I regularly talk about the business model of banking and how it’s changing. The business model is based upon three things:

- Manufacturing, which runs the product and services innovation and administration centres in the back office;

- Processing, which focuses upon operational excellence in processing orders from front office through back office; and

- Retailing, where the challenge is to be customer intimate and provide the best service experience.

Banks in the 1990s decided to run these three operations across multiple lines of business as they moved into a bancassurance model. The bancassurance model meant that many banks began to create universal banking structures that offered everything in finance: retail, private, commercial, investment and transaction banking, along with wealth and asset management and insurance.

A few banks then thought they could leverage this model globally and build universal, global banking structures. The chart below is the result:

The weakness in this thinking is that no-one can be good at everything, everywhere for everyone. You’re going to be rubbish at something.

The second weakness in this thinking is that you can only do this if you control everything. Until recently, these banks did control everything. Banks controlled the end-to-end processing of finance from product thorough distribution and felt impervious to change apart from change within, as in competing with other banks for more business. Hence, banks battled on interest rates and grew by acquisition.

The weakness in both schools of thought are now clear to see, as banks structures crack and fade with challenge.

The crack in the structure comes from two onslaughts: one is regulatory and the other is innovation.

The regulatory onslaught has focused upon changing the universal banking model by trying to prise apart investment markets from retail and commercial systems. This has been in two forms: the American model of stopping banks engaging in casino capitalism through the Volcker Rule (which bans proprietary trading) and the UK model of splitting investment operations from retail and commercial operations through the Banking Reform Act (the bank can still engage in both, but must be under two separate company structures).

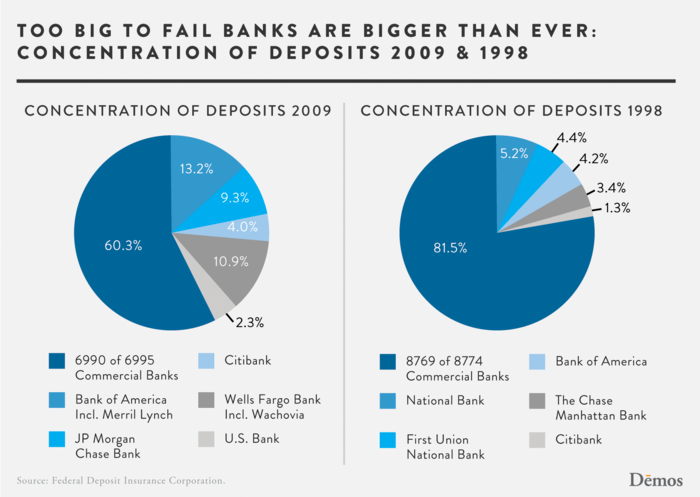

Neither necessarily stops investment markets from being risky or banks being too big to fail. For example, the top four American banks are 40% bigger today than they were in 2009 and, as this chart shows, in 2009 they were already far too big:

Nevertheless, the regulators attack has been notable with banks like Citi and HSBC pulling out of ‘non-strategic’ markets, selling ‘non-strategic’ assets, focusing upon core competencies and restructuring operations. They have had to do this, not only because of the regulatory onslaught but because of the sanction and fines hitting their bottom-line after market fixing and tax dodging.

But the onslaught that intrigues me more is the technology onslaught where apps and mobile are changing the retail experience; APIs are shifting the operations to real-time processing; and cloud combined with data analytics are changing the product and service.

This technology shift is creating a wealth of new companies that offer narrow finance. Narrow finance just looks at a piece of the business model and asks: can I do that better? It’s what TransferWise have done for matching people who need to move money overseas with people overseas; it’s what Zopa, Prosper and Lending Club have done for connecting people who have money with people who need money; and it’s what Friendsurance, Bought By Many and insPeer are doing for insurance.

The new model of finance that takes a narrow focus and replaces buildings and humans with servers and software will win out. That's why the Fintech markets saw over $12 billion invested in 2014, up from $4 billion in 2013 (CBInsights numbers), and why 36 of those startup companies are now valued at more than $1 billion each.

It is also why we are seeing the Fintech bubble, where 1000’s of new firms can attack the old firms’ business model. The old firms’ business model is based upon end-to-end control in a physical structure; the new firms’ business model is based upon narrow focus using open platforms in a digital structure.

The combination of the new firms with narrow focus and the regulators with broad focus is creating a new world. The new world is one where no-one controls anything, certainly not banks, as the user has the choice. Users with choice will focus upon bundling their own bank rather than having a bundled bank. Regulators with choice will aim to break up the too big to fail over-sized banks and increase competition by creating a killer marketplace for incumbents. No wonder Jamie Dimon is so worried.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...