At the start of 2015, I was honoured to be invited to join a new group called the Whitechapel Think Tank. The group was initiated by Jeremy Wilson, Vice Chairman of Barclays Corporate Banking and John Edge, Managing Partner, RRVIG.

The first meeting called together UK Government, Treasury and the Bank of England, Barclays thought leadership, a number of key influencers and thought leaders in finance and technology, and some large corporate customers of the bank. The group has been meeting regularly ever since, with support from the Payments Council, and finally went public at a meeting of the Financial Services Club last week.

It was a good meeting attended by almost 150 people, and demonstrates how hot the topic is in finance.

Oh, what was the topic? What is the Whitechapel Think Tank focused upon?

The Blockchain of course or, if you prefer, the use of Distributed Ledger Technology (DLT).

Jeremy, John and Simon Taylor, who heads up blockchain developments for Barclays Group, talked about their findings and thoughts so far. It was a fascinating discussion and included reference to many of the challenges of DLT – lack of scalability, use of private versus public ledgers, interoperability, implications of the darknet, etc – as well as many of the opportunities – the ability to start real-time exchange of value for free, the upgrade of infrastructures, the capability to replace physical ledger chains with digital ledger chains, the improved resilience and security this delivers and more.

I would love to reiterate the whole discussion here, but do not feel that’s appropriate so I’m going to share something else that came out of the group instead. In case you didn’t spot it, the European Securities and Markets Authority (ESMA) issued a Call for Evidence in the use of DLT earlier this year.

A Call for Evidence is an EU regulatory platform that allows interested parties to signal their interest and express their views and concerns in the preparatory phase of regulatory directives. They also let interested parties comment on the different documents under preparation in ESMA in relation to restrictions, such as reports on market instruments in articles and guidelines on restriction entries.

ESMA’s call for evidence was opened in spring and requested through the summer 2015, with a description as follows:

ESMA has been monitoring and analysing virtual currency investment over the last 6 months, to understand developments in the market, potential benefits or risks for investors, market integrity or financial stability, and to support the functioning of the EU single market.

ESMA’s analysis is set out in this paper. ESMA is seeking to share its analysis in order to promote wider understanding of innovative market developments, and invites market participants and other stakeholders to submit feedback and any additional information on the following topics:

- Virtual currency investment products, i.e. collective investment schemes or derivatives such as options and CFDs that have virtual currencies (VCs) as an underlying or invest in VC related businesses and infrastructure;

- Virtual currency based assets/securities and asset transfers, i.e. financial assets such as shares, funds, etc. that are exclusively traded using virtual currency distributed ledgers (also known as block chains); and

- The application of the distributed ledger technology to securities/investments, whether inside or outside a virtual currency environment.

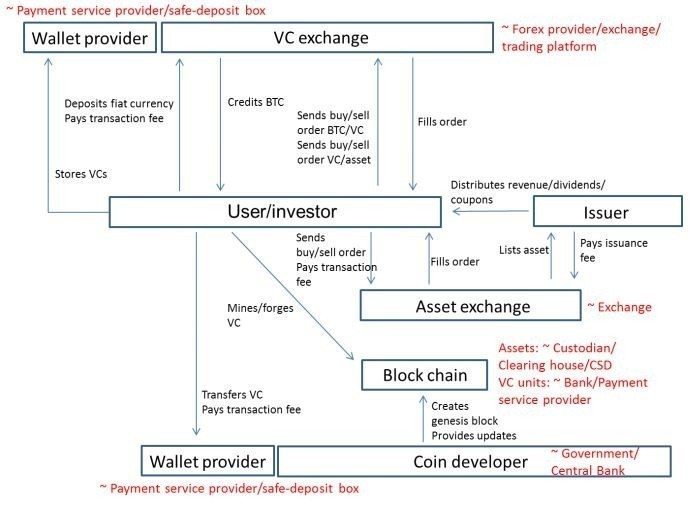

And, just to show you how advanced ESMA’s thinking has progressed, this chart proved particularly interesting:

It shows a potential framework for using blockchain technologies for European investment markets clearing and settlement processes.

The block chain unites the functions of several traditional regulated entities: it is the register of all transactions and hence all balances in the VC, a function that is normally provided by the central bank and banks more in general as well as central securities depositories (CSDs). Furthermore, the block chain clears and settles transactions by enabling confirmation of transactions. For most virtual currencies, transaction as well as clearing and settlement times seem to be much quicker than in the traditional regulated system. Confirmation of a transaction and settlement takes at most a couple of hours and not days. Apart from that, transaction costs can be much lower than the fees charged via traditional payment processing or securities brokerage and settlement. For example, the transaction fee for an NXT transaction is currently a flat fee of 1 NXT, which is currently the equivalent of a bit over 1 cent (USD).

The call for evidence received replies from ABN AMRO., CFA Institute, CME Group, DBT Labs, Deutsche Bank, Digital Asset Transfer Authority, ECSDA (European Central Securities Depositories Association), Euroclear, Intesa Sanpaolo, Krypto FIN ry, LedgerX, Lykke, Modular FX Services Limited, NxtLegal.org, PAYMIUM, SWIFT and Tradernet Limited. You can find the full responses here, but a few highlights.

ABN AMRO sees the main benefits of distributed ledger technology in the following four scenarios:

1. A distributed ledger is used to receive or send payment to buy or sell a security. Payment can be made in a native VC such as Bitcoin or as an IOU such as Ripple that are guaranteed by the coin provider. This would impact clearing and settlement.

2. A distributed ledger is used to buy or sell an asset that represents a security, i.e. a cryptosecurity. Several technologies such as coloredcoins, Ripple or HyperLedger can be used to represent more than one kind of asset on one distributed ledger. The assets on the distributed ledger are governed by a Central Securities Depository ("CSD").

3. Assets and currencies are both represented on one ledger. This scenario allows for near frictionless trade but requires support from multiple parties (network effect) to succeed.

4. Assets and currencies are both represented on a distributed ledger but not necessarily on the same ledger. In this case friction is still very low, but different distributed ledgers can be developed as their functional requirements and desired connectivity options differ slightly. This scenario would also allow for a phased migration.

CME Group would like to draw to ESMA’s attention the following:

In addition to digital currency being a potential new fiat currency, digital currency presents the opportunity for a number of related products such as indices and derivatives, and blockchain as a technology to create a universal ledger.

There is a CFTC regulated entity approved to trade NDFs on Bitcoin (BTC) and other applicants have also applied for CFTC approval to trade physically delivered options on Bitcoin. There are also companies/startups based in the UK which trade forwards of USD/BTC.

In addition, there are also numerous companies/startups that are less developed, which trade futures on USD/BTC, and for which trading appears to settle in Bitcoin. Additionally, there are a number of digital currency related funds.

The Isle of Man and Jersey governments have been vocal in the promotion of Bitcoin related investment products and enterprises. There are a growing number of companies/startups offering cryptocurrency-related services and products from these jurisdictions as well as from Luxembourg.

There are a number of areas where we see potential for the use of this technology:

- Fiat currency payment and settlement

- Securities issuance and transfer – creation of unique identifiers, transaction tracking and asset segregation

- Securities clearing and settlement – through delivery of more efficient post trade processing

- Securities Asset Servicing – through automation of dividend/interest payments and corporate actions processing

- Enforcing derivatives contract and improving derivatives clearing through smart contracts

- Asset registries – without the need for a central administrative authority

- Know your Customer and Anti-Money Laundering registries and surveillance

- Creating transparency – and facilitating differentiated customer and regulatory reporting

Distributed ledger could offer a number of potential advantages for post trade markets:

- Significant reduction of the distance between asset issuers and asset owners reducing intermediation costs as well as operational risks, for example in the processing of corporate actions and redemptions

- Simplification of the exchange of data to find counterparties, negotiate trades and settle transactions, reducing time, risk and capital. The time between trading and settlement could be greatly reduced with settlement taking place very shortly after trading instead of the current T+2 timing (effectively real-time T+0 settlement).

- Creation of open and robust financial infrastructure for new types of assets and transactions (introducing DVP for more asset classes) enabling new, more open business models compared to today’s world of competing vertical silos.

- Strengthening the security of the financial system against cyber-attacks and removing single points of failure in the system, which should give greater confidence to create more open accessible infrastructure.

- If combined with innovations in the fields of online identity management, it could offer a highly flexible system where participants could offer different levels of anonymity, eligibility credentials or transparency to different stakeholders in the financial eco-system.

- Offering greater levels of regulatory transparency than are practicable today, without requiring participants to sacrifice commercial confidentiality.

Possible factors increasing the risk for investors in virtual currency products include:

- The fact that many virtual currency actors are not subject to minimum capital requirements, let alone strict prudential requirements, making an insolvency more likely and potentially more damaging for these firms' clients - i.e. investors;

- The challenge of identifying beneficial owners of securities transactions for anti-money laundering purposes in the absence of a central register. The comprehensiveness, reliability and integrity of the information on trade counterparties contained in the blockchain needs to be assessed in this regard, and solutions may need to be developed in the future to allow for a proper verification of beneficial owners' identity for legal and fiscal compliance purposes;

- Market manipulation is also more likely in connexion with the value of virtual currencies. In the absence of a strict framework regulating the entities providing valuations of bitcoins and other virtual currencies, there is a risk that virtual currency indices might be manipulated or distorted in a way that could result in major losses for investors;

- The lack of proper "safekeeping" for virtual currency assets in the absence of real "depositaries". As explained in our response to Q6, the maintenance of accounts holding virtual currency assets is done through IT servers. In order to ensure that virtual currency assets are protected from the risk of loss, errors, and the risk of fraud, guarantees would have to be put in place in case these IT servers are attacked or compromised. There are precedents of some companies specialised in the safekeeping of bitcoins having been hacked and having subsequently lost important amounts of bitcoins, for which clients were not compensated.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...