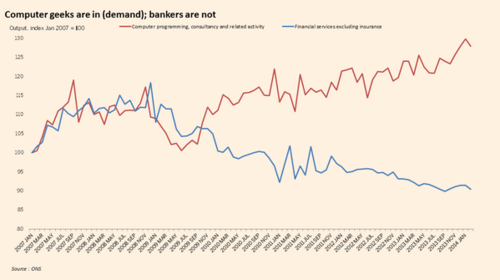

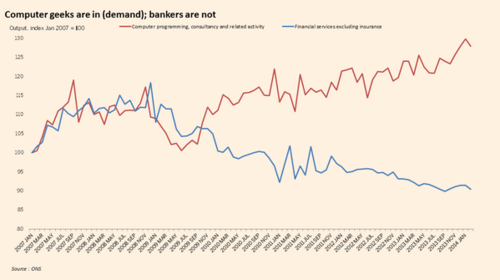

I just got this chart from the FT via Chris Giles:

The chart clearly shows that from the Spring of 2009, algo trading rocketed whilst human trading plummeted.

This is the timing of Chi-X, now BATS Chi-X, take-off. It is the age of the algo, the fashion of the flash boy and the height of high frequency trading.

Having said that, it’s not a clear decimation of markets as Chi-X represents around the same percentage of trade today as it did three years ago, when I was last tracking the trades through Chi-X.

According ot the Fidessa Fragmentation Index today, the LSE trades over 62% of UK equities and Chi-X 18%; in France it’s 67% on Euronext and 19% on Chi-X; in Germany it’s 67% on the Deutsche Bourse and 21% on Chi-X; and so on.

High Frequency Trading in equities peaked in Europe in 2010 when 38% of all equity trades were through algo systems; in the USA it peaked a year earlier at 62% of all equity trades. Since then, the algo trading world has fallen away somewhat, as the low latency wars settled down.

Now it’s all in the spotlight again, as Michael Lewis’s new book Flash Boys has everyone up in arms about gaming the markets by slipping in trades a moment before customers to inflate or deflate prices to the bank’s advantage.

Strangely enough I yawned when I saw Lewis’s book come out, as ti’s old news.

I blogged about this in 2009, and the regulators were already cracking down on such practices.

So I am reading Flash Boys but haven’t found something current.

In fact, it’s talking about a market that has matured.

From a recent Bloomberg review 0f HFT, the market has plateaued:

According to Rosenblatt, in 2009 the entire HFT industry made around $5 billion trading stocks. Last year it made closer to $1 billion. By comparison, JPMorgan Chase earned more than six times that in the first quarter of this year. The “profits have collapsed,” says Mark Gorton, the founder of Tower Research Capital, one of the largest and fastest high-frequency trading firms. “The easy money’s gone. We’re doing more things better than ever before and making less money doing it.”

“The margins on trades have gotten to the point where it’s not even paying the bills for a lot of firms,” says Raj Fernando, chief executive officer and founder of Chopper Trading, a large firm in Chicago that uses high-frequency strategies. “No one’s laughing while running to the bank now, that’s for sure.”

The real current concern is not in fact gaming through flash trades, but dark trading and shadow banking.

Around 40% of all American stock trades, including almost all orders from day traders and retail investors, now happen off exchange, up from around 16% six years ago.

Nevertheless the City is being run by a man and his dog, as the technologies rule.

It’s nto about technology per se, but the ability for technology to create market efficiency and take over from human trading.

That’s what Chris Giles chart shows and it’s reinforced by so many other sources of input..

Last year, European investors put 51 percent of their orders through computers directly connected to the stock exchange or by using algorithms, or algos, to find a counterparty, a study by consultants TABB showed. In 2012, the share was 46 percent.

The foreign exchange market has already embraced algo trading, which accounted for 68 percent of orders in 2013, EBS data showed.

Meanwhile, according to Aite Group, 66% of all currency transactions were through automated trading in 2013 compared with 20% in 2001. About 81 percent of spot trading -- the buying and selling of currency for immediate delivery -- will be electronic by 2018, Aite said.

So the machines are taking over.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...