One of the panellists at this week’s conference said that he

employed twenty people whose sole duty was to find a way to destroy the business.

I liked the idea of that.

It is a strong and emotive statement.

But what did he mean?

“I employ twenty

people in my innovation department who purely look at ways in which they could destroy

the current business.”

In other words, the role of his innovation group is to find

ways to disrupt the current business.

Now that’s all well and good, but the question then is whether

you act upon the advice of those people.

I’ve been in plenty of companies where you can show ways to

disrupt the business, but when is the right point to heed the advice and act

upon it?

A classic case study in management failure to act upon the

knowledge that they should destroy themselves is Eastman Kodak.

Eastman Kodak, or Kodak as we all call them, is the company that invented the

digital camera.

Steven J. Sasson was the electrical engineer working for the company who presented his idea to

the senior management.

“My prototype was big as a toaster, but the technical people

loved it …

... but it was filmless photography, so management’s

reaction was, ‘that’s cute — but don’t tell anyone about it.’ ”

Vince Barabba was head of Kodak’s Market Intelligence back then. Backed by the CEO, he conducted an extensive

market study to work out what digital cameras would mean when Sony introduced

their first commercial digital camera back in 1981.

The results of the

study produced both “bad” and “good” news. The “bad” news was that digital

photography had the potential capability to replace Kodak’s established film

based business. The “good” news was that it would take some time for that to

occur and that Kodak had roughly ten years to prepare for the transition.

Ten years.

And what did they do in those ten years?

Nothing.

They thought that film was still the future, even though

every sign told them it was not.

By the 2000s, Kodak was desperate and going out of business,

as this video from 2007 pretty much demonstrates (well worth four minutes to

watch this btw).

Desperate and too late.

A year ago Kodak filed for bankruptcy protection and their business

has been hounded out of existence.

Similar to Jessops, Comet, HMV and Blockbuster who I

discussed yesterday.

And similar to so many other corporate failures in the past

centuries.

I was part of one such disaster when working for a company

called Wang Computers.

Wang Computers were the fastest growing technology company

of the 1980s, thanks to their dominance in Word Processing.

Word Processing.

Wow, that sounds heavily dated today.

Basically Wang’s business model that gave it fast growth was

replacing typewriters with automated machines.

They were so successful at this that competitive products like

Word Perfect were viewed as dross.

Sales people would tell customers to go and check out the

competition and come back afterwards when they were ready to buy a Wang

machine, so confident were they in their product.

By this time, Wang were known to be the office minicomputer leader

and DEC the engineering minicomputer leader.

Both were the equivalent of the Apple and Samsung darlings

of their era, with Wang predicting in the early 1980s that they would be bigger

than IBM by the end of the decade.

Instead, by the end of the decade, they filed for Chapter 11

and were bankrupt, as was DEC.

The reason being that the PC came on the scene, and attacked

the heartland of the minicomputer market.

From shared servers, the world rapidly moved to desktops,

and desktops allowed easy word processing on open platforms rather than

automation on a proprietary server.

There’s far more to the story than this, but the fact is

that in both the Kodak and Wang stories the mistake was the same: management

were so tied to their traditional models of profitability that they would not

destroy or undermine them, in the fear that it would destabilise their profit

lines.

This is the core of any management learning about innovation,

and goes to the heart of Clayton Christensen’s discussions of the innovator’s

dilemma.

Often a management team will see a new market developing

that could impact their core business.

A digital camera. A

personal computer.

The management team may well have people who make it clear

that such things could destroy their business …. but they just don’t listen,

react, invest or do anything about it, because it would destroy their own

bonus, shareholding, investment and reputation.

Simplistic maybe, but what other reason can you give for destroying

a successful business?

In fact, until Steve Jobs returned to Apple in 1997 when it

was almost bankrupt, this was true of that business. The only reason Apple survived is that Jobs

changed strategy completely and innovated out of the problem by looking for new

markets – digital entertainment – rather than sticking unyieldingly to their

existing market – desktop computing.

And has this got anything to do with banking?

Yes.

After all, when all the evidence points to rethinking the

business model of retail banking, as discussed yesterday, then management need to think differently.

But there is also a caveat here.

Sure, you can work on destroying your existing business,

testing and prototyping new ideas to see if they could displace or replace what

you do today.

But when is the time to act?

Act too early and you destroy your business by betting too

big on the next; act too late and you destroy your business by missing the

tipping point.

So there is a balance here, and is well illustrated by

another story going back to my NCR days.

In the mid-1990s, everyone was saying that cash was going to

decline in usage, to be replaced by the internet and mobile (yes, even then,

there were mobile telephones texting cash!).

The cashless society would emerge in the near future and

then who would need to buy from a firm whose very name is the National Cash Register Company?

The writing was on the wall, the company would need to

rethink.

Fifteen years later, NCR is still making good money out of

cash machines, with most stock analysts viewing the firm as a Buy or Strong Buy.

The reason is that the cashless society is a misnomer –

everyone still wants and needs cash. Add

on to this the fact that the firm reinvented the technology so that off-premise

ATM capabilities means you can stick an ATM anywhere, even in Antartica,

and you can see why these technologies are still around.

And when the #1 reason why people choose a bank is the convenience

of an ATM nearby …

Source: Tom Noyes blog

It’s a very good reason for believing that cash (and NCR)

will be around for a long time to come, and why management shouldn’t be too

quick to destroy themselves.

But NCR’s survival was not down to a big bet on ATMs in

banks.

If NCR and their brethren (mustn’t forget Diebold,

Wincor-Nixdorf) had stuck to ATMs in bank branches, they would be dead by now.

Instead, they innovated the ATM to push it further, to

off-premise, to mobile, to non-cash functions and more.

They also expanded the market horizons for ATMs. Just look at how the skeleton of the ATM now means Airline Ticketing

Machine.

The net:net is that companies need vision, agility, flexibility

and ability.

Vision to see what’s coming next, agility to see when a new

market takes off, flexibility to change strategies if needed, and ability to transition

the company from their old markets to the new.

That’s what Apple and NCR managed to achieve, and some banks

too.

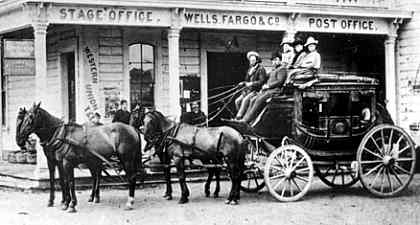

Just look at Wells Fargo’s conversion of the Pony Express into a banking system.

Django unchained.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...