I blogged the other day about too many banks and that there’s not a big enough market for forty of them here in Britain. It made me think about what do customers really want? We talk about digital, apps, mobile and more, and yet the average customer … are they bothered? I suspect that many don’t give a jot about whether the bank offers these or not. Maybe young professionals do, but the average punter on the high street, I’m not so sure. In fact, going against the grain of many of my own blog entries and those of others, I could see a world where a bank doesn’t need to bother to develop and deploy anything, and they would still keep most of their customers.

Half of all customers would not switch banks, even if their bank didn’t offer a decent mobile app, because it’s not important to them. Another quarter of the bank’s customers would only switch if they were offered a nice bribe, like the Santander 123 account that cost them £1 billion a year in lost profit to get people to switch. Mind you, a bribe does work as over three million of the UK’s meanies moved. That demonstrates that it’s nothing to do with tech that gets customers to move; it’s about the money in their pocket and purse.

Finally, there’s a segment that are bothered about how innovative the bank is. How big is that segment? I have no idea, but it’s not huge as First Direct has been offering a cool, high level of customer service bank without branches for a quarter of a century and yet only attracted just over a million customers. Metro Bank has been open for over six years, has branches and tech, and still hasn’t achieved a million customers. Spending £2 million on each of its 42 branches, and yet to turn a profit, the bank is adding over 20,000 customers a month growing to a total of 848,000 customers as of the end of Q3.

So going back to my earlier discussion of too many banks, if there’s only a very small segment of the population that will be lured by tech banking, how much is that segment worth?

Well, quite a lot as it turns out. After all, as I blogged the other day, the branch experience can be a salutary one. This means the branch user is primarily a non-technical one or a business these days. They’re not the confident hi-tech customer, and most of those are pretty well off. I’m not saying poor people use branches, but I am saying that the higher worth customer does not, or not out of choice anyway. However, the anomaly here may be that the poorer customer makes the bank more money. Poorer customers get more charges, go overdrawn more often, need more credit and are generally going to be ones you can make more money from.

Does this therefore mean that the hi-tech bank is going to have the higher net worth, less profitable customer? Yes, but they aren’t unprofitable as higher net worth customers can be cross-sold more products: mortgages, investment, cards, loans, savings and more. In fact, looking to the USA, here’s a few interesting stats from the Financial Brand.

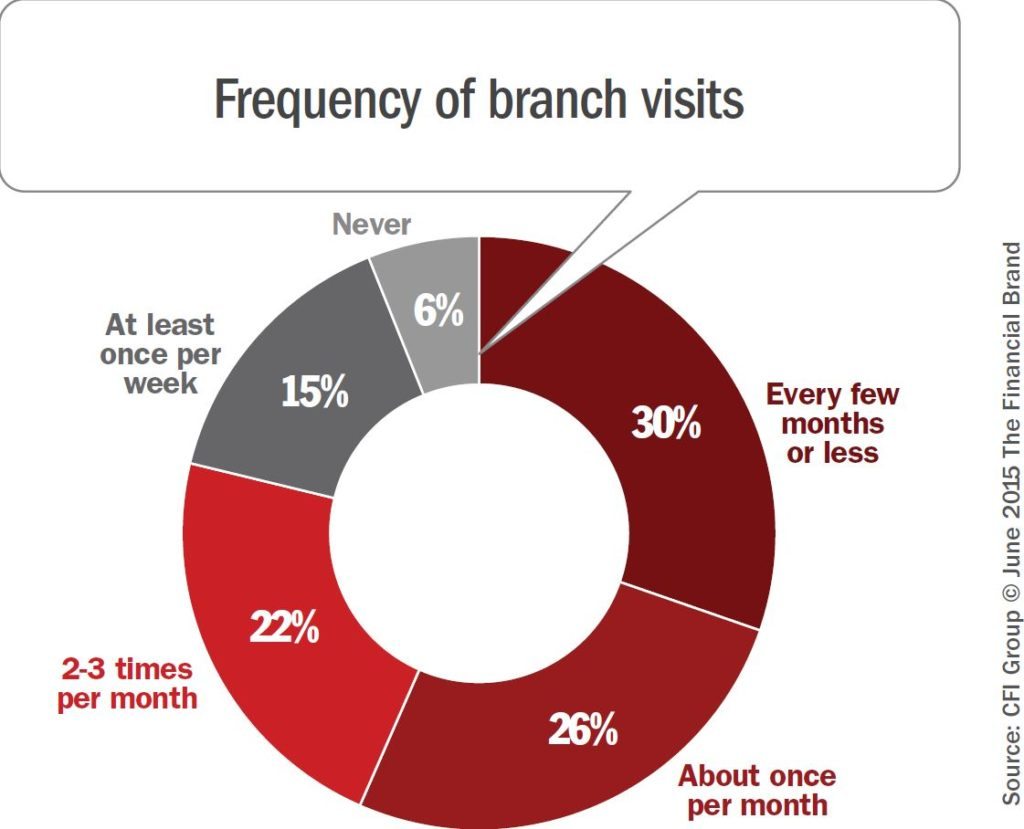

Most US customers visit the branch regularly still (probably to pay in cheques)

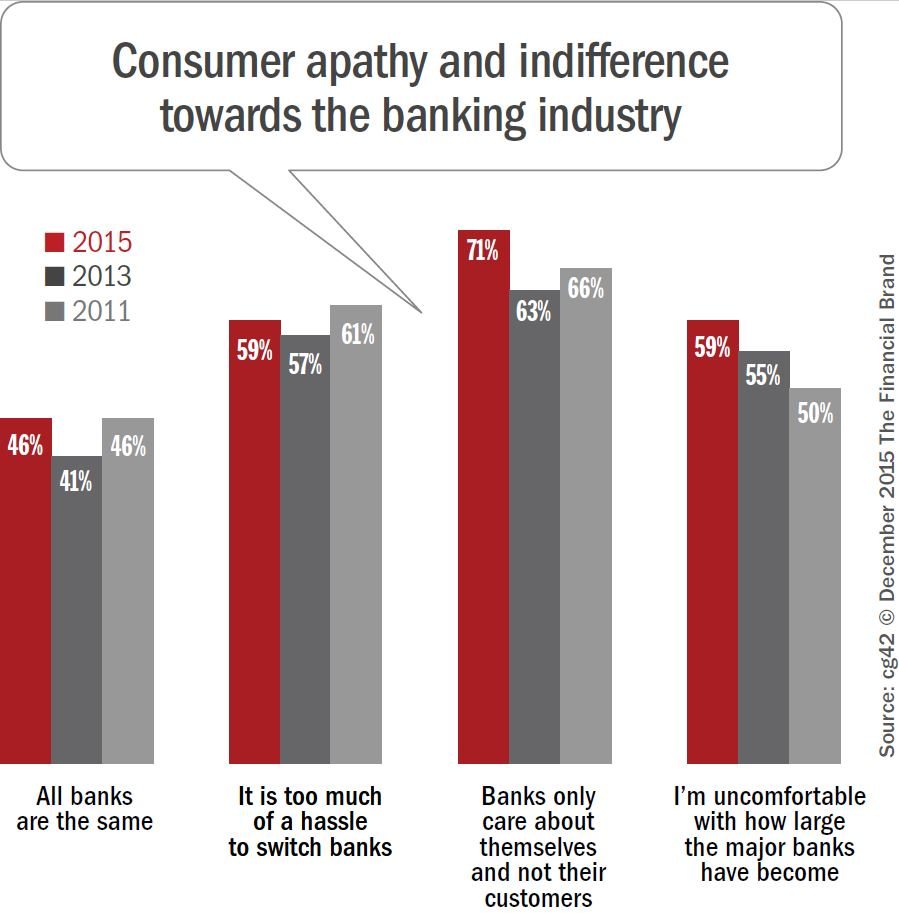

Most US bank customers don’t feel any special relationships with their bank

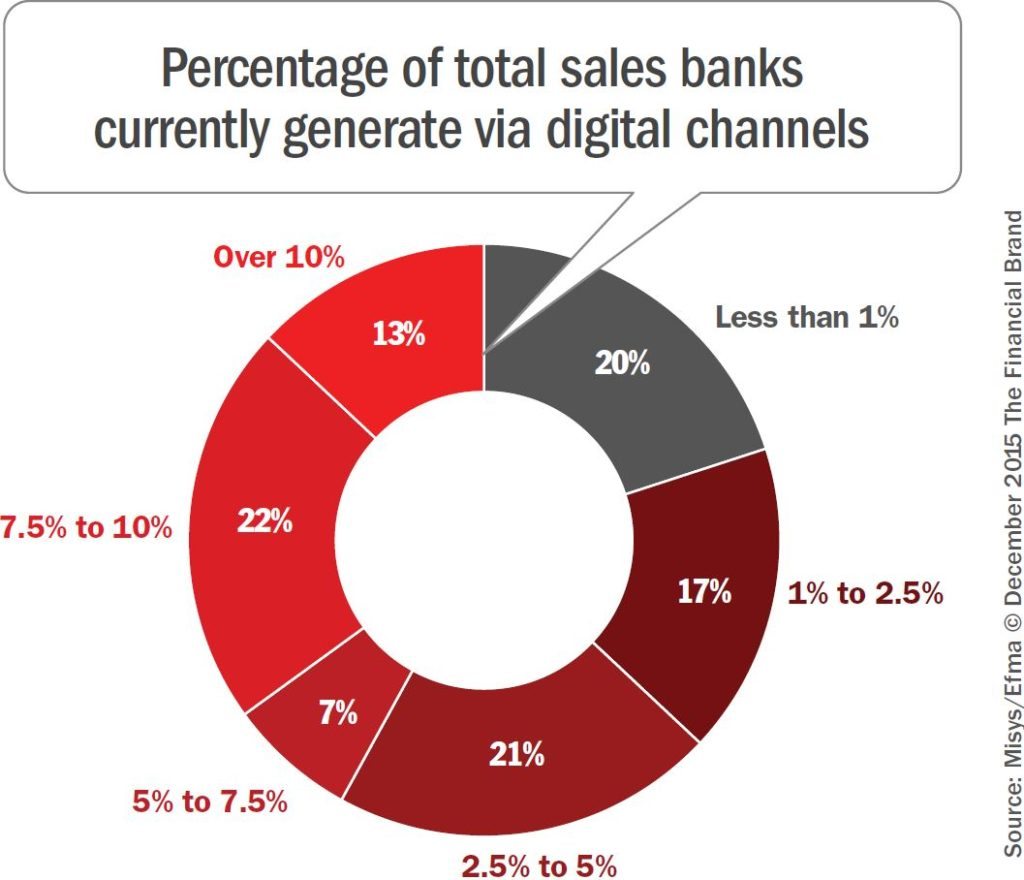

Most bank business is not sold through digital platforms

In fact, most millennials have the same outlook as boomers when it comes to banking … according to Facebook.

Facebook studied the financial relationships of working-age Millennials (ages 21–34) in the United States, including a specific profile for affluent Millennials (earning $75,000+) and compared affluent millennials to Gen X and boomers.

Here’s what they uncovered.

Millennials have two main financial priorities: paying down debt (43%) and saving for the future (38%). 46% say that financial success means being debt free whilst 21% say owning a home is how they would define it.

They see credit cards as a strategic tool: 46% say the main reason they use them is to build credit, and 36% say they use credit to increase their financial flexibility. Yet at the same time, they are wary of getting deeper into debt, which is why over half of all millennials prefer to pay with cash or debit rather than credit, and one in four describe credit cards as something that worsens their financial standing. Even affluent millennials were 2.2 times more likely than affluent Gen X / boomers to pay primarily with cash.

Many millennials move regularly and 83% of Millennials in Facebook’s study say they seek financial guidance during those times, with buying a home being the main trigger (at 48%). But half of all millennials say they have no one to turn to for financial guidance. Only 36% talk to their parents about money and just 8% trust financial institutions.

Facebook says millennials are 1.5 times more likely than other generations to discuss their finances online. Furthermore, they focus 40% of the conversation about finance on Facebook. When faced with important financial questions, from how to best build credit to how to buy a home, millennials put their faith in the wisdom of their friends and family online. And as the world shifts towards increasingly visual communication, from photos to videos, GIFs and emojis, the impact of imagery is felt within the financial conversation, too.

Looking at millennials’ second most important financial priority — accumulating savings for the future — Facebook found that 86% are actively saving.

This last one is interesting as it is direct conflict with other research. For example, GOBankingRates asked more than 5,000 adults how much they had saved in a savings account in 2015. The results showed that 62% of Americans have less than $1,000 in savings. They asked the same question again this year, to more than 7,000 people to see if Americans’ saving rates have improved in the last year or so. But the results are worse: the percentage of Americans with less than $1,000 in savings has jumped to 69%.

Another survey by TD Ameritrade found more than nine in 10 millennials overspend, fall short on savings or take on additional debt at least once a month per year.

Commenting on such research, I really liked the statement from Brandon Hayes, a CFP and vice president of oXYGen Financial: “our issue is we’re spending before we even save and then never look back … with a cashless society, it’s tough to appreciate a dollar when you never see one.”

In other words, people have lost the ability to know how to spend less than they make these days.

For me, it just illustrates our complex relationship with money, finance, banking and our lives. When I was growing up, my mum would regularly quote at me a line from Charles Dickens’ David Copperfield. It was Mr. Micawbers’ recipe for a happy life:

“Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.”

Anyways, it never worked for me. I’m hopeless with budgeting, thanks to the invisible nature of money. However, and this is the real point of covering the areas I’ve just covered above, is that the nature of our relationship is changing back to one where we will be better with money.

You see, technology made money disappear. For the past three decades – my adult lifetime – money has moved from a paper passbook stamped with debits and credits, to an invisible balance that you could only find by calling someone or going to an ATM, to a visible balance in my phone. However, in that process, the traditional banks have moved their ledger system from branch to call centre to internet to mobile, but it is fundamentally flawed. The flaw is that it shows me what I’ve spent. It shows me the past. It doesn’t tell me anything about how I spent or where I spent. It just shows me what I spent.

It’s all in the past and it’s all pretty bland.

Slides stolen from David Brear, CEO, 11fs

And that is where the new banks have their real opportunity. To provide insights into money, spending and our lives and by informing us of our future spending and saving needs to live well. That’s where I see the likes of Moven, Monzo, Loot and more making a difference and, to be honest, that might just be enough of a buzz to get customers to switch … along with a healthy bribe of course!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...