I regularly use the line that banks will become Value Systems Integrators, but haven’t blogged about this much, so here’s the explanation.

Banks have historically controlled the value chain of finance from deposits to credit. Because of this, banks have become control freaks, believing they have to build and manage everything. It’s the reason why banks take great delight in telling me about their many 1000s of developers. Some banks even have more developers than the largest software houses, such as Microsoft.

But this is last century thinking.

Banks should not control and build everything as they’ve proven they’re not very good at it. A bank may be great at some things, but they’re not going to be great at everything. They’re going to be bad at something.

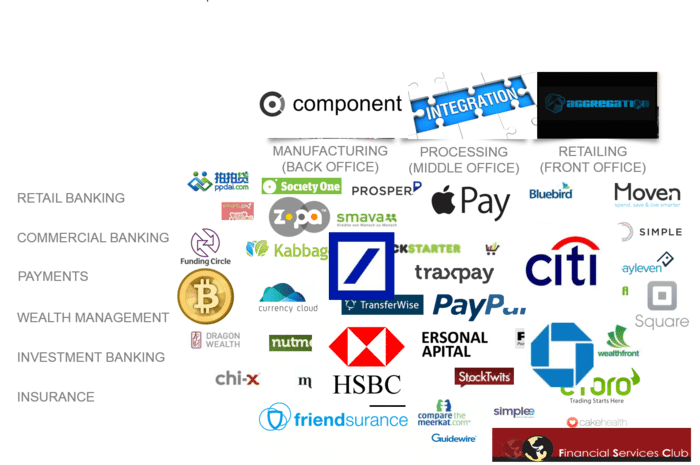

And this is where the value systems integration starts to play. In order to be relevant in the new digital age of Fintech, banks need to start focusing on their core competencies. Those competencies may be with customer engagement and fulfilment, operational excellence in their transaction processes, innovation in product and service; but it will not be competent in all of these things.

So the bank must first work out its internal map of core competency.

Once this is completed, there then needs to be some external horizon scanning to find out if the belief that these are core competencies is true. Do your credit products compete profitability with the peer-to-peer lenders? Can your FX service provide the same rates as TransferWise? Are you enabling customers to meet their expectations of real-time everything in the same way as Circle? Is your offering as engaging as Moven or as flexible as Fidor?

The reason I raise this is that many banks I talk to think of Funding Circle, Lending Club, TransferWise and Circle as alternative finance and yet, when you talk with these start-ups, they refer to themselves as narrow finance.

The target of all new start-ups is to take just one piece of banking and do it better than a bank, based upon today’s technologies. I would claim that most banks will fail at competing with this model, as banks try to be all things to all people, rather than one thing for some people.

But banks do have a great pedigree, a great history, millions of customers onboard in many instances, and a clear culture of understanding regulation and risk. Therefore, what a bank needs to do is take their map of core competencies, check if they are real and then create a new map of competency shortfall.

This new map will identify where the bank is failing to live up to customer and competitive expectations, and identify how short the banks is failing to meet those needs. Can the bank develop those competencies internally? Can the bank meet and exceed those needs, compared to the competition? Are there others out there who can do this better?

The trick then is to rebuild the bank model to not control anything, but to provide the plug and play capabilities to allow 100% flexibility for the customer to meet their needs through the bank’s services. This is where I’m talking about Value Systems Integration.

The Value Systems Integrator (VSI) is where a bank leverages technologies to deliver the total end-to-end value chain for their clients, but through partnerships and integration rather than internal developments and management. A VSI knows that their customer needs 100 different things to manage their value store and exchange, but buys and partners with 100 different companies to deliver those stores and exchanges, rather than developing them all themselves. A VSI is a bit like a Systems Integrator such as IBM, Accenture or SAP. Do IBM, Accenture and SAP do all of the things their clients need themselves? No way. Instead, they partner, acquire and integrate to deliver.

This is the future bank. It’s not a software house and it shouldn’t have more developers than Microsoft. Instead, it’s an integrator of many components and delivers those components to their customers in the best and lowest cost form possible.

The key is to remember that statement: a VSI knows that their customer needs 100 different things to manage their value store and exchange, but buys and partners with 100 different companies to deliver those stores and exchanges. Why should I go and find all the different Fintech startups to satisfy my needs? Especially when I don’t trust most of them because they are upstarts.

If my existing licenced bank provided a trusted aggregation of the startups, and saved me searching for the 100 pieces I need to manage my value chain, then they stay relevant. This is why they need to become a VSI.

Related story: BaaS – build your own bank (from 2009)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...