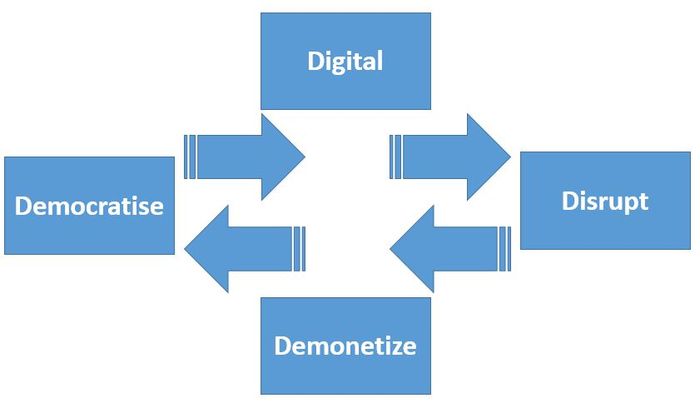

I attended a great meeting in Austria with Google yesterday. There were a number of Google Vision presentations and discussions, along with nice vignettes from Accenture and Raiffeisen Bank. One slide particularly caught my attention however, as I’ve just started to see a cycle in Fintech and this slide from Google’s Creative Evangelist (really?) Jeremy Abbett put this on screen:

What it shows is that digitalisation eventually hits markets. When the technology is ripe, it disrupts those markets. Typically it means that markets lose value and become near free. In other words, the technology rips out the profit and demonetizes everything. Finally, free markets are in play, as the business model is democratised.

He illustrates this with the usual suspects: music, film, entertainment, travel etc. In particular, we had the Kodak moment of technology created that makes picture-taking free. Music adapted but streaming means that it’s now tiny subscription based services: who buys music anymore? Even entertainment is being turned on its head as Netflix loses its film library and Amazon Prime pays Top Dollar for Top Gear.

I like the concept, although I can see some flaws when we apply this to banking. What this cycle should mean, fi banking were like every other industry, is that technology is attacking the physical structure of banks and stripping the business model to pieces. It is.

The follow-on is that the margin in the traditional bank business model is then ripped away by start-ups. It is. Just look at P2P or payments to see that the products banks traditionally used to make margin are no longer viable.

But democratisation of banking is not happening. This strikes to the heart of the Libertarian dream: that banks and third parties can be removed from the value chain. They aren’t. It keeps coming back to the Law and Government licences, which gives banks breathing space to adapt their models to the FinTech disruption. If you don’t believe this, then just read the extract at the end of this blog taken from the New Yorker, it’s hilarious.

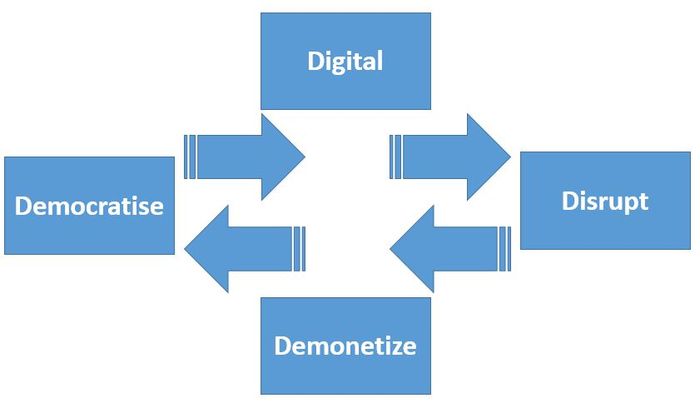

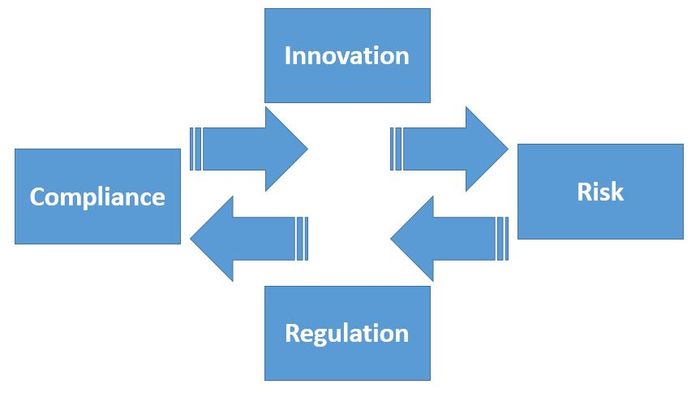

So my view of the world is that there is another cycle in play, called the risk cycle. This cycle is similar to Jeremy’s but subtly different:

To begin with, we see massive innovation in play that leads to disruption and new business models (the first two stages of Jeremy’s cycle). As these new companies emerge to tackle the incumbents however, they create risk. Several of these new firms go bankrupt or work around the tight regulatory controls in place. As governments and policymakers realise what is in play, they then work fast to fill the gaps in their law-making structures. Think MtGox and Silk Road, but also think Uber here. Uber is in that third cycle right now, as the incumbents fight back through the legal and regulatory system to shut them down or, at least, make them look more like the incumbents with the same duties and responsibilities.

This is the dialogue most banks are having right now: how to make the upstarts behave within the same constraints as the incumbents. This leads to a new level of compliance that is different to, but just as onerous as, the pre-existing market constraints. Then, of course, new players start to see gaps in the regulatory armour and begin to innovate again.

I like these two charts as they are brothers-in-arms. The difference being that you cannot democratise a tightly regulated market, but can only do this in markets that don’t matter to lawmakers.

From The New Yorker, March 2014:

L.P.D.: Libertarian Police Department

BY TOM O’DONNELL

I was shooting heroin and reading “The Fountainhead” in the front seat of my privately owned police cruiser when a call came in. I put a quarter in the radio to activate it. It was the chief.

“Bad news, detective. We got a situation.”

“What? Is the mayor trying to ban trans fats again?”

“Worse. Somebody just stole four hundred and forty-seven million dollars’ worth of bitcoins.”

The heroin needle practically fell out of my arm. “What kind of monster would do something like that? Bitcoins are the ultimate currency: virtual, anonymous, stateless. They represent true economic freedom, not subject to arbitrary manipulation by any government. Do we have any leads?”

“Not yet. But mark my words: we’re going to figure out who did this and we’re going to take them down … provided someone pays us a fair market rate to do so.”

“Easy, chief,” I said. “Any rate the market offers is, by definition, fair.”

He laughed. “That’s why you’re the best I got, Lisowski. Now you get out there and find those bitcoins.”

“Don’t worry,” I said. “I’m on it.”

I put a quarter in the siren. Ten minutes later, I was on the scene. It was a normal office building, strangled on all sides by public sidewalks. I hopped over them and went inside.

“Home Depot™ Presents the Police!®” I said, flashing my badge and my gun and a small picture of Ron Paul. “Nobody move unless you want to!” They didn’t.

“Now, which one of you punks is going to pay me to investigate this crime?” No one spoke up.

“Come on,” I said. “Don’t you all understand that the protection of private property is the foundation of all personal liberty?”

It didn’t seem like they did.

“Seriously, guys. Without a strong economic motivator, I’m just going to stand here and not solve this case. Cash is fine, but I prefer being paid in gold bullion or autographed Penn Jillette posters.”

Nothing. These people were stonewalling me. It almost seemed like they didn’t care that a fortune in computer money invented to buy drugs was missing.

I figured I could wait them out. I lit several cigarettes indoors. A pregnant lady coughed, and I told her that secondhand smoke is a myth. Just then, a man in glasses made a break for it.

“Subway™ Eat Fresh and Freeze, Scumbag!®” I yelled.

Too late. He was already out the front door. I went after him.

“Stop right there!” I yelled as I ran. He was faster than me because I always try to avoid stepping on public sidewalks. Our country needs a private-sidewalk voucher system, but, thanks to the incestuous interplay between our corrupt federal government and the public-sidewalk lobby, it will never happen.

I was losing him. “Listen, I’ll pay you to stop!” I yelled. “What would you consider an appropriate price point for stopping? I’ll offer you a thirteenth of an ounce of gold and a gently worn ‘Bob Barr ‘08’ extra-large long-sleeved men’s T-shirt!”

He turned. In his hand was a revolver that the Constitution said he had every right to own. He fired at me and missed. I pulled my own gun, put a quarter in it, and fired back. The bullet lodged in a U.S.P.S. mailbox less than a foot from his head. I shot the mailbox again, on purpose.

“All right, all right!” the man yelled, throwing down his weapon. “I give up, cop! I confess: I took the bitcoins.”

“Why’d you do it?” I asked, as I slapped a pair of Oikos™ Greek Yogurt Presents Handcuffs® on the guy.

“Because I was afraid.”

“Afraid?”

“Afraid of an economic future free from the pernicious meddling of central bankers,” he said. “I’m a central banker.”

I wanted to coldcock the guy. Years ago, a central banker killed my partner. Instead, I shook my head.

“Let this be a message to all your central-banker friends out on the street,” I said. “No matter how many bitcoins you steal, you’ll never take away the dream of an open society based on the principles of personal and economic freedom.”

He nodded, because he knew I was right. Then he swiped his credit card to pay me for arresting him.

Tom O’Donnell’s children’s novel, “Space Rocks!” is out now.

Photograph: Spencer Platt/Getty

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...