I saw a fascinating presentation by Porter Erisman, author of Alibaba's World, last week. Porter was involved in the early days of Alibaba, having lived in China since 1994. As an American in China it must have been a fascinating experience, and Porter talked about how Alibaba was formed and how it differs to Amazon and other retailers.

For example, Amazon emerged from a Western economy that had moved from mom and pop stores to large malls, grocery stores and urban shopping centres. As a result, the retail model replicated the offers of these centralised centres and replaced them on margin over time.

China didn’t have that structure. China in the 1990s just had the mom and pop stores, and no large shopping centres and malls. So Alibaba’s original idea was to create a global marketplace connecting small Chinese businesses with the world’s buyers. Porter described it as being an online tradeshow, and Jack Ma sold it to the Chinese firms that way. Alibaba in 1999 was building a massive Expo for Chinese businesses to engage with the world’s manufacturers. That was the original idea anyway.

It’s interesting as that idea is still valid today. For example, I recently heard Lending Club talking about their partnership with Alibaba, where the world’s largest peer-to-peer lender will provide small business loans for US customers of the Chinese ecommerce giant.

Anyways, back to the early days of Alibaba as an online tradeshow, it went well. So well that Jack Ma and team saw an opportunity to provide a service connecting people called Taobao. Taobao was launched in 2003, and aimed to emulate the eBay success in America but, in this case, in a different way. After all, Chinese consumers didn’t collect collectables at that time, as there really wasn’t anything worth collecting, or so they thought. The only thing Chinese people had that was collectable in the early 2000s was Chairman Mao’s Red Book, and most people were trying to get rid of those.

This is why Taobao, which means “digging for treasure”, focused upon connecting small Chinese businesses and sole traders – the mom and pop stores, as there weren’t many big firms – to Chinese citizens. It worked, but not before being exposed and made potentially vulnerable to the entry of eBay into the Chinese markets.

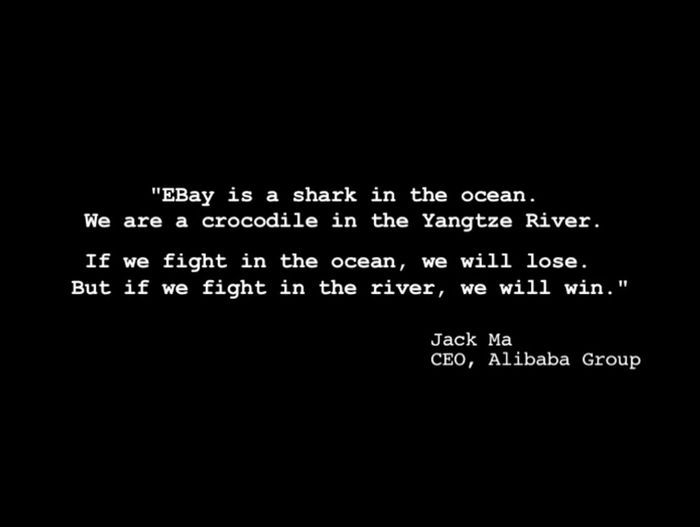

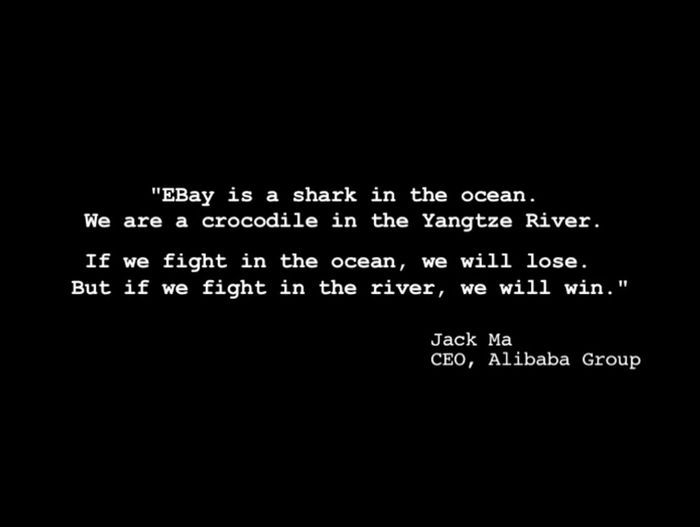

eBay entered China by buying heavily into its Chinese equivalent Eachnet. Jack Ma knew that eBay could eradicate Alibaba, and determined that the US auction service was not right for China. But Alibaba at the time was tiny compared to the mighty eBay, who had millions of dollars to win over the Chinese market. However, eBay was not Chinese and did not understand the Chinese markets like Jack Ma and his team at Alibaba. For example, they cut back on features that Chinese consumers liked, such as emoticons and animations.

Taobao ramped these features up to be a far more social commerce model, as well as adding the sprinkler of being free. eBay did not offer a free version to compete and made other mistakes, eventually pulling out of China completely having lost millions of dollars.

At this point Alibaba had won and began to diversify into other areas. For example, Alipay was launched in 2004 as an escrow account service to allow consumers to hold funds until they were happy with the goods they received. This was key to Taobao’s growth as China had very poor consumer protection laws. In 2008, they launched TMall, a B2C site for the sale of key branded goods and services as an offshoot of Taobao.

In 2013, Alibaba's money fund Yu'E Bao (Leftover Treasure) was launched and marketed to users of Alipay. It has been particularly successful because cash transfers from bank accounts to Yu'E Bao take just one click, with assets rising from zero to 578 billion yuan ($90 billion) in less than two years.

They then expanded into banking in 2015, launching MyBank during the summer. All of this is consolidated into the brand Ant Financial. Ants build colonising and are weak on their own but together are strong. That’s the message Ant Financial wants to send to Chinese citizens and it seems to be working as Ant Financial is worth $45 billion already and plans an IPO of its own in 2017.

Then there was the mobile payments milestone as Alibaba competed with Tencent to win the battle over Red Letter day 2015. This was followed by the record Singles Day on November 11, with Alibaba’s sales surging past $14 billion, a 60% rise on the Chinese e-commerce giant’s performance a year ago and over $5 billion sold in the first 90 minutes. Even more eye-popping is that Alibaba said its logistical division would use more than 1.7 million people; 400,000 vehicles; 5,000 warehouses; and 200 aeroplanes; to handle deliveries.

I wrote about these things a while ago, and keep coming back to them as Alibaba is now making one more major play. They have put together an even grander idea to build a brand new business model. One that is either crazy or amazing or both. The idea is simple:

- you advertise movie concepts and ask customers to crowdfund the movie ideas they like, all channelled through Alibaba Pictures;

- once a movie is funded and gets made, you can buy tickets to see the movie in Taobao;

- when you see the movie, you might want to watch the digital release at home on Youku, Alibaba’s version of Netflix;

- then, if you like the movie that much, you can buy branded memorabilia on TMall;

- and all of it is paid for and funded through your Ant Financial accounts.

In other words, a digital marketplace that manages the complete process of digital creation from start to finish. Imagine doing the same with books, which is what Amazon is doing with Kindle Direct Publishing; or with music, which is what marketplaces like feiyr offer; and you start to see why Alibaba can become the panacea of all things online in China, and the linkage between China and the rest of the world.

For me, I would summarise the key attributes of Alibaba’s business model is:

- Think big from day one

- Use the internet to be global, not local

- Be aware of the competition but don’t be afraid of them

- Create winning strategies by knowing your customer better than the competition

- Always focus on the customer

- Continually diversity into adjacent areas

- Never say never

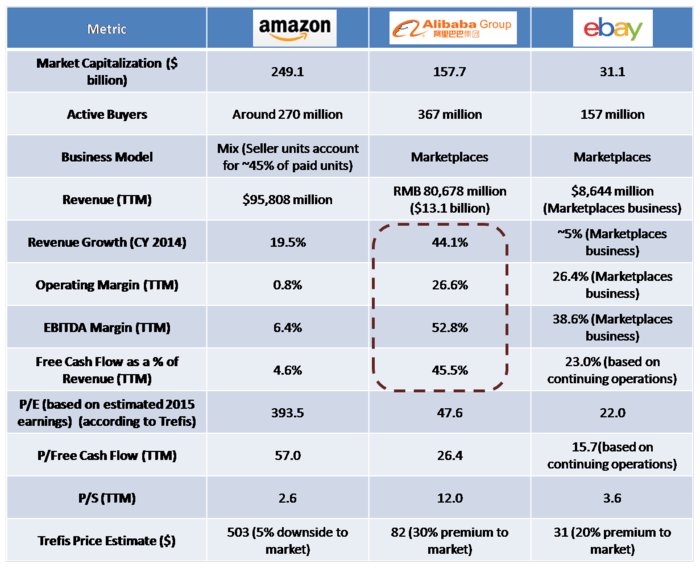

Finally, if you want to look at its future potential, you only need to look at this chart from Forbes to get an idea of Alibaba’s possible future dominance.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...