Being #SIBOS week, there’s a rush of new reports to push out. McKinsey’s Global Payments Report and Cap Gemini’s World Payments Report being the two big one I noticed this week.

A quick review of each.

McKinsey’s report summary opens with the following:

Global payments revenues have been growing at rates in excess of expectations. Asia once again—particularly China—is the primary engine propelling the global numbers, but all regions, even those where revenues have recently been in decline, are contributing to the surge. Payments growth is currently a truly global phenomenon.

Looking ahead, however, McKinsey expects that global payments revenues will begin to reflect the flip side of Asia’s prominence as a growth driver. The expected macroeconomic slowdown in Asia-Pacific (APAC), in other words, is dampening expectations for payments growth overall. However, the turnaround in other markets will make up for some of this decline. McKinsey expects this rebalancing of revenue growth between emerging and developed markets will lead to tempered but still healthy revenue growth of 6 percent annually through 2019.

The most recent McKinsey Global Payments Map reveals several additional trends of note. As in 2013, growth in 2014 resulted primarily from volume rather than margin growth ($105 billion versus $30 billion). And although liquidity-related revenues (those linked to outstanding transaction account balances) were again the largest revenue growth contributor (53 percent), transaction-related revenues (those directly linked to payments transactions) climbed more strongly in EMEA and North America, contributing more to revenues than in any year since 2008.

McKinsey expects the contribution of transaction-related revenues to continue rising through 2019, growing faster than liquidity revenues (7 percent and 5 percent CAGR), and contributing more to global payments revenue growth for the period ($360 billion compared to $220 billion). The impact of weakening macroeconomic fundamentals, primarily in APAC, will mostly impact worldwide liquidity revenues while transaction-related revenues, more driven by payments-specific trends and the ongoing migration of paper to digital, will continue to grow at historical rates. Further, the digital revolution in customer behavior and the intensifying competition will likely revive the war on cash, giving further impetus to transaction-related revenues. Still, with CAGRs of 9 percent in EMEA and 7 percent in North America, liquidity revenues should continue to grow as interbank rates recover from historically low levels.

McKinsey also anticipates a rebalancing of revenue growth. During the last five years, payments revenues grew by 18 percent CAGR for APAC and Latin America combined, comparing favorably with flat revenues in EMEA and North America. During the next five years, however, these growth rates will be 6.5 percent and 6.0 percent, respectively.

Setting aside changes in macroeconomic fundamentals that are difficult to predict, McKinsey foresees four potential disruptions that will alter the payments landscape during the coming years.

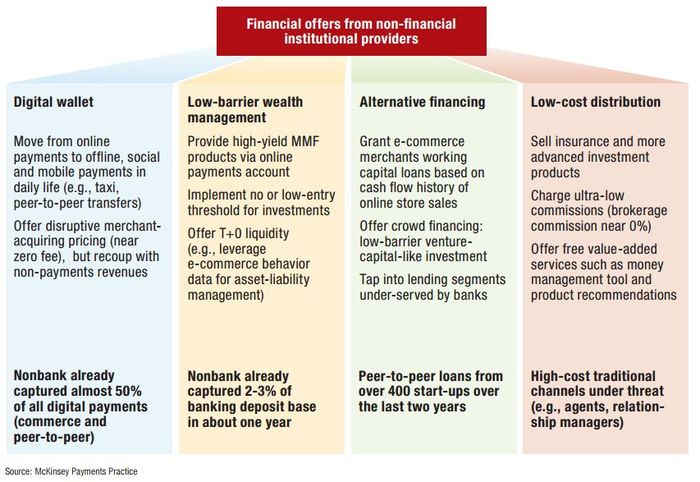

Nonbank digital entrants will transform the customer experience, reshaping the payments and broader financial services landscape.

The payments industry has recently seen the entry of diverse nonbank digital players, both technology giants and start-ups, that are presenting increased competition for banks. While start-ups have generally not been a major threat to the banking industry in the past, McKinsey believes things will be different this time due to the nature of the attackers, the prominence of smartphones as a channel, and rapidly evolving customer expectations. To maintain their customer relationships and stay relevant banks will need to respond to these changes with new strategies, capabilities and operating models.

Modernization of domestic payments infrastructures is underway.

The industry is currently going through a wave of infrastructure modernization that is required to compete effectively with nonbank innovators and address evolving customer needs. More than 15 countries have modernized their payments infrastructures in the last few years, and many others are in the planning stage. Because infrastructure upgrades are costly at both the system and bank levels, banks need to find ways to build products and services on top of the infrastructure that provide value to end users and accelerate the “war on cash,” in order to recover these investments as quickly as possible.

Cross-border payments inefficiencies are opening doors for new players.

The entry of nonbank players and new infrastructure demands is not limited to domestic payments: they will also affect cross-border payments. To date, banks have done little to improve the back-end systems and processes involved in cross-border payments. As a result, cross-border payments remain expensive for customers, who also face numerous pain points (e.g., lack of transparency and tracking, slow processing times). However, as nonbank players increasingly encroach on the traditional cross-border turf of banks— moving from consumer-to-consumer (C2C) to business-to-business (B2B) cross-border payments—they will force many banks to rethink their longstanding approaches to cross-border payments.

Digitization in retail banking has important implications for transaction bankers.

The digital revolution will extend well beyond consumer payments and retail banking, causing significant changes in transaction banking. As customers grow accustomed to faster and more convenient payments on the retail side, they will soon demand similar conveniences and service levels in transaction banking. In fact, recent research by McKinsey & Company and by Greenwich Associates already shows a growing preference for digital channels among companies. And having witnessed the impact of nonbanks in consumer banking, transaction bankers are becoming more aware of the nonbank threat in their own backyard, and of the potentially major downside of failing to invest in digital infrastructures and services.

Overall, McKinsey expects to see the payments industry continue growing at a moderated yet healthy rate during the next five years. But within that growth there will be rebalancing of revenue sources and, more importantly, powerful disruptive forces will begin to reshape the global payments landscape.

My favourite chart in their report is this one:

… because it makes you realise just how much change or, if you prefer, disruption is taking place in banking.

Then we have Cap Gemini’s coverage.

My coverage of the report will be much shorter as I’m unable to copy their report text (it’s secured), but the net:net is that Cap Gemini’s Report talks a lot about non-cash trends, and shows that the volume of non-cash transactions globally has increased by 7% and looks to continue forward into the future. Using the latest statistics available on the scale from 2013, the figures show that non-cash is now generating 358 billion transactions a year and is set to increase to 389.7 billion in 2014, an 8.9% growth rate. China is now the fourth largest country for non-cash usage, just behind Brazil, Europe and America.

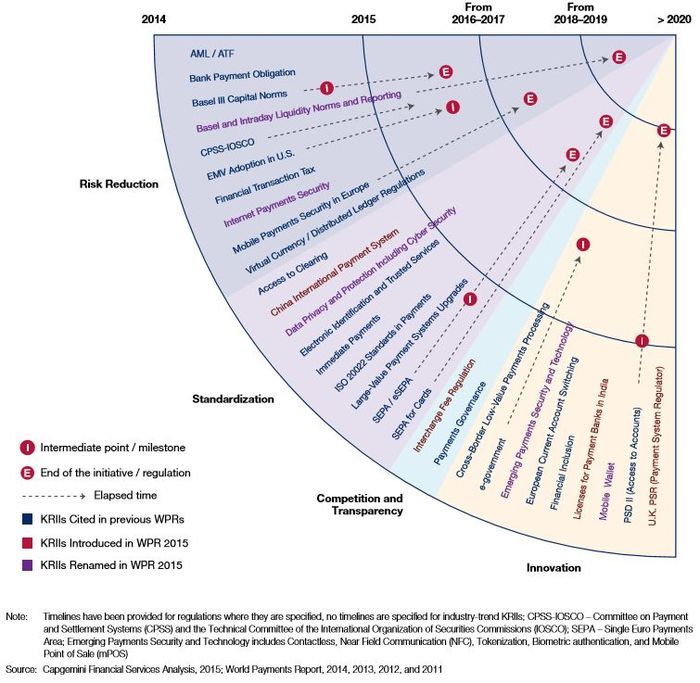

Their report looks at things that are driving these trends, including key regulatory drivers from EMV migration in the USA to the PSD2 in Europe and the technology drivers from blockchain to mobile wallets.

My favourite chart in their report is this one:

Mainly because it’s a WTF chart. This shows all the regulatory stuff that banks are dealing with and when someone goes woohoo we’ve created money without government, I’m just going to show them this chart and say yea, go for it.

You can download the reports below:

- McKinsey’s Global Payments Report

- Cap Gemini’s World Payments Report (the link is fine although your browser may tell you the website certificate has a problem)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...