Most technologies take 20 to 30 years to mature. Some take longer. If you look at videophones for example, they’ve been around in theory for over half a century …

… but it took Skype to make us comfortable with calling.

With biometrics, it’s similar. It’s been around for a long time …

… but it took the iPhone to make us comfortable with fingerprints.

So we know that certain technologies will become easier to cope with which makes them more pervasive and, in accordance, they become cheaper which makes them more ubiquitous.

Pervasive and ubiquitous technology developments take 20 years or more because they start out as difficult and expensive.

Think of any new technology and the price point is often a barrier to adoption. Over time, the price point drops as development cycles fasten and demand grows. It’s the law of increasing returns, where the more iterations of a technology, the more likely it is to become pervasive and ubiquitous.

If this is true therefore, banks and technology firms should be thinking about the next generation technologies today, and considering how they might change everything tomorrow.

Wearables, robots, the internet of things, nanotechnologies and more will be so persuasive and ubiquitous in ten years that they will not be ignored. However, you can ignore them today if you want, as they’re not here yet.

But then put things a different way. If you had known that the smartphone would be the focal point of the human universe, would you have invested in that first? And when should you have invested in that? When was the tipping point for the smartphone? Was it when Apple launched the iPhone? And yet we had smartphones before that. They were called Blackberries.

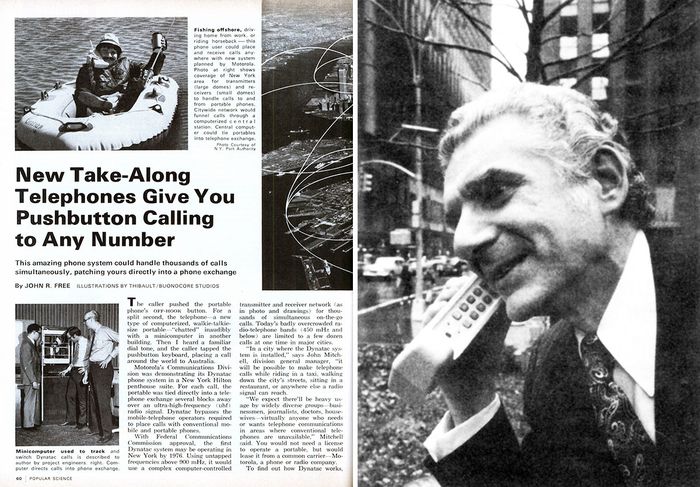

In fact, mobile illustrates well the old mantra of we knew it was coming, we just didn’t know when.

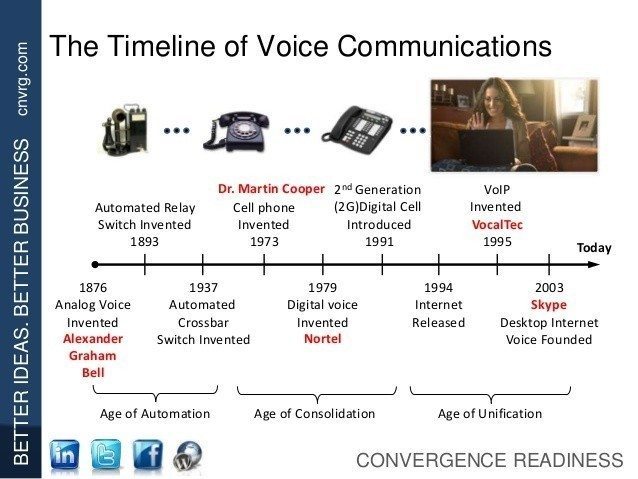

The mobile phone was first conceptualised back in 1947, but took another quarter of a century before the first voice call was made on a mobile telephone in 1973 by Marty Cooper. It took another ten years from Marty’s concept hand phone to launch it to market through Motorola.

And then a further quarter century before the mobile phone became smart. Fifty years in the making, the mobile telephone has now revolutionised the planet, including banking, but it’s been a long time coming.

Taken from Jim Sevier’s Slideshare http://www.slideshare.net/jsevier/basic-voice-communication

I remember working on WAP-based banking back in the mid-1990s, and developing systems that could interact electronically with mobile back then. But today’s capabilities are a dramatic change from back then. So what will the phone look like in the future?

It’s already moving to being a wearable watch, but what will it be after that and when should you start developing towards that future state?

I guess the nearest we can get to considering these things is to look at something like Star Trek, as Star Trek invented the Motorola phone.

By the time we got into The Next Generation the phone had become a wearable badge.

However, would that work with apps? How would you get your twitter and facebook fix on a badge?

As with all these things, predicting the future is not easy, but we do know that embedded intelligence through the internet of things means that tomorrow’s phone won’t be a phone at all. Instead, it will be our link to the digital world around us, with everything communicating with everything.

That world is one where, as everything connects, everything can transact. So, if I were a bank looking for the tipping point in the next generation of technology, I would just start working hard on processes that enable machines to buy from machines. That’s the next big thing, and we know it’s coming … we just don’t know how soon.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...