A final presentation from EFMA week that I need to reference

before moving on came from Eric Mackor, Head of Channel Development at the Netherlands

Retail Bank ABN AMRO (as opposed to the transaction bank part of ABN AMRO that

was acquired by the Royal Bank of Scotland).

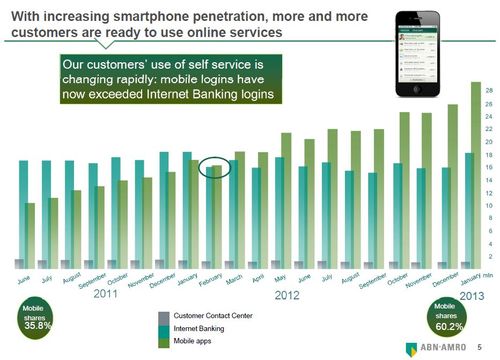

He talked about the changing dynamics of channel usage

within the bank and noted to start with that mobile is now their dominant

contact point with customers, with over a million interactions per day,

representing three out of every five customer contacts and far outweighing

internet and call centre services.

This statistic is corroborated by other presentations referenced

during the week, bearing in mind my two favourite statistic points were:

It took 13 years to get two million customers using Internet

banking; it took just two months to reach that number for mobile banking.

[Barclays Bank]

It took 10 years to get twenty million contacts per month

through Internet banking. It took 18 months for mobile.

[Société Générale]

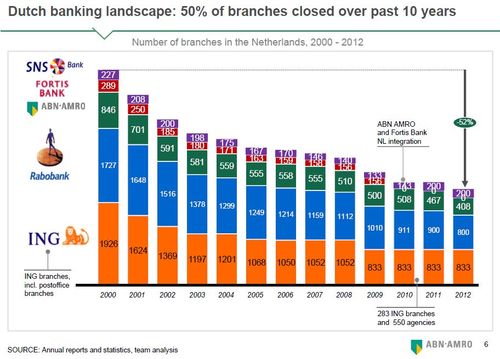

Therefore it’s not surprising that over half of all the bank

branches in the Netherlands have closed in the past decade.

Not surprising, but it does beg the question as to what the branch

is there for today?

For example, Eric’s next slide had the following title:

Brutal fact: on a weekday a small branch welcomes 20

customers; and 27 customers withdraw cash at the indoor ATM

And each of these small branches has an average of two staff

servicing twenty customers in an eight hour day. That’s just over one customer served per

staff member per hour. That’s either amazingly

personal service or an awful lot of thumb twiddling during the day waiting for

something to happen.

The punch line of Eric’s presentation however, is that although

the bank can see more and more ways to service the customer out of branch, the

customer’s won’t let the branch go.

A slide that explained their customer types showed five

distinct categories of consumer:

- Intensive channel users who use all channels regularly;

- Personal contact seeking customers, who want advice and

face-to-face service; - Self-directed people who think they can do everything

themselves; - Passive hybrid customers who only talk to the bank when

they have to; and - Inactive channel users who never talk to the bank via any channel

The last two categories represent the least profitable and smallest sector for the bank, whilst the first two are the targeted ‘mass affluent’,

whilst the mid-category is the majority of the client base.

Amazingly, the first three categories all answered the

question: I prefer to discuss more

serious banking issues in person (89%) and in case of problems, I want to be able to go into a branch and speak to

someone (94%).

In other words, although the bank knows the branch is dead, the

customer does not. This is why ABN are following

the strategy that I’ve blogged about before,

as in consolidating branch operations into super branch centres and automating

more and more in remote branch machines.

There was lots of other fun stuff to report from the EFMA

conference too, such as customers enjoy visiting bank branches about as much as

getting a tooth pulled out or being intimately analysed by their doctor:

Slide from presentation

by Barbesino Paolo of Unicredit and text is a variation of a tweet by Mark

Pickens

However, I cannot dedicate my blog more to this one subject

as there’s so much more to talk about, like the second Financial Services Club Poland

meeting last night.

More on that later, as it led to a ding-dong discussion

about interchange fees, but for now it’s back to the land of the living which

is better than the land of the zombies!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...