We had the final 2012 plenary meeting of the Financial Services Club

Clearing & Settlement Working Group (CAS-WG) yesterday.

Well attended by industry luminaries, the debate was all

about the usual stuff: regulations, standards, risk, issues, frustrations and

opportunities.

What was particularly interesting for me is that we now have

three subject groups working in unison to solve many of the issues and

frustrations in order to identify and leverage the opportunities.

A wave of regulatory

change

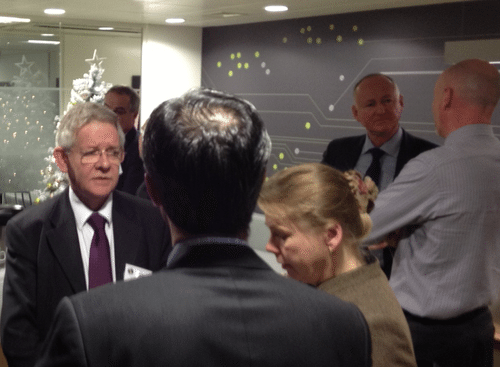

First, there is a Regulations Subject Group that has started

to map out the issues in regulatory conflicts and overlap.

This is being achieved by mapping out a complex cube of

regulatory change (doubleclick image to enlarge).

The cube will outline how each regulation impacts each part

of the post-trade lifecycle mapped against the participants the regulation

affects.

This is a major piece of work, but is intended to determine

where cross-infection of regulations occur.

A cross-infection is where there is a mismatch in requirements

between one regulatory change and another.

A good example is the requirements for the draft EU CSD

Regulation (CSDR) and Short Selling Regulation.

The Short Selling Regulation requires that LCH imposes

penalties and buy-ins on anything that clears on EquityClear but equity trades are

also captured by the CSDR, and its settlement discipline regime.

The result is that a UK equity trade clearing at LCH and

settling at Crest will be hit by two sets of regulatory overhead for the same

trade: once at LCH under short selling and a second time at Crest under CSDR.

The debate about regulations went on for some time as John Fortescue,

VP Prime Services at Credit Suisse Securities Europe and Dave Grace,

Post-Trade Securities Strategy for Global Operations at Barclays Bank,

discussed EMIR (the European Market Infrastructure Regulation), Dodd-Frank, MiFID II and more.

As per our previous discussions, collateralisation and

real-time collateral management between exchange venues will be a critical

differentiation factor in the future, as will being able to respond and react

fast to change.

But a piece that came up yesterday that was new is the idea

of breaking apart global operations and services and going regional.

This came in light of the EU moves towards transaction taxes

and a Banking Union, whilst the UK works more closely with the USA on

harmonising approaches to breaking up failed banks for example.

Meanwhile, the UK’s Financial Services Authority (FSA) also

appears to be gold plating some regulatory requirements, as usual, which means that

there are global, regional and national frictions at all levels.

For the banks, buy side and intermediaries, this means

complete confusion.

This has been noted in many news sites, but most recently an

article in the Harvard Law School Forum provided great insights into the

similarities and differences.

As the article notes, there is a great degree of commonality

of approach between the EU and the US, but some important differences.

For example, “while both regimes envisage registration and

conduct of business rules for dealers, the US regime extends rules and capital

requirements to major swap participants (MSPs).”

Similarly, “the US regime requires the execution of OTC

derivatives subject to the clearing obligation on a swap execution facility or

designated contract market ... in the EU, these issues are being addressed

separately as part of the legislative proposals to replace MiFID.”

Finally, “the EU regime has no equivalent to the US ‘push

out’ rule restricting the derivatives trading activities of banks, the ‘Volcker

rule’ restricting the proprietary trading operations of bank groups or the

provisions allowing regulators to restrict bank ownership of CCPs.”

Read the whole article if you

want to know more.

As can be seen, the regulatory aspects of clearing and

settlement is a key aspect of change in

the post-trade world.

Market Infrastructure

Change

Following the regulatory discussions, we had a close look at

market infrastructures from the Subject Group Chair Kathleen Tyson-Quah.

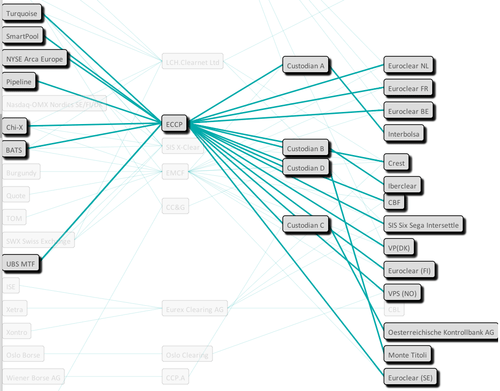

What was interesting here is that this group is also modelling

and identifying how the markets are related and managed by mapping out the

order flows between the various post-trade venues.

The Group have built a tool – the Enriched Market

Infrastructure Illustration Tool http://emiit.info/

- which shows how each of the exchanges clears with each CCP and CSD (doubleclick image to enlarge).

The aim, over time, is to map out the flows of volumes and

values across these venues, which would give the markets and regulators a clear

view of where the greatest exposures and systemic risks appear.

The idea of the website is that this is populated by the venues

themselves and the Subject Group over time, to become a wikisource of information

about the clearing and settlement flows across the City and global markets.

Technology Change

This was similarly supported by the Technology Standards

Subject Group, jointly chaired by Virginie O’Shea of Aite Group and Graeme

Austin of ISITC Europe.

This group is focused upon LEIs and ISO17442, which became

the source of a great discussion, as Andrew Douglas of the DTCC discussed what

was happening in this space.

For example, Andrew presented a slide that discussed the USA Commodity Futures Trading Commission’s (CFTC) Swap Record Keeping and Reporting Rule (Part 45).

This is the rule that determined to standardise Legal Entity

Identifiers (LEIs) according to the forthcoming rules being laid down by the

G20.

The CFTC, as part of Dodd-Frank, implemented this first in

the form of a 20 character alphanumeric field called a CICI (CFTC Compliant

Interim Identifier).

Unfortunately, this almost derailed the standardisation of

these identifiers as it meant that the rest of the world saw CICIs as being an

American, rather than global approach.

However, as noted at previous CAS-WG plenaries, the convergence of CICI

and ISO rules has resolved these concerns to a lesser or greater degree.

The dialogue went around a number of other issues in this

space:

- tracking and reporting to trade repositories,

- how many trade repositories will emerge (seven

is best guess), - the concerns of concentration risks of

consolidated CCP operations (although right now, CCPs are fragmenting as there

are now 23 in Europe alone)

and more.

It occurred to me as this discussion swirled around the room

as to how all of this is interconnected and why the Working Group and Subject

Groups have moved onto the right track.

First, we have a group mapping the relationships between trading

venues and operators; second, we have a map of the regulatory structures and

how they impact the venues and operators; and finally we have a focus upon the technical

requirements to implement the changes required, and how to resolve or highlight

those areas where there are gaps or issues.

So, that’s a wrap for 2012 and here are the plenary slides

for those interested.

Meantime, we have further Subject Group meetings planned for

January 2013 and the next plenary likely to take place in late February or

early March.

If you’re interested in joining in, then just pop me a note

email:admin@balatroltd.com.

The CAS-WG is free to join and attend thanks to the support

of our partners and enablers: Kemp Little, BT, the A-Team Group and the Realization

Group.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...