I was sitting the other day thinking about the good old days.

In the good old days, if something was big and challenging, banks would get together and create a co-operative to solve the problem. SWIFT, Visa and MasterCard were all bank created co-operatives. Admittedly, times have changed and now Visa and MasterCard are private entities, but originally they were created to solve problems that a single bank could not tackle like making global payments and processing billions of card transactions.

Since the good old days, I wonder if banks have taken their eye off the ball. A good example is Alipay, Yandex and PayPal. As the internet took over, banks decided to ignore the need for online payments and let these startups take over. Now the startups are more than upstarts, as they have taken a major chunk of online transaction processing.

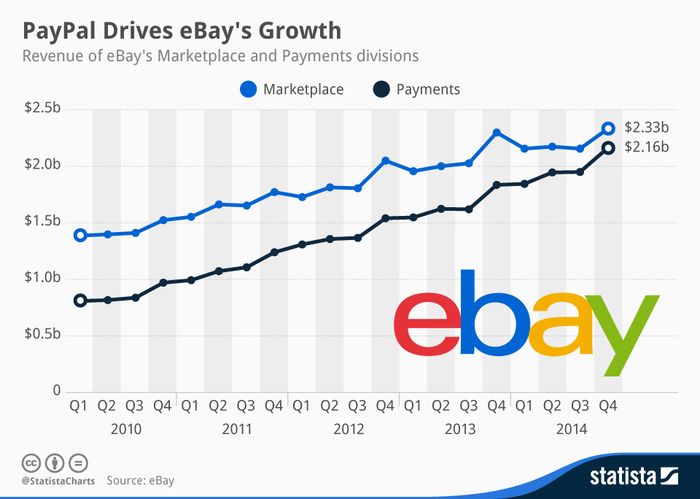

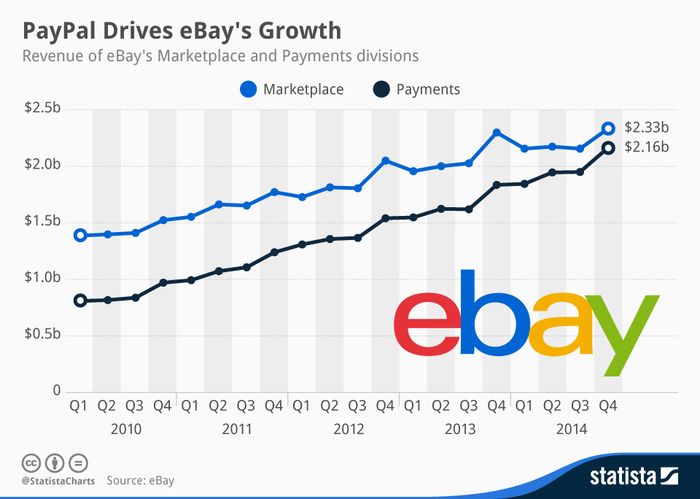

Take PayPal’s latest exploits. Last Monday 20th July, PayPal split from its mother ship eBay and rocketed rapidly to a $50 billion valuation. The last time PayPal was trading publicly in 2002, just before eBay acquired the business, it was valued at $1.5 billion. That’s some explosion of business, especially as the mother ship is worth less than its baby. eBay was trading at just over $34 billion market cap as PayPal split.

It’s no wonder as PayPal has almost 170 million active users in over 200 markets trading in 57 currencies.

The thing is that banks should have been creating a collegiate version of PayPal for global online payments. The nearest you get to that is something like the domestic Dutch payments system iDEAL, created to lock out PayPal. Meanwhile, Sweden has upstarts like Klarna solving the problem in an even better way, and one that doesn’t involve using cards.

Why didn’t the banks cooperate to create a global online payments system?

So now we have Apple Pay in the UK and USA, and banks have been slobbering to get in on the action.

I wouldn’t be surprised if, in a few years, every bank is somehow wrapped up in Apple’s wallet. Lovely.

The thing is that Apple Pay achieves two things for Apple at the banks expense:

(a) They own the customer mindshare or relationship if you prefer; and

(b) They have the banks completely at their control.

If you don’t believe the latter point, then just look at how all the US banks have reduced their fees to ensure they are part of the wallet. This means that Apple could demand further deep discounting in the future and, if they get this from one bank, then all the other banks will have to follow.

So here’s where my thinking goes out there to the old days. If banks could solve insoluble issues in the 1970s by working together, how come they couldn’t work together in the 2010s to create a mobile wallet?

Why haven’t banks cooperated to create a global mobile payment system?

The answer is that banks don’t trust each other anymore. However, because of this lack of trust, they’re giving the game to the upstarts. Well done guys.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...