I’ve talked a lot about blockchain, but not much lately about the use cases, of which four stand out in terms of real activity: Clearing and Settlement, Trade Finance, Payments and Digital Identity. I thought I’d do a deeper dive into these during the quietness of August, starting with what’s happening in Clearing and Settlement.

Today, I’ll talk about what is happening generally and tomorrow, a discussion of six specific companies that are leading the race to create a shared ledger for Clearing and Settlement in a variety of markets.

Clearing and Settlement is where all of the early action has been, as it is clearly an area ripe for change. You can see that just from these recent announcements:

- Blockchain sets it sights on the OTC market | Treasury Today

- Global regulators attuned to blockchain risks - Sydney Morning Herald

- Treasury's turn to study blockchain technology ...

- Blockchain and T2S: A potential disruptor - Standard Chartered Bank

- How the Tech Behind Bitcoin Could Revolutionize Wall Street | TIME

- SETL Launches Blockchain Powered Platform to 'Revolutionize ...

- Sydney Stock Exchange develops blockchain settlement system ...

- ASX pioneers blockchain technology - Business Insider

- GMEX Adopts uClear Blockchain for Real Time Clearing and Settlement ...

- Euroclear Announces New Blockchain-Based Gold Settlement

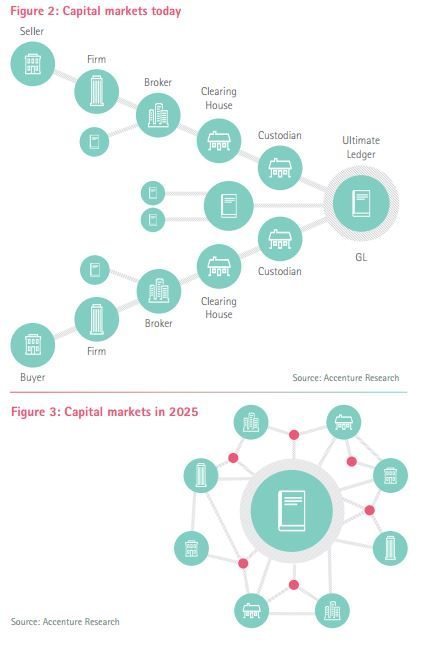

The interesting aspect of all of this stuff about Clearing and Settlement is that the current industry structure is dominated by centralising institutions: central banks, Central Counterparty Clearing structures, Central Securities Depositories (CSDs) and centralised collateral management systems, such as the ECB’s Correspondent Central Banking Model (CCBM). Yet blockchains are meant to be decentralised, so how can this work in a centralised operation? Well it can because most of the developments are being run as permissioned or double permissioned networks by these central operators, on behalf of their markets. Banks and stock exchanges globally are working with blockchain start-ups, led by people who have been immersed in these market spaces, to realise this dream of billions of dollars of savings.

In fact, CCPs should consider shared ledgers as a new hardware and software hosting option, with the potential to reduce their overall technology and operational costs. For example, a CCP's transaction database and executable business logic for many financial transactions could potentially be hosted outside of the CCP, allowing bilateral peer-to-peer execution using smart contracts provided by the CCP. Equally many related functions ranging from general governance to synchronising upgrades of smart contract versions would still require a central coordinating body.

Anyway, the clearest exposure to the opportunity here was the Santander/Oliver Wyman report that estimated inefficiencies in the global collateral management market are costing banks $4 billion annually. More than this, the report concluded “that distributed ledger technology could reduce banks’ infrastructure costs attributable to cross-border payments, securities trading and regulatory compliance by between $15-20 billion per annum by 2022.” No wonder banks are interested.

Nevertheless, even with all of this excitement when it comes down to it, blockchains are not the solution for Clearing and Settlement. The reason I say this is that the issue is not a technical one but an industry challenge. Over a decade ago, Europe tried to change the market structure and produced a report by Alberto Giovannini listing the 15 barriers to an integrated European market. Those challenges had little to do with technology, and were far more about legal and structural challenges. Those are still challenges that need to be resolved if we are to have an effective shared ledger in the Clearing and Settlement markets. It is for these reasons that even with distributed shared ledgers and smart contracts, the centralisation of clearing will not disappear.

Today, what we see is that it may be effective and possible to apply blockchain technology to a ledger controlled by a centralised structure – RTGS (Real Time Gross Settlement), TARGET2 for Securities (T2S), DTCC, ASX, NASDAQ and so on. However, many of these central structures then need to link across industries, regions and continents to connect all the players involved. Creating a blockchain that could be shared by all counterparties – every bank and intermediary worldwide – is still a long way away. As David Rutter, CEO and founder of R3CEV states:

“Clearing and settlement is another area which is attracting a lot of interest at the moment, but it is unlikely that we will see blockchain solutions in this space in the first wave, it's more likely to be the third or fourth wave … there's been a lot of talk about what will happen to companies like SWIFT and CLS (Continuous Linked Settlement), but we have to remember the crucial role these institutions play in financial markets. If we look at CLS, there's certainly a technology component, but there are also legal contracts with hundreds of countries and regulatory underpinnings that would need to be considered. It's not a question of replacing these infrastructures but helping them adapt to conform with new standards.”

Source: Accenture Research

Interestingly Adam Ludwin, CEO of Chain who developed the NASDAQ blockchain clearing system, disagrees:

“When people say blockchain technology will change Clearing and Settlement, what that really means is that blockchain technology will make Clearing and Settlement redundant. It’s as if I gave you a 10 dollar bill, and then asked you how do we clear and settle that payment. You would look at me funny, because it doesn’t make sense.”

Fascinating stuff, and I could talk a lot more about this area but instead will just point to a range of articles that will give you more background and debate:

Developing Blockchain Real-Time Clearing and Settlement in the EU, U.S., and Globally, by Joanna Diane Caytas of Columbia Law School, June 2016

Holding, clearing and settling securities through blockchain technology: Creating an efficient system by empowering asset owners, by Eva Micheler, London School of Economics, Law Department and Luke von der Heyde, May 2016

Blockchain and T2S: A potential disruptor, by Standard Chartered, June 2016

The potential of Blockchain and why it matters to push the boundaries, by Adena Friedman, President and COO, Nasdaq, May 2016

Could Blockchain Really Replace The Need For Clearinghouses, by Luke Clancy, Risk-Tech Forum, May 2016

This is also worth a look if you’re wondering about real-time clearing. Is that what we really want?

RTGS, and the story of collateralised risk instead of credit risk, February 2016, FT Alphaville

Finally, if you have another half an hour left, Consensus 2016 had a great panel comprising itBit, Nasdaq, CME Group and Digital Asset last May on this topic. Worth a watch.

Meanwhile, there are quite a number of start-up companies that are leading the charge to create shared clearing ledgers with Digital Asset Holdings and R3CEV at the forefront. They are not the only ones though as there’s also SETL, T0 (Overstock), Clearmatics, Symbiont, itBit, Colored Coins, Tradeblock, Epiphyte and more. This is not surprising as when we say Clearing and Settlement, there’s a lot to clear and settle and it’s not just over here, but it’s everywhere. European Clearing and Settlement of equities, derivatives and more; American Clearing and Settlement of equities, derivatives and more; and Asian Clearing and Settlement of equities, derivatives and more. Then there are different ways of doing Clearing and Settlement of equities, derivatives and more. You can do it on an Erethreum blockchain; a Ripple blockchain; a HyperLedger blockchain; and even the Bitcoin Blockchain (if you want to clear and settle bitcoins).

I’ll talk about some of the leading companies in this space tomorrow.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...