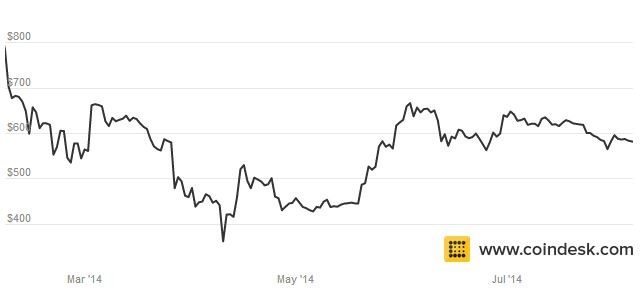

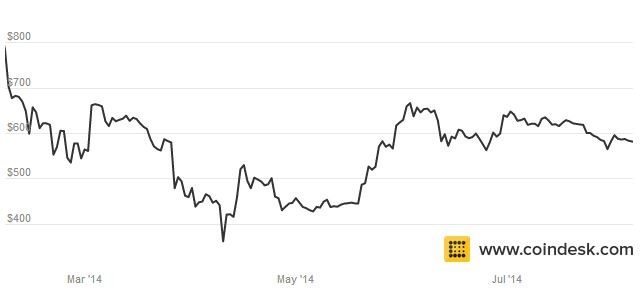

Since the Mt.Gox implosion, confidence in bitcoin has somewhat dampened, as demonstrated by its flat-lining priceline…

You would think that when Dell, Baltic Air, Wikipedia, the German newspaper Taz and the Royal National Lifeboat Institution (RNLI) all announce that they will be taking bitcoin payments – as they all did in July – the price would jump. It didn’t.

You would think that in a month when New York announces draconian bitcoin regulations, whilst London does the opposite, that the price would jump.

It didn’t.

The bitcoin price has been around $600 for the past six months, dipping down to under $400 in April (when Chinese businesses began receiving official deposit shutdown notices from banks for trading in bitcoins) after the peak of over $1,100 per bitcoin in December just before the Mt.Gox collapse.

Why is the bitcoin price flat-lining?

Because the most excited innovators, who brought into the bitcoin concept, were stung by the losses at Mt.Gox.

Mt.Gox was destroyed by a bug, as discussed yesterday, , but the losses resulting were about 5% of the total bitcoin marketplace at that time.

$500 million lost in a $10 billion economy.

The market needs those propagators who got stung to return before bitcoin will start to rock and roll again, although the movements of companies and charities like Dell and the RNLI do make a difference.

As does the Bitcoin Foundation.

I realised after all my discussions yesterday, about the Bitcoin Foundation that I didn’t even bother to mention who they are or what they do.

So when someone asked, I thought it worth blogging a bit more about this group.

To start, here are the basics.

The Bitcoin Foundation was founded in July 2012 (not September as Wikipedia states, which is when it was launched publicly) with a vision “to ensure all people have the opportunity to realize Bitcoin's potential”.

The Bitcoin Foundation is a charitable fund that is designed to achieve three key objectives, namely to standardise, promote and protect the Bitcoin infrastructure.

First, in order to standardise the core development of the Bitcoin infrastructure, the Bitcoin Foundation funds core development team to make Bitcoin more respected, trusted, and useful. The team has three full time developers who have led Bitcoin Core development through the latest versions (blog posts on every core development update can be found here).

The second part of the Foundation’s activities focus upon cryptography.

Cryptography is the key to Bitcoin’s success. It is the reason that no one can double spend, counterfeit or steal bitcoins. If Bitcoin is to be a viable money for current users and future adopters, it needs to maintain, improve and legally protect the integrity of the protocol.

In order to do this, the Bitcoin Foundation provides global policy leadership publishing various documents, such as “Removing Impediments to Bitcoin's Success”, and acting as leading advisor to US policymakers and regulatory agencies (most people forget that just one year ago, the US Government was completely fed up and uneducated on bitcoin).

In other words, the Bitcoin Foundation acts as and provides funding for government lobbying, making all the rounds to Congressional offices and regulatory agencies, as well as advising and collaborating with international governments such as the Isle of Mann, Luxembourg, Brussels and Gibraltar.

Third, the Bitcoin Foundation exits to promote Bitcoin by hosting annual conferences that bring the community, as well as supporting and funding community resources like Bitcoin.org.

In other words, they are pretty active as the central voice of the Bitcoin community.

A key point here, that the Foundation underscores, is that they are not a centralised or controlling service.

Bitcoin is not built for centralisation or control. That is why the Bitcoin Foundation is trying to organise but not centralise the Bitcoin community. It is why the Bitcoin Foundation partner with existing web services, press, individual leaders and resources to try to create a more robust and stable ecosystem.

So why is the Bitcoin Foundation smeared with controversy (in case you didn’t know, it is).

There has been extensive critique of the Bitcoin Foundation and its leadership, such as the discussion yesterday, of their involvement in the Mt.Gox failure.

Former vice-chairman of the Bitcoin Foundation, Charlie Shrem, faces federal money laundering charges for his role in assisting agents of the infamous online drug marketplace Silk Road.

Executive chairman Peter Vessenes' relationship to former board member Mark Karpeles, the disgraced CEO of bitcoin exchange Mt. Gox, has been highlighted as inappropriate.

In fact, the Bitcoin community in general is divided over the role of the Bitcoin Foundation as a community or industry representative.

Nevertheless, this reminds me of the Occupy Wall Street movement.

Originally a protest against the mass greed of the corporate world, Occupy soon became a mass of all agendas from save the planet to be nice to whales.

It needed a voice, and the Bitcoin community also needs a voice.

This is highlighted by Joshua Sherman this week:

The Bitcoin community is in need of centralization. By centralization I do not mean a core authority, but rather a core voice. This is not an optional element in the future success of Bitcoin. While the origins of motivating adoption to Bitcoin have been grassroots, a continual shift in the way Bitcoins are earned by new users is a key reason why a central voice to the currency is essential for merchants and new users to trust adopting the cur1rency.

The Bitcoin Foundation is that voice today.

IN fact, what we’re seeing is the emergence of the system.

From grass roots anarchy (2010) to organised chaos (2014) to a regulated and functioning economy (2018?).

That is where Bitcoin is going, and the Bitcoin Foundation is the main glue to organise the chaos today.

In doing so, their priorities are now to:

- standardise core development by tackling scalability and security challenges, increasing transactions-per-second and more;

- protect: the integrity of the cryptocurrency by extending policy teams in major western capitals, expanding bitcoin policy work to emerging market economies and building a rapid response team to respond to any policy threats; and

- promote Bitcoin more through education and outreach by launching a global brand awareness campaign, educating mainstream society on Bitcoin's social and economic benefits; creating an international press team; and developing strategic partnerships with key organisations and conferences.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...