OK, OK, it’s time to get down to the real business of

blogging, banking and bonuses. As per my

usual form, here are four specific forecasts for the economic movements of 2013:

- The USA is a solid rock (but)

- South America is the place to be

- China becomes a hot consumer market

- The Eurozone stays together with fissures,

cracks and holes

OK, these are not wild and wacky forecasts - you got those last week - but they're the practicable forecasts based upon all of the 2013 outlook forecasts I scanned during the Christams hols.

The bottom line is that we all thought 2012 was tough but 2013 looks to be

just as, if not more, challenging. This is reflected

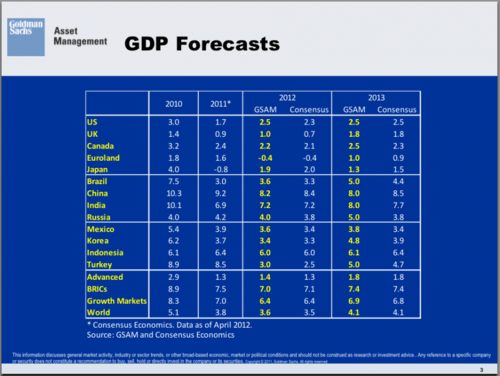

by the OECD’s global forecasts, which were downgraded substantially in November

2012 from the forecasts just six months earlier.

The OECD now expects growth of 1.4 per cent in 2013 from the

34 economies that make up its membership, down from the previous 2.2 per cent

forecast in May 2012.

So, where to invest?

Investing in the CIVETS was one tip from the Economist

Intelligence Unit in 2009. CIVETS are

Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa. Not so sure about Egypt after the Arab

Spring, but the others were pretty sound.

This was corroborated by Jim O’Neill who reckoned you should

invest in the Growth8. What are the Growth8? The BRICS joined by Indonesia, Vietnam,

Mexico and Turkey.

I’m not so sure about the growth prospects from an

investment point of view in the BRICs anymore – by way of example, the growth

in China is slowing – but certainly the prospects for Indonesia, Vietnam and

Turkey are consistent in both forecasts so that’s worth noting.

There are other areas worth noting and investing too though,

such as Korea. O’Neill has already

switched Vietnam for Korea …

… and several economists are making noises that this year is

going to be a tough year for finding the right investment areas.

For example, Citigroup economist Geoffrey Denis writes in

the FT:

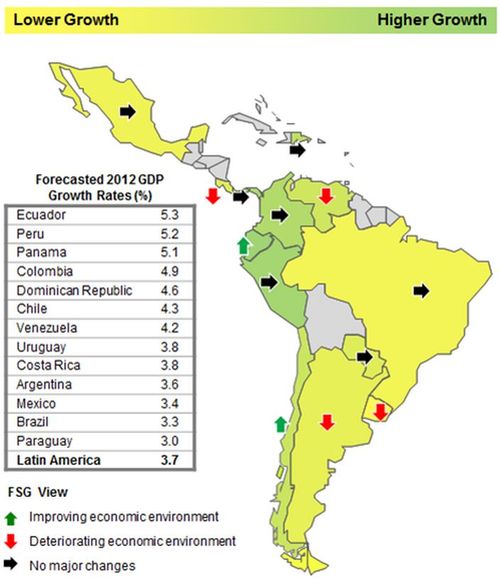

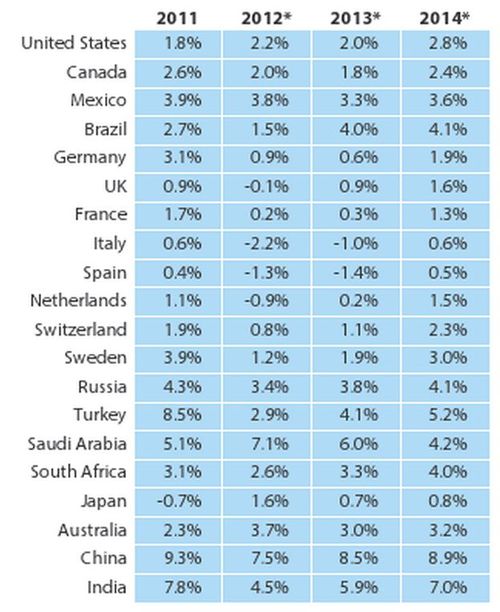

Twelve months ago, we

had expected Taiwan to grow by 4 per cent in 2012; now the forecast is just 1

per cent. Other sharp forecast declines have occurred in Brazil (3.4 per cent

to 0.9 per cent), India (7 per cent to 5.4 per cent), Korea (3.4 per cent to

2.3 per cent) and South Africa (2.9 per cent to 2.2 per cent). The same is true

in China, despite clear recent evidence that the growth slowdown is finally

ending; over the past year, our 2012 forecast for Chinese growth has fallen

from 8.4 per cent to 7.7 per cent.

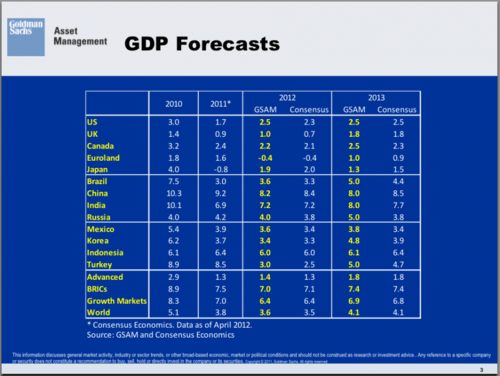

and points to Chile, Mexico, Peru and Russia as being

markets that have exceeded growth expectations.

This is also backed up by forecasts from the OECD, which predicts that

the strongest growth market for 2013 is Chile, which is forecast to expand 4.6

per cent this year.

The net:net of all of these forecasts is that South America

is the place to be.

South America is the

place to be

Source: Frontier Strategy Group

Last year many said North America was worth the investment,

which it was, but the brinksmanship of the Republicans in trying to push the

country over a fiscal cliff meant that the New Year began with the shine of the

US of A somewhat dimmed.

That does not mean that the US economy isn’t going to be growing

this year, with forecasts of two percent or higher growth which is more than

double the UK’s estimates of around one percent.

Even so, the growth money will go into the Southern Americas

rather than the Northern.

This leads to questions about other parts of the BRICs,

particularly China.

China: a consumer

market

The good news is that China is still growing.

Source: OECD Economic Outlook, November 2012

The bad news is that China’s future looks to be a difficult

one.

For a long time, we’ve all been banging the China drum but

we there are a lot of issues, such as the China shrinking population challenge,

the internal inflationary pressures, the future intercountry dealing and where China’s

future growth will come from, a housing boom, the difficulty of moving from

state managed enterprises to private business, and more.

The People’s Republic has done a pretty good job of managing

these challenges, but the biggest challenge of all is still to come:

transitioning the Chinese economy from an export-dependent market to a cohsumer

market.

This is a challenge but it’s also the greatest opportunity, particularly

for companies outside China. As Jim O’Neill,

the man who coined the BRICs phrase, has pointed out: China has over a billion

people who have been developing from people dependent upon the state for

support to people who are now the new class of consumer.

Obviously this does not apply to the whole of China – there are

still huge disparities between the Eastern rich and the Western poor – but it

does mean that there are a new class of consumers who are affluent, wealthy and

looking to buy into big brands including those that we buy into: Apple, Nike, Tiffany,

Prada, Rolls-Royce and more.

This means that there will be big moves in 2013 for firms to

expand their presence in China as recently demonstrated by Apple Maps: ‘While many around the world have slammed Apple's new mapping software in iOS

6, the company has built a special version of Maps for China that has been

praised as a “huge improvement over Google Maps”.’

So, in 2013, my expectation is that an awful lot of companies

will be investing big time in their brands in China. The thing is that whilst these firms focus

upon growth markets in South America and Asia, what happens in the rest of the

world, particularly the Eurozone?

The Eurozone stays

together with fissures, cracks and holes

According to the OECD, the Eurozone economies will contract

for the second successive year in 2013. Greece

will once again be the worst performer, with their economy expected to shrink

4.5 percent. The Spanish, Italian, Slovenian and Portuguese economies are also

predicted to contract over the course of 2013.

In 2012, the Eurozone would have unravelled rapidly if it

hadn’t been for the efforts of the Franco-German alliance to hold it all together. In the end, it was really the alliance of

Angela Merkel and Mario Draghi that pulled the rabbit out of the hat.

Source: the Guardian's Steve Bell

The rabbit turned out to be the

Banking Union but, as mentioned in this blog, the Banking Union is just as likely to pull the European Union apart as it is

to keep it together.

But what is it that the Franco-German alliance wants? The European Union of 27 nations or the

Eurozone to succeed with 17?

I would argue the latter, as a thriving Eurozone will force

the ten non-euro nations to join. For

this reason alone, it is likely that 2013 will see even more efforts amongst

the core of the Union to baton down the hatches of the Eurozone and tie it

together.

This will require more than a Banking Union – everyone knows

that a fiscal union is required – but the Banking Union will be the first step

toward the fiscal union, so that’s going to be the job in hand. Expect wholesale regulatory change and enforcement

as a result.

More on that tomorrow, as we look at the banking outlook for

2013, but suffice to say that the overall summation of the world outlook is a:

- Solid North America

- Growing South America

- Consumerising Asia; and

- A Cracked Europe

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...