Talking of no-one giving a jot about customer service in

banking, there is a subtle nuance here which I thought someone might have

spotted or commented upon but …

The nuance is that any organisation that takes friction out

of the transaction process has the potential to change banking considerably.

There are several examples of how such friction removal or

rather frictionless commerce occurs, and they are all the subjects we usually

choose:

Amazon, Apple, Google, Facebook, PayPal et al.

It is the reason why these firms have seen their volumes of

business spike exorbitantly.

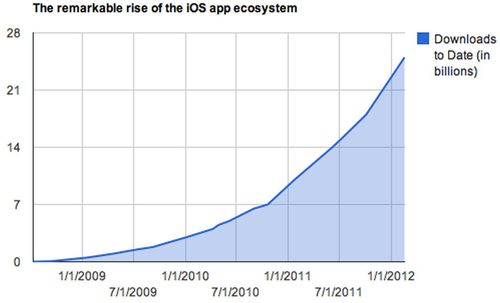

Apple has seen its download business for apps alone blossom

into a $10 billion business in just three years (forget the iPad and the

iPhone) …

Source: Techcrunch

Whilst iTunes revenue run rate is also $2 billion a quarter.

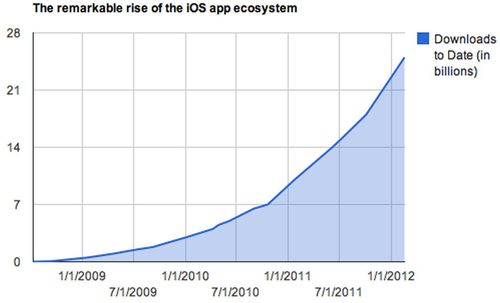

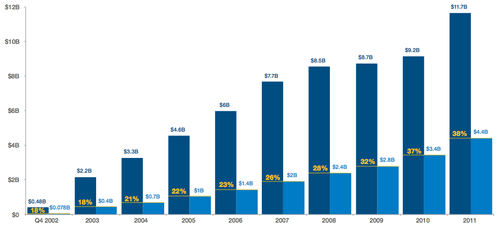

Amazon has seen revenues double in just two years (2009 through

2011).

Source: Michael J Parks

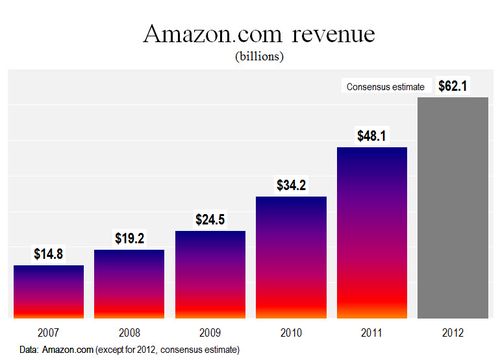

Google’s revenues are similarly doubling every two years.

Source: Marketing Land

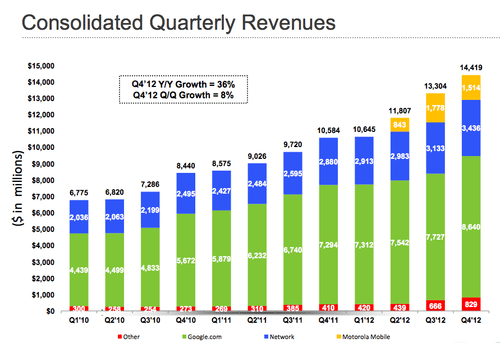

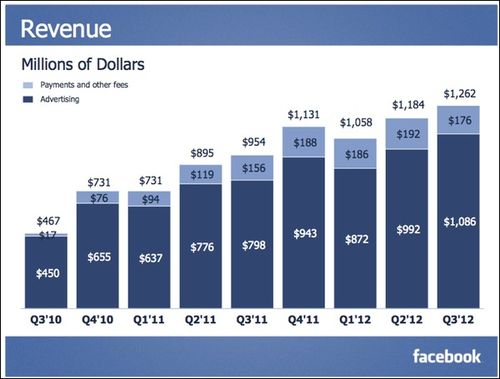

And Facebook’s not doing badly either (albeit with some

questions still about their business model).

Source: Marketing Land

Meanwhile, my favourite is PayPal, as y’all know. PayPal has grown from a mere minnow

processing $1.5 billion of transaction per year in 2001 to a behemoth

processing $1.7 trillion dollars by 2011.

Source: Venture Beat

Every example is one where a business has seen an opportunity

to leverage the digital data age.

Apple has made accessing entertainment online easy.

Amazon has made shopping online easy.

Google has made finding stuff online easy.

Facebook has made socialising online easy.

PayPal has made payments online easy.

They regenerate regularly – google makes one or two

algorithm changes every day - and they recognise that data is their asset.

These companies have annihilated the old world of shopping

and watching, meeting and greeting, learning and working.

What does this mean for banking?

I recently made a commentary about this …

… but if you can’t watch the video, the gist is that banks

are data-based businesses and if they do not leverage data and become agile in

the focus upon the digitized customer, then they will be disrupted.

In fact, there are already fledgling examples of such

disruptions out there, such as Simple and Moven (Movebank, like Banksimple, recently changed their name).

We shall see what happens for, when there is one that makes frictionless

finance as easy as Apple makes entertainment and Amazon makes shopping, then we

will see a movement to the new world of future banking and customers will be attracted

to move rather than disturbed to change.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...