I just visited with Roberto Ferrari at CheBanca! in Italy. For those who don’t know CheBanca!, it is the digital first bank launched in 2008 by Mediobanca. Mediobanca provides merchant bank services in Italy and had never had a retail bank before. Therefore, it made sense in the post-meltdown digital age to implement a fintech bank fit for Italy, and CheBanca! claims to be that bank. You can find out more here.

Anyways, being a digital first bank does not mean being a digital only bank, and Roberto took great pride in showing me his branch.

I know, it doesn’t look like much, but wait till you get inside

A digital bank with a branch? Yep. CheBanca! has launched almost 50 of them so far, with more to follow. This has proven critical in getting trust and deposits, with the main aim of achieving three things that digital only does not achieve:

- Trust

- Brand

- Service

These three things are harder to achieve when you are unseen, unproven and unknown, although some are bound to disagree. However, Roberto and his team gave me some interesting statistics that may back up this claim.

First and foremost, asset holdings in areas with a branch are 2.5 times more than those areas that are unbranched. This reinforces item #1: Trust. When you can see where the money goes in and out, the claim is that this builds more trust than the unseen bank.

Second, CheBanca! is gaining 4,000 new customers per month with 45% from branches and 37% from remote contact (the bulk, 30% of that 37% is generated by the internet). The remaining balance of 18% is generated by third party physical channels. That means a whopping 63% today is coming from direct physical contact, and demonstrates the increased trust in the branch services as well as the strength of the branch in building brand.

Third, customer behaviours demonstrate that, for service, they prefer digital with 37% of customers handling all of their transactions and operations just through digital access. Then there are a second group of customers, 26% of the total, who deal with CheBanca! purely through remote servicing via the web and call centre. A third group that represent around 28% of all customers, use all the access points (web, call centre, branch). Finally, only 9% deal with just the branch and nowhere else.

However, you have to think about the first two – would they trust a pure play digital firm with zero branches? – and the latter two – for over a third of customers (37%), the branch is still important even in a digital first bank.

Interestingly, the figures continue to bear this out when you look at how customers interact with the bank, versus performing transactions. 89% of all contact is via digital access, three times the volume of contact that takes place in a branch. Just 9% of customers visit a branch every month versus 7% contact the call centre and 42% interact via digital channels.

So there are a few things about a digital first bank branch that are different. For example, once you get inside, it looks a bit empty.

All you can see is a concierge with an iPad, a machine that looks like a teller (but isn’t) and something at the back that might be a Star Trek transport station (and is).

Looking back the other way across the branch (which is in an L-shape), you see a few teller stations.

These are stations to chat with people about account opening, service and advice, and the typical staff member here is from Gant, Massimo Dutti, PC World or similar retail stores by background. They’re not bankers, but customer agents who are enjoying the experience of joining a bank that helps people live their lives, or so they tell me.

Finally, at the back of the L-shape are a few rooms with frosted windows.

These are the serious advice stations. They operate by customers making appointments to see wealth managers, mortgage advisors or similar and then, when they turn up, they check-in and can see which pod they’re going to go to and who they’re going to meet.

However, you don’t need to wait if it’s about advice, as you can go to the transporter room. The transporter room is this weird funky station at the back.

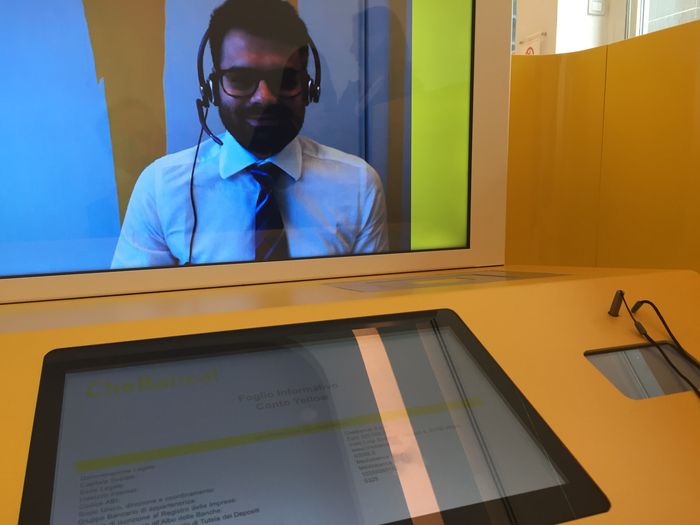

Once you sit at the station, it’s got all sorts of cool features like biometric recognition using digital signature and shared screens with video operators.

Here’s me talking with one of them.

This particular small branch serves around 259 customers a month at these videostation, and it has proven successfully at broadening and deepening customer relationships using those old bank metrics of cross-sell and up-sell. According to the bank, the service videostation has a 15% cross- and up-selling success rate.

Finally, if you just want to deposit a check or cash, you use the funky self-service machine.

This machine can do almost everything and recently appeared in Italy’s Got Talent! as a dog trainer.

CheBanca! boasts over half a million customers overall, since the bank opened for business in 2008, and is now rolling out its digital branch formats. Today, there are four branches based on the new format. By the end of September 2015 there will be eight in a selected sample of medium and big towns. Equally, the bank intends to roll-out the videostation experience via Skype from September.

All in all, there’s lots of things I liked about the digital branch concept. I know folks will throw rocks, and say that digital customers don’t need branches but today’s statistics and customers don’t support that view. Tomorrow maybe.

The only thing I didn’t like is having retailers for customer service and talking about up-sell and cross-sell. We did that in the UK and it went badly wrong – just look at PPI if you want to know more – so that aspect of the business has to be handled with care. I’m sure that CheBanca! and Roberto will do their utmost to ensure it is though*, as they want to be the coolest bank in Italy and, based upon this experience, they probably are.

* Roberto points out that CheBanca! has been awarded the Best Bank for Customer Satisfaction in Italy for the past three years and has a Net Promoter Score (NPS) of 47. He claims that “sales is a result of true customer satisfaction”.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...