

least because regulations impact one another, and continuously evolve, thus

require constant monitoring and attention.

Regionally focused KRIIs have a tendency to

be replicated in other regions, so regulators and banks need to ensure that

individual regulations are not designed and implemented in a vacuum.

While individual KRIIs can potentially be

net positive or negative for innovation, payments innovation often emerges as

KRIIs converge.

This is certainly the case for payments

processing and servicing, as well as standardization and security—areas in

which innovation has regularly emerged as a direct result, or a byproduct, of

KRIIs.

Going forward, KRIIs aimed directly at

driving innovation, with changes visible to the customer, have great potential

to result in substantive change.

Contactless cards / NFC initiatives offer a

prime example.

An increasing number of smart phones are

being equipped with NFC technology, suggesting the market is becoming ready to

drive usage of NFC technology in the payments industry.

The bank and non-bank players piloting NFC

innovations include major names like Google, PayPal, MasterCard, Visa, and

Apple.

The combination of industry initiatives,

core bank infrastructure and non-bank players has and will be a powerful force

of transformation in payments.

Even SEPA, long focused on compliance, may

perhaps soon be viewed more for its innovation potential.

As the legal certainty around SEPA

migration grows stronger, PSPs can start to look beyond the migration phase,

and toward the SEPA platform to promote competition, efficiency, and

innovation.

The SEPA migration deadline is

fast-approaching and significant preparation is required, so firms need to act

soon if they have yet to commence their preparations.

The deadline for migrating to SEPA Credit

Transfers (SCT) and SEPA Direct Debits (SDD) has been set at February 1st,

2014, shifting the focus on SEPA migration from ‘when?’ to ‘how?’ While SCT

adoption rates have been steadily increasing since the launch date, SDDs have

shown little progress thus far.

Ongoing uncertainty around key aspects of

SEPA requirements raises the possibility that SEPA benefits may not be fully

realized.

Outstanding issues include the need for a

common interpretation of SEPA requirements, certainty around exceptions being

requested in Member State transition options, and assurances that technical

interoperability can indeed be achieved.

The industry is already looking for ways to

leverage SEPA as a platform, and use the standardization that SCT and SDD offer

to drive innovation.

You can order a copy of the full report from EFMA, and the summary of each section is below:

- Part One, the Non-Cash Trends

- Part Two, the Regulatory Trends

- Part Three: SEPA

- Part Four: Innovation

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...