I

often see interesting blogs and articles in foreign language and, thanks to

Google Translate and the pervasive power of the English language as the

standard language of the internet and business, I’ve now been connected

globally with people on the edge of bank innovation and design.

I regularly track French, German, Spanish, Japanese, Russian and

more in the banking hemisphere and, as a result, spotted my Ukrainian friend Mykola Chumak had

found a wonderful update on innovation centres in banks this week from the

Russian site Future

Banking.

The banks identified include BBVA, Capital One, Citi and ING,

although these are just a few of the banks that have such centres as Barclays,

HSBC and more are known for their innovation centre focus as well as many

vendors such as IBM, HP, Accenture, Polaris and so on.

Nevertheless, Future Banking picked on these so, combined with my

own research, here is the lowdown:

BBVA (adapted

from an article in Intelligent

HQ, April 2013)

“BBVA Innovation Centre is a place where ideas become reality.

Innovation and enterprise are two strategic pillars for BBVA, and a lot of the

group’s efforts go into this field. The world we live in is changing

constantly, and with every passing day we have to face new challenges. And our

challenge is to grow while making our customers grow.” – BBVA

Over the last 10 years, BBVA has been driven to become more

customer centric and match its offerings to its customers’ needs. Given the

pace of technology change, customers’ rising expectations and the digital

disruption those forces cause, innovation is a critical part of BBVA’s

ethos.

Headquartered in Madrid, BBVA Innovation Centre is the place where

ideas are born, and where they pass through an experimentation process: from

prototypes to tests. After this step, results are analysed and valued before

they are turned into something real and form part of BBVA’s value proposal,

their way of relating to people.

This effort shows. In late 2008, BBVA became one of the

first banks in Europe to introduce online money management (PFM),

introducing a series of innovations.

Its online personal finance management service, then called Tú

Cuentas, let the bank’s online customers see their account balances

and transactions from different providers in a single place, categorize their

transactions, and benchmark themselves against their peers.

The centre is a meeting point, a place for sharing, and, above

all, for listening and learning from the innovation ecosystem.

Part of an innovation network which works to ensure that each and

every one of its partners is a bridge towards the inside and outside of the

organisation, with partners including tech giants Google, IBM, Cisco and

Microsoft, as well as relationships with both academic institutions, like

the Massachusetts Institute of Technology (MIT) and Stanford, and commercial

organisations like Gartner and Continuum.

The model is one in which innovation feeds off the sharing of

ideas, knowledge and projects in a fluid and transparent way. Therefore,

typical features in the offices are the open spaces. The centre layout

encourages natural meeting points both for employees and for visits arriving

from anywhere in the world.

The Bank’s Strategy and Innovation unit was created in 2007, as

part of the Technology and Operations department, whose main purpose was for

the banking industry to incorporate emerging technologies. The unit developed

projects such as ABIL, or the first virtual assistant focused on the banking

sector, and others which are very useful for this area in Spain, Portugal and

other countries. BBVA tries to imagine the branch of the future, and then

does something about it.

The bank is actively involved in several projects, including Big

Data, and ‘Easy Bank’ or close and accessible banking.

For BBVA, the Big Data concept has an approach based on the

intelligent management of digital training, which when analysed can be used as

a basis for decisions which bring about improvements in the quality of people’s

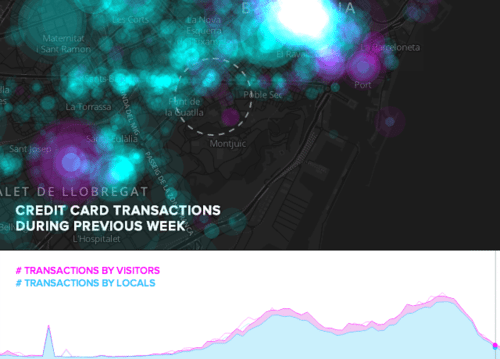

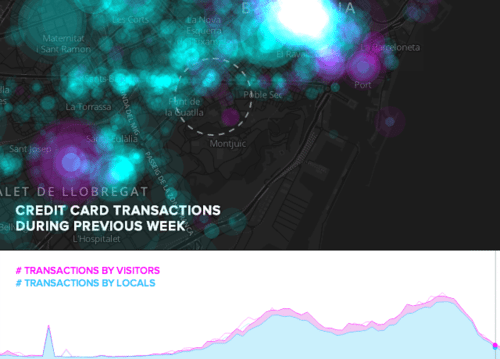

lives. For example, in March, BBVA’s Big Data technology joined

together with CartoDB to analyse and visualise the

economic impact of the Mobile World Congress in Barcelona.

In order to be able to carry out this visualisation, Big Data

technology was used with which BBVA analysed millions of credit card transactions to

show a dynamic and interactive graph of these results.

Picture sourced from CartoDB

Big Data projects are one of the core areas of the BBVA innovation

strategy, which has a specialised team in the BBVA Innovation Centre working on

developing projects which maximize potential for managing digital data.

Perhaps the most significant of all BBVA’s innovations is the BBVA

Contigo service, which combines personal advice with the use of remote

channels, with the aim to complement and eventually replace the branch

network. Each customer has a personal advisor they can contact via e-mail

or phone to make inquiries or perform transactions, in addition to BBVA’s

various virtual banking channels.

CAPITAL ONE (adapted

from Capital One Lab’s website,

and a speech by Capital One Lab’s Managing Vice President Mark Jamison, as

reported in Bank Systems & Technology, April 2013)

Capital One Bank considers itself a laboratory in US banking

innovation and behave as a technology company, rather than a bank, developing

the entrepreneurial spirit of a technology innovaition incubator amongst it

employees.

The bank launched a new organisation unit in 2011: Capital

One Labs.

The subdivision was launched with its own special building,

designed by one of America’s leading architectural firms, and now has three

labs opened in America.

Teams within Capital One Labs are organised with three

employees: a business analyst, an engineer and a designer. Each team works on a

specific project and must achieve concrete results within six months.

The firm describe themselves as “a passionate team of

entrepreneurs who are reimagining the way people interact with their money”,

with the aim to create products and prototypes that will delight customers.

With a focus upon payments, Capital One Labs develop

consumer experiences across a variety of social web, mobile, and emerging

digital payment concepts.

Under the auspices of the Capital One Labs, the bank also holds

regular meetings and competitions for young designers. For example, in 2012,

the bank held MoDevUX Hackathon, a competition for developers of mobile banking

applications. Hackathon brought together

fourteen teams of developers, the youngest of whom was just eleven years old.

The thinking behind the lab is illustrated best by Mark

Jamison, managing vice president of Capital One Labs.

In a speech given at CEB TowerGroup’s annual conference in April

2013, Jamison said that many consumers are disappointed with the level of

technological innovation from their banks, and financial institutions must meet

customer's expectations in a digital world or face the consequences.

Jamison believes the advent of smart mobile devices have

been a catalyst for "creative destruction," a term first coined by

early twentieth century economist Joseph Schumpeter.

He talked about several industries that have been greatly

marginalised by recent technological advances including travel agencies, atlas

publishers and camera makers. "There have been major industries eaten up

by apps," he said, adding, "Of the original Fortune 500 list [first

published in 1955] less than 15 percent still exist today."

This warning is especially pertinent for banks, he noted,

who face increased competition in some aspects from non-traditional

competitors, such as Google, PayPal, Bitcoin and Green Dot. "I think

they're more of a threat that many people realise," he added.

Jamison advised banks to incorporate characteristics that

are usually indicative of the most technologically innovative companies, such

as speed and agility, collaboration and dative design.

Speed and agility are key for any innovative company, he

said, because "it's important to rapidly test and prototype" new

products, rather than develop something for 12-18 months before bringing it out

to market, only to find it's something consumers don't want.

Regarding collaboration, Jamison said banks should not be afraid

of open platforms and enabling external parties to build out their proprietary

platforms. He pointed to Simple (formerly BankSimple), which has deals with

federally insured banks to hold its customers money, as prime example of this.

Jamison also advised banks to utilise data analytics to

target their customers with more relevant offers. He said Capital One runs

algorithms on millions of customer card transactions to determine the most

common "co-occurences" -- that is where customers who spend money at

one retailer are most likely to also spend money. Banks can further mine data

to determine what times of the day certain offers might be relevant.

Financial institutions certainly don't lack the sheer amount

of data to glean this information. Jamison noted that in 2012, two zetabytes of

data were created, which is more than what was created in the entire history of

the world up until that point, he said.

"All this massive amount of data is out there," he

added. "The key for banks is figuring out what matters and what

doesn't."

CITI

Citi has had a focus upon innovation for some time, with

Chief Innovation Officer Deborah Hopkins appointed to the role back in 2008. As a result it probably has the

biggest presence and push towards innovation labs of any of the banks out there

today.

For example, the bank opened the first of a number of innovation

labs in Ireland in 2009.

The press release stated that Citi’s Global Transaction Services business “opened its new global

Research, Development, Innovation and Learning Centre at its offices located in

Dublin” as “the first financial services company to partner with the Irish

Government to bring research and development projects to Ireland.”

Citi announced the investment of $24 million for the

development of a next generation intelligent payments solution as part of this

centre opening, which brings Citi’s total investment in research and development

in Ireland to $100 million at that time.

The firm employs over one hundred people in the R&D

centre, and has also opened other centres in San Francisco, Israel and Singapore,

as well as the Financial Data Intelligence Lab in Israel in 2013, with the mission to use Big Data technology to analyse financial

markets information. In 2013, the bank opened further research

centres with plans for Hong Kong, Mumbai and Miami.

Om another note, Citi opened the Midtown Innovation Lab in

New York in 2010 which demonstrates the future branch, along with this future branch concept

in their flagship Tokyo, Japan office:

As can be seen, Citi’s pretty dedicated and committed to

innovation.

ING

The ING Customer Experience Centre (ICEC) is located in

Amsterdam offering organised tours for foreign bankers, young IT professionals

and other interested members of the public.

The Centre was established a few years ago as a joint

venture between ING and HP, IBM, Microsoft, Intel, Cisco and Progress. The

centre therefore has a multidisciplinary team of specialists engaged in modelling

consumer behaviour in different situations, and the creation of behavioural

scripts on the basis this analysis.

This leads the bank towards the development of innovative

products using theatrical simulations involving customers. At the centre

of these solutions, the bank can show that it has developed:

- Improved

interaction with visitors using Kinect, the technology used for marketing

purposes to enhance customer contact in marketing campaigns. - Microsoft

Surface Windows 8 tables, allowing the bank consultant to use visualisation

tools with the client to choose banking products, conduct investment

planning, etc. - Aurasma,

a visual browser for "augmented reality." - Mobile

applications and technology from a variety of NFC applications to Bump and QR-codes.

The values of the ING Customer Experience Centre include:

- Being

the fastest is more important than being unique; - Adapt

and fail; - Quickly

fails achieve fast successes; and - Create

a single network for the bank in which all can create, share the results

and reinforce each other.

A good example of the work at the ING ICEC is given by one

of their graduates, Wendy Steffens,

who explains how they answered the question: "How can an application on the Samsung SUR40 table, with Microsoft

PixelSense 2.0, support the personal introductory conversation between ING

Private Banking prospect and advisor?" which is now a pilot program

running in the ING Private Banking branch in Wassenaar, The Netherlands.

Postnote: I’m sure there are other innovation centres in

banks out there, so let me know if you have one we should know about.

Post postnote: Mykola runs a firm called idnt, which offers design

for retail outlets, as well as logistics, typology, merchandising and marketing

ideas for innovation in finance.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...