I have recently spent a lot of time talking about KYC (Know Your Client), AML (Anti Money Laundering, often confused with ALM which is Asset and Liability Management), Client Onboarding, PEPs (Politically Exposed Persons) and SARs (Suspicious Activity Reports).

It’s all wrapped up in financial crime, compliance, legal, audit and operational risk.

The core of the issue was sparked by the US regulators going after HSBC and StanChart, but has spread to London where the FCA (Financial Conduct Authority) has started fining firms for misdemeanours.

Some might say about time, as the FCA’s predecessor the Financial Services Authority (FSA) did pretty much nothing about money laundering in the City. As their own report discovered, around 75% of City firm’s do not apply to tests required for effective AML:

Three quarters of the banks in our sample failed to take adequate measures to establish the legitimacy of the source of wealth and source of funds to be used in the business relationship.

Hence, it is low hanging fruit to go and investigate a bank and then fine it.

Some might say that’s what happened with HSBC when they were hit with $1.9 billion of fines for money laundering breaches in the USA.

Most of this was related to terrorism funding in the Middle East and drug runners in Mexico.

My friend David Bagley fell on his sword over that one.

David was the Global Head of Compliance for HSBC and Chair of the Wolfsburg Committee that set the rules on AML for banks worldwide.

Some contradiction of issue there isn’t there?

The issue is that sometimes you just cannot tell who is a launderer and who is not.

An Iranian born businessman, who has lived in America for 15 years and now has dual US nationality, will open an account as an American citizen and send funds to Iran. Is that illegal? How could the bank know this in advance?

Ask any bank how many PEPs their counterparties might be shielding and they have no idea.

In fact, they might know that the parent company of their Iranian-born businessman is American, and that it deals with overseas subsidiaries through the United Arab Emirates (UAE) in Dubai for the Middle East.

The fact that the UAE subsidiary business then fuels funds into Iran is hard to catch.

Nevertheless, it does happen.

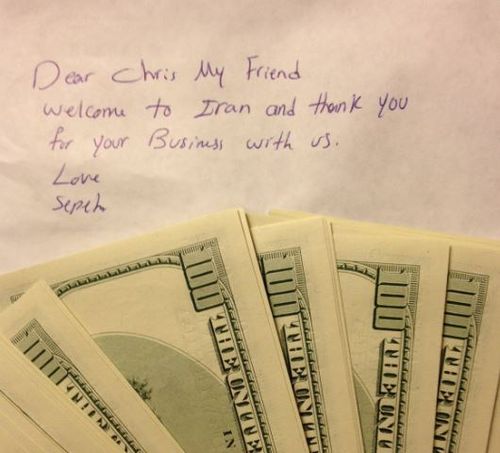

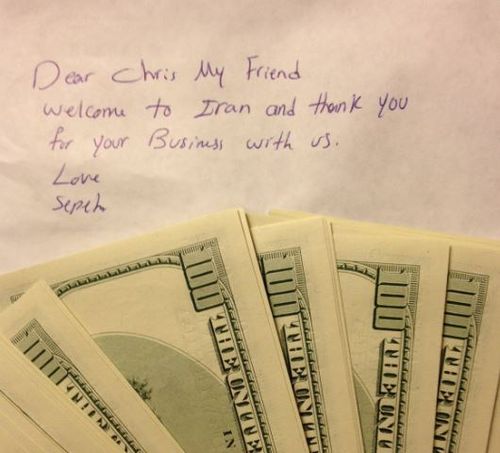

Here’s a note for example, from an Iranian contact who paid me for some advice recently.

The payment is in brand new crispy $100 bills, with sequential numbering.

Where did that come from?

Dubai.

How do I know this?

Because I always remember and still enjoy telling the story about when the Americans raided Saddam Hussein’s Palace in Baghdad after the Gulf War and found almost $1 billion of brand new crispy dollar bills.

How did they get there?

Through UBS branches in Syria, Libya and related countries.

The dollar is the global reserve currencies, and money launderers and terrorists want to trade in dollars and banks are the easiest way to do this.

Or they used to be.

Now, they’re all running scared of the US authorities and so they’re all throwing any suspicious countries off the network.

Barclays were one of the first to be embroiled in this when the Money Transfer Networks found themselves stranded.

This was followed by news that HSBC were rationalising and caused a diplomatic row by ejecting diplomat’s accounts randomly, and causing a ruckus with the likes of the Belize Embassy and the Pope.

JPMorgan has just done the same thing, and caused a row with Colombia.

This arbitrary ejection is more to do with it not being worth it.

JPMorgan made it quite clear that the cost of compliance of managing these entities is greater than the returns. In other words, the risk and continual costs of monitoring clients for PEPs and SARs is an overhead too far.

But what happens when these countries, companies and individuals are thrown off the network?

They just find a way around the network.

In Africa, we are seeing nested accounts growing rapidly, whereby countries off the network work through countries on the network to transact.

This is true in areas such as Lithuania, where a friend of mine tells me that the only banks that offer dollar FX services there are now Deutsche and Commerzbank. Everyone else has shut their doors.

In fact, the growth of alternative payment schemes such as Bitcoin is fuelled by the actions of countries and regulators to throw those who need to transact off the network.

For example, one banker said to me that most of the barter business between corporates is to get around the network of banking.

In other words, Coca-Cola’s exchange with Russia is in Vodka, which they then sell back in America.

This is the nature of the network and the more that governments, especially the USA, crack down on money launderers and terrorists, the more that money launderers and terrorists will seek to exchange through another mechanism that is untraceable, untrackable and off the network.

In other words, hard cash dollars.

Just part of the ove $200 million in cash found in the home of Zhenli Ye Gon in Mexico, 2007.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...