As mentioned yesterday, I’m joining Uday Goyal for the opening session of innotribe at SIBOS 2013.

The session focuses upon how the business model of banking is changing, and includes discussions around all aspects of innovation and change in banking.

A good insight into this session has been summarised by co-founder and co-organiser of innotribe 2013, Mariela Atanassova.

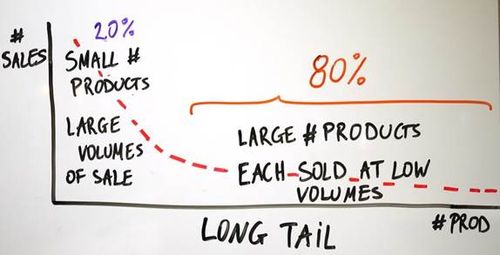

The 'Long Tail' Model Is Coming to Banking

The outside world is disrupting the very fabric of the business of banking.

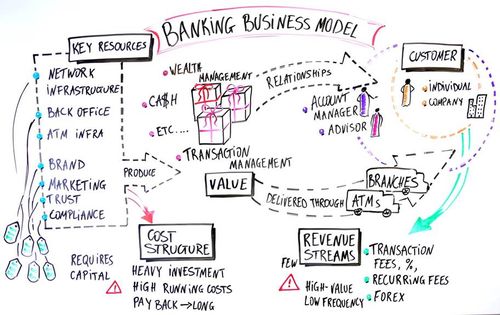

The business as we used to know it over the past 50 years relied on several things:

- Heavy and costly marketing and sales to acquire customers and build trust.

- Locking in these customers so that switching to a competitor was hard*.

- Investing in relationships with wealthy customers to provide custom advice, while at the same time treating the less-wealthy as a mass market, with one-size-fits-all products.

- Generating repeat revenues through percentage and transaction fees, which resulted in banks’ preference for less frequent but high-volume transactions*.

- Very costly investment in infrastructure: networks, back office, branches, compliance .This was an upfront investment that discouraged or blocked new entrants from the market*.

* I have placed an asterisk next to the strategies bankers can no longer rely on.

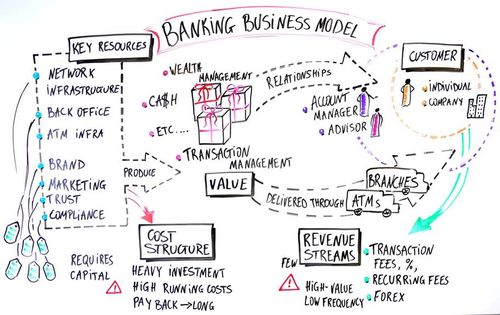

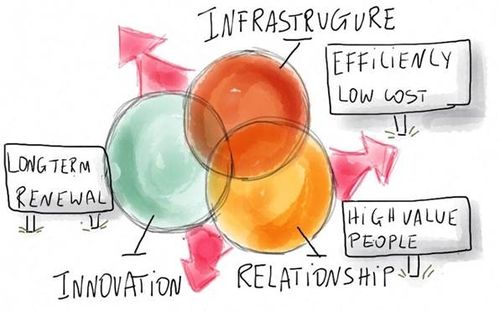

Banking as we know it is a classic bundled business model that combines three different businesses in one:

1. An Infrastructure business that should run as a utility;

2. A customer relationship business that is high value, high cost and is focused on turning knowledge of the customer into custom services; and

3. A product innovation business with an entrepreneurial culture, innovation and related research and development costs.

Since most banks were running with this same strategy, competing was difficult, with practically no differentiation of products and services.

Certainly an industry that is focused on undercutting itself by shaving basis points from its profits, while suffering from the heavy cost burdens of legacy systems and knowledgeable experts in sales and marketing is no fertile ground for evolution, innovation and growth.

And now newcomers are experimenting with creative strategies to steal the banking pie (or give it away for free).

So here’s how

the outside world is disrupting the very fabric of the business of banking:

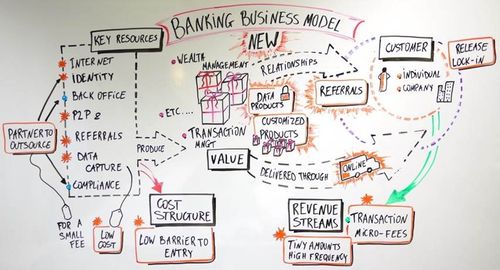

- 1. Interoperability and hyperconnectivity are allowing customers to switch providers easily, releasing the lock-in.

- P2P and referrals are changing how “relationships” and trust are built, thereby replacing the need of costly marketing, branding and relationship managers.

- We are seeing a shift from the high-value, low-frequency revenue model to the reverse, with micro fees providing recurring revenue, undercutting the traditional banking margins and fees.

- Technology changes displace the need for proprietary high-cost networks, lowering dramatically the barrier to entry. Investment is shifting to infrastructure that allows learning about customers’ patterns, needs and environment. Identity is a key component of this shift.

- This data-centric model creates a new capability – providing highly customizable, personalized products at a very low production cost.

In effect, these changes are creating a business model for doing banking that is dramatically different from the old model – it’s a long-tail business model, capable of capturing lots and lots of tiny revenue streams.

So what does that mean to banks? Judging from other industries (for example the telecommunications industry, which is a few steps ahead in this process), there are several choices:

- Unbundle their current model and focus on excelling in one of the three businesses. That means that some banks will become excellent transaction infrastructures, while others will choose to innovate products or become expert relationship managers providing high-value personalized advice.

- Transform themselves into a long-tail business model organization, throwing away their traditional thinking and acting like the newcomers in the business.

- Partner! If you take this last option to a distant future, we may not be talking about “banks” anymore, but banking as a function composed of many different players serving different parts of the system and providing different value on the way.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...