In conversation with bankers and start-ups, it is clear that there is a differing view of the world. It is not as clear-cut as nimble innovator versus dinosaur incumbent, which is how many portray this chasm of difference of thinking, but there is a difference in thinking. It is a radical difference in thinking, and perhaps best summed up by the fact that a banker turned to me recently and said: “surely this is Techfin rather than Fintech?” I thought about what he meant and realized that this is the subtle difference between the innovator and the incumbent. An innovator thinks of this as Fintech: taking financial processes and applying technology. Incumbents think of this as Techfin taking technology to work with financial processes. This difference in thinking, although subtle, does create a very different thought process and output to the way in which technology is used and so I thought I would delve a little deeper, as this is a key to seeing how the world differs between the innovators and incumbents.

First, the start-up Fintech firm. This firm looks at the world through the eyes of a technologist. This means that the start point is technology. Apps, APIs, Analytics and more are the foundations of their thinking. Open source, open operations, open thinking are at the heart of their culture. Embracing diversity, working globally and no reference offices or structure are the tools of their skillset. And seeking a mentor, an angel and an investor are the base capital requirements to get them started.

The start-up starts with thinking about how technology could transform financial processes. This means that they take something that exists – loans, savings, investments, payments, trading and more – and think about how they could reinvent these processes. Peer-to-peer (P2P) lending is a good example. When Zopa started in business in April 2005, they told me about their business model and it sounded weird, to be honest. “We’re an eBay for loans”, they told me. “You give us your money and we lend it out on your behalf. You get better interest on your money than you would with a savings company, and people pay less for their loans”, they continued. “Want to invest £10,000?”

No way, as it sounded crazy. An untested, unproven business that would take my investment and manage the risk of lending that investment to borrowers? An eBay for loans? That’s start-up thinking. A decade later, that start-up is taking over £1.2 billion in funds from over 53,000 consumers to lend at the most competitive rates in the UK. In fact, the start-up P2P model is so popular that it’s been copied worldwide with the US being the one of the fastest growing markets where over $8 billion has been lent, doubling year-on-year. It is why Lending Club had one of the hottest IPOs of 2014 followed up by SoFi receiving over $1 billion investment in their latest funding round.

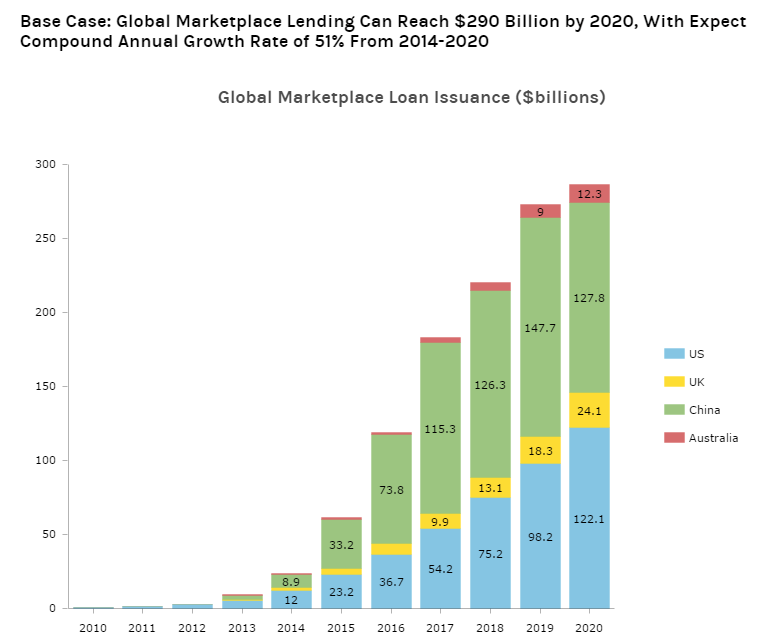

These are significant numbers, but nowhere near as significant as the forecasts being made by banks like Goldman Sachs and Morgan Stanley. Goldman Sachs predict that almost $11 billion of bank profits from lending will move to the new start-up social economy by 2020 – about 5% of the current market – whilst Morgan Stanley estimate that global marketplace lending should reach $290 billion by 2020, with a CAGR (Compound Annual Growth Rate) of 51% from 2014-2020, and China and America being the two largest markets.

And this is the key to the Fintech thinking of the innovators: how can we take an existing market with a middleman and replace the middleman with a technology intermediary. That is what bitcoin is focused upon – replacing the bank with the internet for value transfer; it is what new trading schemes like T0.com focus upon – replacing the stock market with the blockchain; and it is what firms like TransferWise and Currency Cloud believe – replace FX markets with P2P connectivity to enable money to move.

There are many more examples, the rapidly growing and disruptive Fintech scene is hot because it is all about using technology to transform financial processes. The incumbent thinking of the Techfin is very different.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...