What happens when the cost of payments reaches zero, the speed of payments is instant, and everyone globally can make and take a payment, what happens then?

I just had an interesting chat with someone and realised two things: one is that we’re talking about moving away from batch to real-time, and that’s where the shared, distributed ledger system fits; and moving away from banking to Fintech platforms, and that’s where the industry will integrate over time.

On the first point, we have a historical banking system built upon a mainframe ledger at the back end, to support face-to-face operations on the front-end. The re-architecting of that system demands we destroy the back end, as it was built on the basis of batch, overnight updates. How do we become real-time at the back end? That’s the key question.

I keep returning to this question as it’s the infrastructure that has to be changed. I recently spoke to Klarna for example, and they said that they don’t worry about PayPal, Stripe, Square or others, as they’re all built on Visa and MasterCard. A system that is out-of-date. That was intriguing conversation, and the key is to look at how things need to work today.

Things need to work today where we exchange everything everywhere, for virtually free. Blogging, emailing, entertaining, creating, sharing, transacting are all free. How do you make money when everything is free? By creating additional value on the basic exchange. Add value to blogs by writing good blogs. Add value to entertaining by being more creative and entertain better. Add value to payments by providing information enrichment around the payment. The payment itself will be free.

I remember some years ago, a Japanese banker saying to me that his greatest concern was when a bank opened offering payments for free, funded by Google adverts. Well, it’s here now folks. Everything is free. How do you make money when it’s free? Ads, information, value add services and more. These are the key things.

But a bank, payments processor or institution cannot provide money for nothing and payments for free if their systems were built for the old way of doing things. The old way being through counterparty systems that take days to process, involve a lot of human touch and run on systems that update overnight.

This is why the shared distributed ledger technology created by the bitcoin white paper of Satoshi Nakamoto is so important. It’s not bitcoin or even the blockchain that is being discussed here, but the fact that he created a trusted, shared ledger system through the internet that can record any exchange of value between anyone in real-time for virtually free. That is the key reason why this is being debated so actively by banks:

- UBS Bank Is Experimenting with ‘Smart-Bonds’ Using the Bitcoin Blockchain

- Santander: Blockchain Tech Can Save Banks $20 Billion a Year

- Barclays talks blockchain, bitcoin and distributed ledgers

- Codename Citicoin: Banking giant built three internal blockchains to test Bitcoin technology

It’s all well summarised by Philip Stafford in the Financial Times: Banks and exchanges turn to blockchain.

So as we rapidly turn our archaic batch, back end systems into real-time distributed ledger systems, we will see a move from payments in days with high fees, to value exchange in real-time to almost free. That solves problem one.

Problem two is the disruption of Fintech to banking. Some believe Fintech will destroy the financial system built upon that archaic physical structure descried above. Some believe banks will just win out and be central in the Fintech reform. I believe we’re seeing something else. We’re seeing a hybrid system emerge, where banks are nurturing and investing in Fintech and Fintech is trying to destroy the things in banking that don’t make sense.

It doesn’t make sense to exchange value in days through a network that creaks. We can change that to a system that works in real-time for almost free, and that’s the shared ledger. It goes more than that though. Klarna, Stripe, Square, Holvi and more are not built on the shared ledger. Instead, they are all Fintech firms that are trying to get rid of legacy bank structures constrained by old world technologies, and enable them to work better in this new world.

Similarly, the P2P Lenders and Crowdfunders are trying to get rid of old world operations in banks, and replace them with new world structures. That’s working, but it’s slow. As I said yesterday, asset managers spend more on marketing per year than the combined investment in new robo-advisors.

In a recent Economist article, they note that “individuals and funds provided over €1.5 billion in equity and debt to European SMEs in 2014 … a pittance compared with the €926 billion of funding made available by banks but the amount is more than doubling each year.”

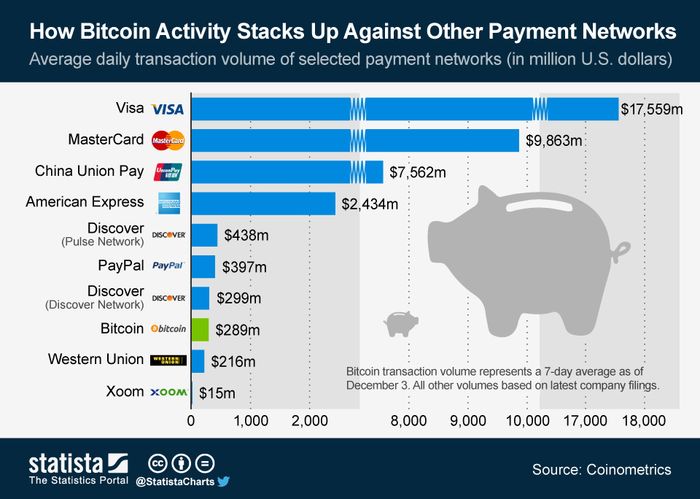

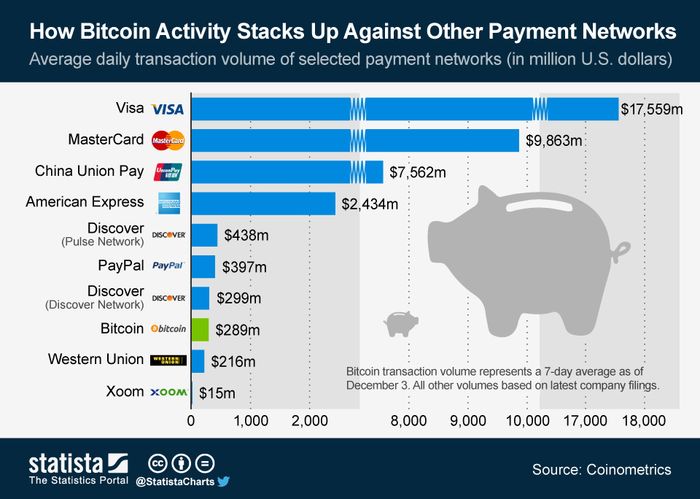

Similarly with SWIFT, Visa and MasterCard. If you look at the stats, they speak for themselves:

Source: Coinometrics, May 2015

In other words, the incumbent system can probably give itself years before it has to change. The concern should be that that is a complacent view, and most banks are not complacent. They are changing before they have to change, by investing and embracing the innovation culture.

What you end up with is an old bank system radically transformed by the mobile internet into a new value exchange system that integrates technology with finance. A new world order, but one that has its roots firmly founded in the old world wisdoms. And one of those wisdoms is that you don’t trust storing money in a system that leaks; and you don’t trust trading with someone you don’t know, unless there’s a system that ensures you get what you are promised.

That is why banking and blockchain are coming together, and why the old system is embracing the new. Keep watching this space.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...