We’re talking wallets.

Digital wallets.

They’ve been talked about for a long time.

Google Wallet was perhaps the first big launch but, since then, there have been many.

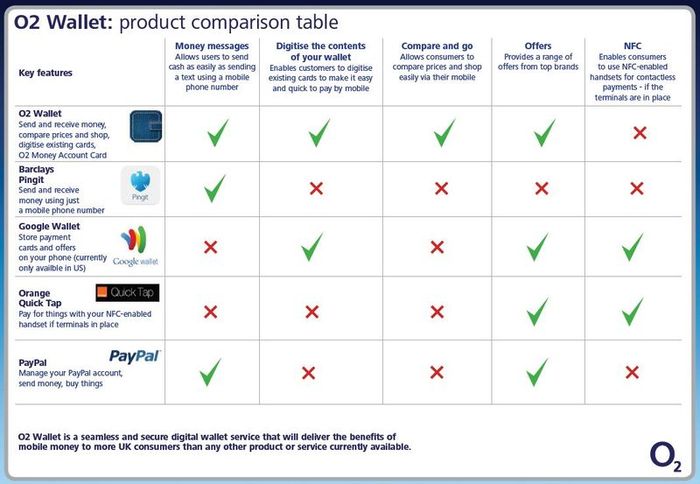

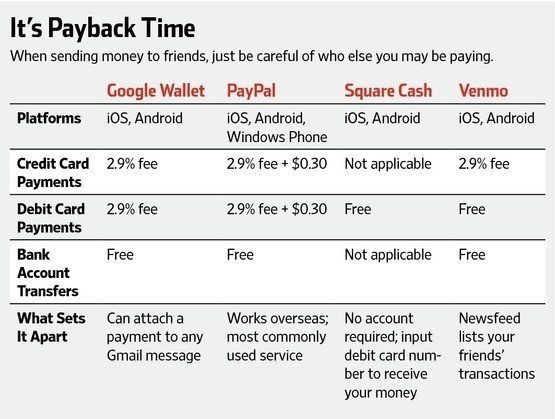

Two years ago, I showed this slide from O2 on the state of mobile wallets, and said let the wallet wars begin:

Two years later, the war hasn't even started.

O2 wallet has been retired and the Orange system is not a wallet but just an NFC payment called Cash on Tap that is now offered to all EE network users.

Of the others here, Barclays Pingit has moved along at a pace. Since it launched in February 2012, the Pingit app was downloaded 3 million times and the total amount of money sent using the service had reached £540 million by July 2014.

That’s about £250 million a year at current run rate, which is not that amazing considering that the UK spends 2,000 times more than that on cards annually (£500 billion a year).

Pingit sees itself joined by Paym and Zapp in the UK.

These are organised by the UK Payments Council and clearing company, where Paym is a simple P2P payments based upon knowing the recipient’s mobile telephone number only, whilst Zapp is more of a full service wallet (provided through a subsidiary of VocaLink):

Providing a central service to all is a mdoel that has been proven effective in Turkey, so maybe a co-ordinated rollout form the clearing firm makes sense.

If that doesn’t work, there are always the powerhouses of Google, Apple, Facebook and Amazon (GAFA) that we always focus upon.

Google Wallet looked like the megabeast when it launched in May 2011.

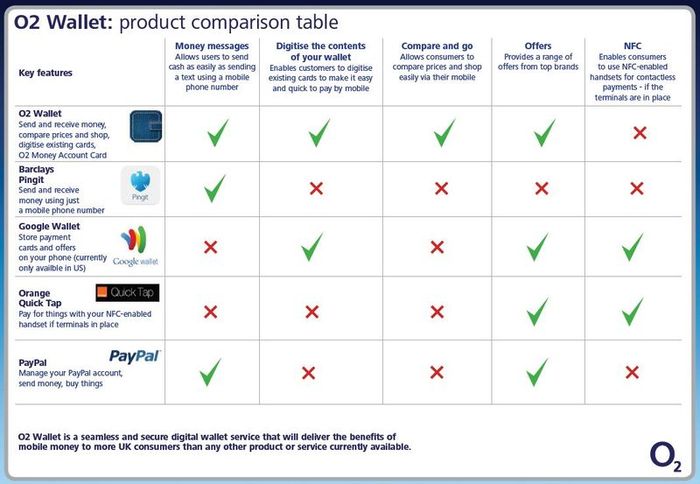

Now over three years old, Google’s Wallet is still only available for American users, appears to be stagnating and has little traction. Like Google Checkout, it just seems like a service that Google hope will succeed but never really does. In the latest development, you can just plug money into Gmails …

With almost half a billion Gmail users, that could make a difference but I don’t think so. That’s because people see different brands for different things.

Amazon is for buying.

Google is for searching.

Facebook is for sharing.

Apple is for entertaining.

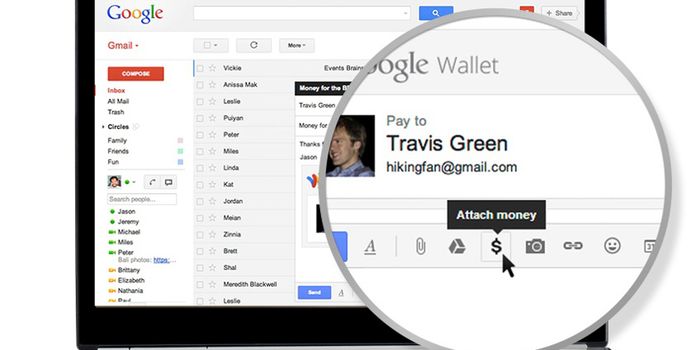

And PayPal is for paying (as is Square).

Source: Wall Street Journal

That’s why, for all the efforts of the GAFA crew, each of whom have a wallet (Amazon Wallet, Google Wallet, Facebook Messaging Payments, Apple Passbook), the most likely winner is the one that has the breadth, depth and name in this space: PayPal.

Meanwhile, as one person commented, ISIS (nothing to do with the Islamic State) and Venmo. Really?

No.

More likely Visa than any of those.

But even with all of these alternate wallets, what’s really going on here?

Why so much activity and focus upon a digital wallet?

Especially as most people aren’t interested.

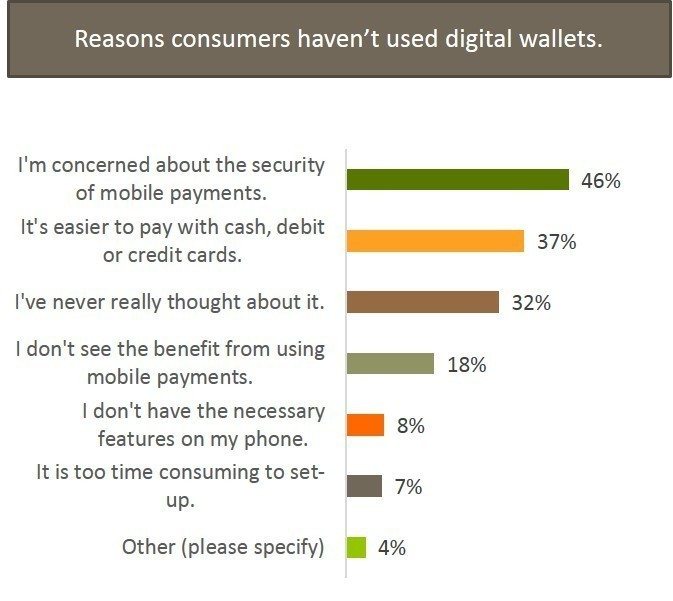

After all, in a survey of over 2,000 American consumers by Thrive Analytics, they found that almost 80% of heard of the digital wallets from the big guys like Google and PayPal, but only a third have used one.

However, most people are concerned about the security of such services, and so few (7%) are using wallets regularly.

In a similar research study by Yankee Group, a mere 16% of consumers used their phones to make an in-store purchase between December 2013 and February 2014. Among these buyers, 73% made fewer than five purchases a month.

Such low rates of adoption have already killed off several wallet launches, such as O2 in the UK and Square Wallet in the USA, but here’s the real reason why there’s so much activity: everyone wants to create the next generation PayPal.

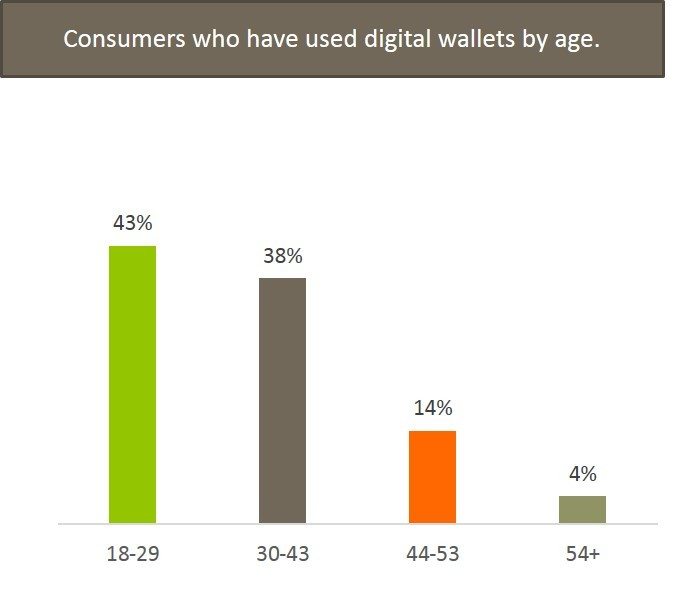

You only have to look at the demographics to realise that things will change.

When the next generation are committed to a technology, we know that the generations behind will follow (kids tech mom and pop about tech).

Eventually, digital wallets will supercede card usage.

As cheques disappear, cash usage declines and cards are displaced by wallets, every provider of payment services wants to be the next PayPal, Visa, MasterCard, ChinaUnionPay.

That’s what this is all really about, rather than than the itsy-bitsy wallet wars we see right now.

Give it ten years and we will look back at 2013, 2014, as being similar to 2003, 2004 with internet payments. PayPal was emerging and alternatives were abounding but flailing.

Seems very similar to today.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...