Building on yesterday’s debate about Google and co coming into banking, and the previous discussions of such:

- Imagine less than 50 banks left in the world by 2030 (why most will not become digital)

- If you think 'rip out and replace our systems' is naive ... think again

... and there’s been loads more, I was shocked to stumble across a survey this week that shows the attitude of Millennials (people born from the 1980s to 2000 that grew up with the internet).

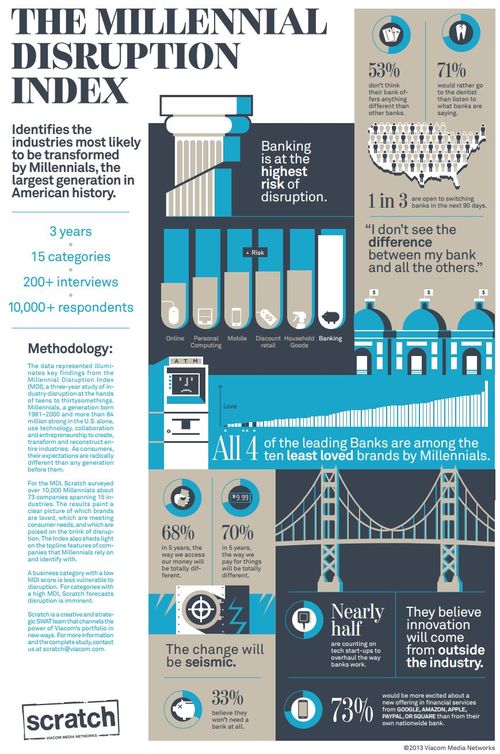

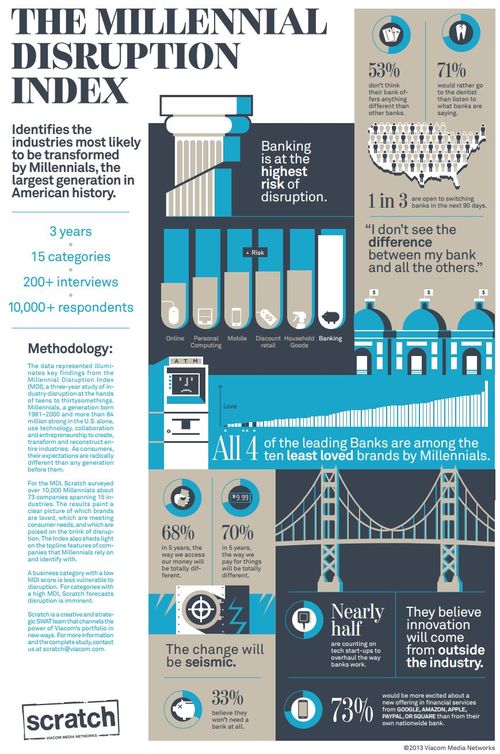

The survey is called the Millennial Disruption Index (MDI), and represents a three year effort by Scratch, a creative agency. Scratch interviewed over 10,000 Millennials in America, and asked for their views about 73 businesses in 15 industries. The results are astounding, finding the most likely industry seen for disruption is banking.

America’s big four banks all rank in the top ten of least loved brands:

- 71% of Millennials would rather go to the dentist than listen to what a bank has to say;

- 73% of 10,000 Millennials would be more excited about a new financial offer from a tech company than from their bank;

- Half of all Millennials expect Google, Amazon & Square to overhaul banking; and

- 33% think they won’t need a bank at all.

This should seriously worry banks when they see the infographic (doubleclick image to enlarge):

But even more worrying is when it’s backed up by Accenture saying that non-banks will take a third of incumbent banks revenues by 2020.

Their report on Banking 2020 shows: “a number of emerging trends—including digital technology and rapid-fire changes in customer preferences—are threatening to weigh down those full-service banks that limit themselves to products and services that get distributed primarily through physical channels, particularly branches. Given the scale of these disruptions, our analysis shows that full-service banks, as a group, could lose about 35 percent of their market share by 2020. Who gains this market share? Digitally oriented disruptors that are far more agile and innovative – the equivalent of speedboats competing against schooners.”

Too right.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...