Our biggest stories of the past week are ...

Money laundering, KYC and a PEP talk

I have recently spent a lot of time talking about KYC (Know Your Client), AML (Anti Money Laundering, often confused with ALM which is Asset and Liability Management), Client Onboarding, PEPs (Politically Exposed Persons) and SARs (Suspicious Activity Reports). It’s all wrapped up in financial crime, compliance, legal, audit and operational risk.

AML prevention lies in digital identities: the new form of money

After yesterday’s post about KYC, PEPs and AML, someone said: “so what’s the point Chris?” The point was to point out the problems of catching and tracking financial crime and, today, to take a look at the solutions.

"Flash Boys" ... that's old news Michael

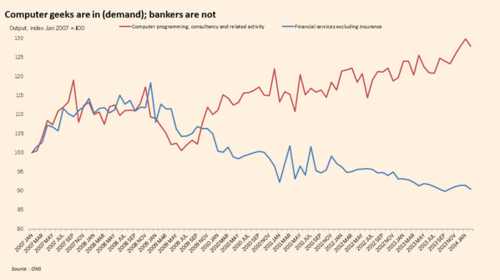

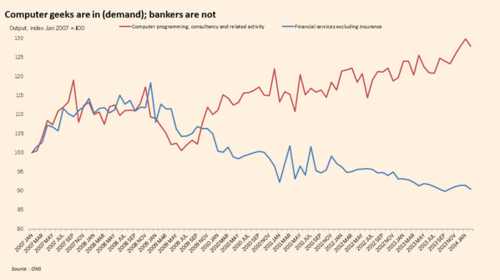

I just got this chart from the FT:

The chart clearly shows that from the Spring of 2009, algo trading rocketed whilst human trading plummeted.

We concluded a major six-part series on Digital Banking:

Part One: Major parts of banking are stuck in the last century

During my lifetime, two things have fundamentally changed the world: travel and technology.

Part Two: Heidi Miller, Bitcoin and fitness for purpose

Building on yesterday’s theme about how a cheque from Canada has taken six weeks to process and had significant processing charges taken from the deposit as a result, reminds me of Heidi Miller’s speech from SIBOS 2004, which is still talked about today. What did Heidi say that was so compelling?

Part Three: We are not Borg, we are Human and dancing to a different tune

Building to the theme of the divide between the old world of finance and the new, and why (some) banks aren't fit for the 21st century, brings a few more points to mind, in particular about control and centralisation. Banks were built as control freaks. They need to own the complete end-to-end cycle of everything. They have to develop their own software, systems and services, which is why they end up with more developers than Microsoft as a result.

Part Four: You may be innovative today, but tomorrow you're just an incumbent

I’m going to give up on the discussions about banks dragging heels when it comes to the global net soon, but only after a few more pieces of debate. Today, it’s all about innovation.

Part Five: Please refer to the Digital Department

I have this cheesy line in my presentation about digital is a journey, not a destination. The destination comment is that most senior bank management think it’s a one-off project, like building a pyramid or a cathedral. You make the investment and it’s done. That’s not the case.

Part Six: Banking-as-a-Service, five years later

In a final note on the Digital Bank Transformation, I return to a theme I’ve explored a few times. The core of the model of banking is represented in various ways, but I encapsulate it as three companies in one: a retailer that has customer intimacy; a processor that has operational excellence; and a manufacturer of products.

The major general news stories of the past week include ...

Forget AstraZeneca, it's Barclays we should be worried about - The Telegraph

The loss of Britain's only major home grown investment bank is a more serious issue for Britain than whether or not AstraZeneca is bought by Pfizer

Day of reckoning looms for Barclays' investment bank - Reuters

LONDON (Reuters) - Barclays Plc is set to announce plans to cut thousands of jobs and shrink its investment bank as Chief Executive Antony Jenkins tries to get his turnaround plan for the British bank back on track after a bad 10 months.

MPs attack Sir Win Bischoff role at regulator - The Independent

The appointment of former banker Sir Win Bischoff to lead Britain's accounting and corporate governance watchdog was described as "the City looking after City insiders" at a hearing of the Treasury Select Committee yesterday.

JPMorgan closing accounts of foreign diplomats in U.S.: FT - Reuters

(Reuters) - JPMorgan Chase & Co is closing the accounts of current and former foreign government officials in an attempt to avoid the compliance costs associated with them, the Financial Times reported on Tuesday.

America is an increasingly hostile environment for a British bank - The Telegraph

Barclays must submit detailed plans to regulators on how it intends to fund its North American business

UK anger over 'secret' EU financial transaction tax plan - The Telegraph

The Chancellor has accused the EU of working in "secret" to agree a financial transaction tax that threatens the City of London

Barclays’ investment bank sees its profits slashed by half - The Independent

The scale of Barclays’ problems in its investment bank were laid bare after it revealed the division’s profits had halved, just two days before its chief executive Antony Jenkins announces sweeping changes.

How thieves can use your mobile to empty your bank account - Daily Mail

Every day, hundreds of thousands of us pop into coffee shops. While we sip our cappuccinos, we may connect our smartphones to the cafes’ Wi-Fi network, and catch up with friends via services such as Facebook. But what coffee drinkers do not suspect is that lurking among their fellow latte lovers are bank robbers.

Barclays quarterly profits fall 5% - BBC

Barclays first quarter profits fall 5% to £1.69bn, following a slump in revenue at its investment bank.

If you like the Finanser, check out our latest book: Digital Bank

The Financial Services Club is sponsored by:

For details of sponsorship email us.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...