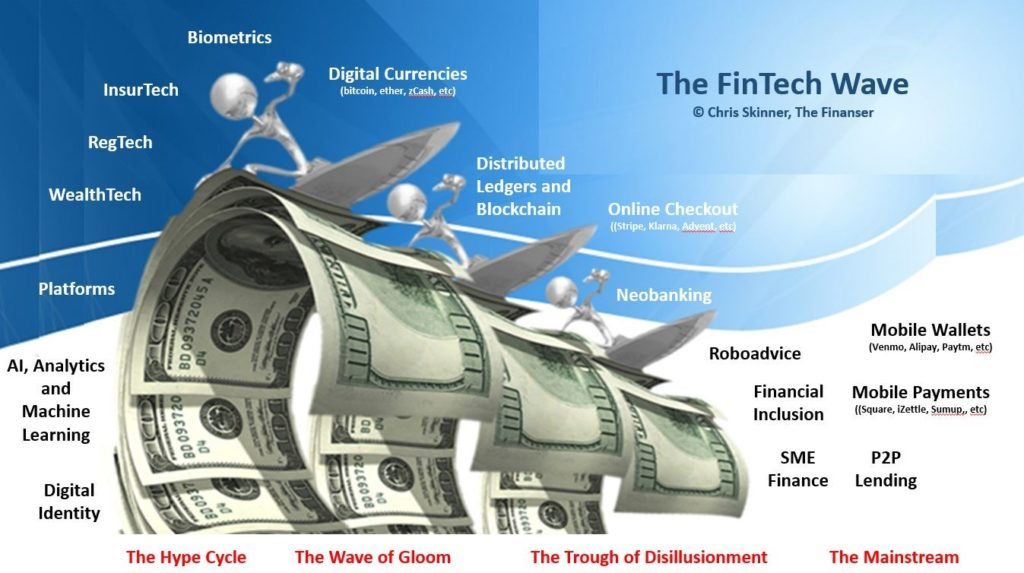

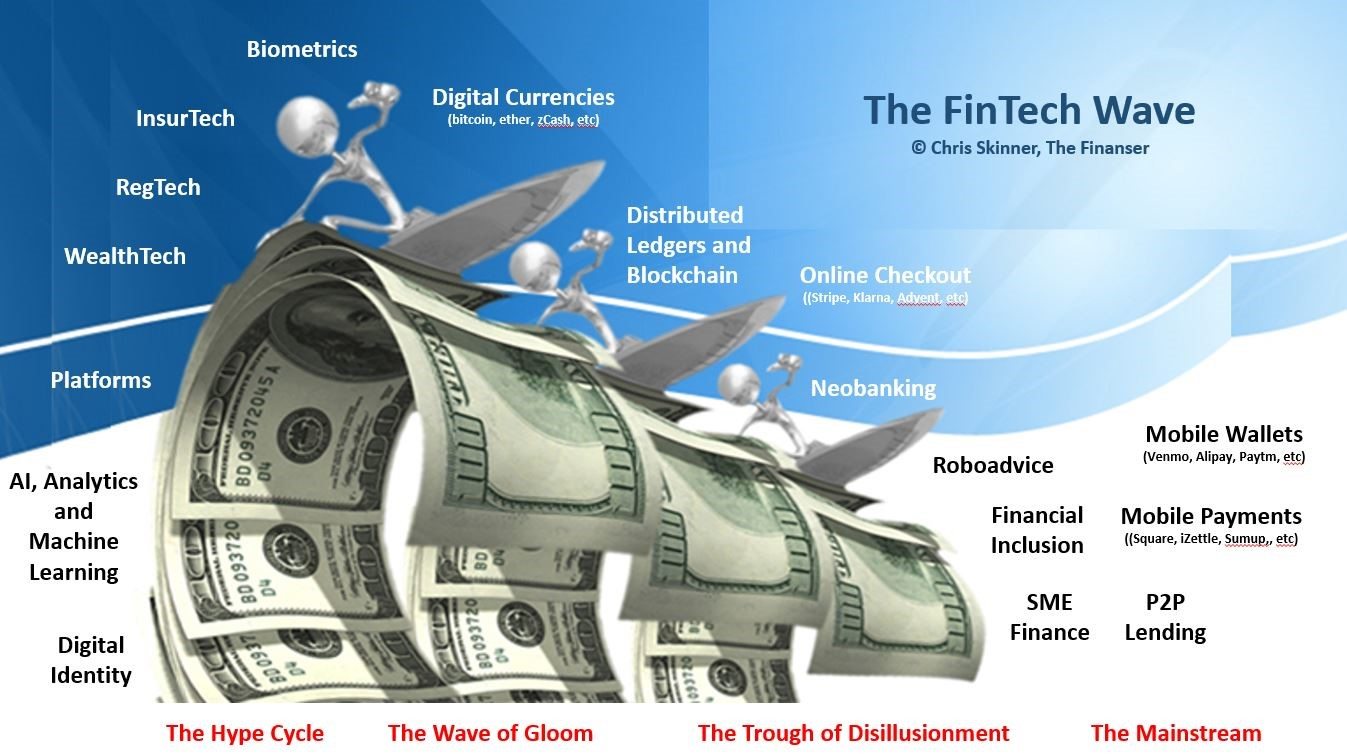

As mentioned in the first part of these two pieces, we talk a lot about FinTech. We talk about it as though it is one thing when, in fact, it is many. There are nuances to this market that is over a decade old today, that need to be fleshed out in more detail as, just as with technology in general, some of this FinTech is in the hype cycle, some is in the chasm, and some is coming into the mainstream as accepted.

I call this the Chris Skinner FinTech Wave (loosely based on Gartner’s Hype Cycle), which I did not share in the first entry but, now you know where I’m going, here it is:

As you can see, some technologies are rising, some falling and some are now widely adopted such as lending marketplaces. In this second part, I thought it worth discussing the remaining areas that are primarily generic technologies with a financial flavour such as AI, machine learning, IoT and biometrics. I don’t intend to define the whole market for each of these, but purely to place a dialogue around where they fit in the FinTech scene at a high level.

So, here is the FinTech Wave, Part Two.

Blockchain Distributed Ledgers

This is an area that needed definition, and is quite contentious because, in financial markets, blockchain became so over-hyped and misunderstood that it hit a wall. In my view, this technology is now firmly over the hype wave and crashing towards the trough of disillusionment. The main reason for this is a lot of investment in experiments, not realising they are experiments. Gartner summed it up well in a list of the Top 10 mistakes companies are making when considering enterprise blockchain projects:

- Misunderstanding or ignoring the purpose of blockchain technology

- Assuming that current technology is ready for production use

- Confusing future blockchain technology with the present-day generation

- Confusing a limited, foundation-level protocol with a complete business solution

- Viewing blockchain technology purely as a database or storage mechanism

- Assuming interoperability among platforms that don’t exist yet

- Assuming that today’s leading platforms will still be dominant (or even extant) tomorrow

- Assuming that smart contract technology is a solved problem

- Ignoring funding and governance issues for a peer-to-peer distributed network

- Failure to incorporate a learning process

This means that many banks are now wondering where the returns are in their blockchain investments and reeling back on those investments. The key here is the blockchain, when it really is used well, will be as transformational as the internet. However, the use of blockchain shared ledgers is more to do with agreeing new infrastructure operating models, such as how we replace core networks like SWIFT, Visa and the DTCC, than the technology itself. Nevertheless, for those who want to know more, I would refer you to the in-depth analysis I made last year of blockchain use cases and operations:

- What is and what isn’t a ‘blockchain’?

- Blockchain is like the internet before the browser

- Blockchain is dead, long live the Blockchain

- How much is being invested in blockchain start-ups?

- The five major use cases for financial blockchains

- Applying Blockchain to Clearing and Settlement

- Six Standout Start-ups Focused Upon Blockchain Clearing and Settlement

- Applying Blockchain to Trade Finance

- Five Standout Start-Ups Focused Upon Blockchain Trade Finance

- Applying Blockchain to Payments

- Nine Standout Start-ups Focused Upon Blockchain Payments

- Applying Blockchain to Identity

- 12 Standout Start-ups Focused Upon Blockchain Identity

Digital Identity

Digital identity is another big area of debate, because it requires an agreed structure before the technology can be deployed. Who runs a digital identity scheme? How is it operated? If self-sovereign, as many are arguing it should be, what happens when access is blocked and needs to be unblocked, such as when you have an accident and the medical care team need access to your health details? These questions will be solved over time, and the two entries above:

give you a great deal of depth on this area specifically.

Analytics, Artificial Intelligence and Machine Learning

We have talked at length about data being the new oil or gold, and data being the differentiation between winning banks and those that lose. The internet giants make their money out of data analysis and usage. That is their business, and financial institutions have the same opportunities with data, fi they use it well. This is why many financial firms are investing in machine learning, artificial intelligence and data analytics, as it allows them to improve their credit risk modelling, cross-sell ratios and enhance the user experience. It is all about deep learning from customer’s data to personalise and improve their relationship digitally with the institution.

Again, there’s a great deal written about this area, and I can recommend the following links:

- Machines that learn will decimate human jobs … or will they?

- Should we automate humanity or maybe we can never automate humanity

- web 3.0 and an Internet of Markets leading to web 4.0 and the Internet of Things

- Bank regulations change every 12 minutes leading to the Semantic Regulator

Cybersecurity

There are lots of scary numbers about cybersecurity, because no one wants to be hacked. That’s why IDC estimate that $101.6 billion will be spent on cybersecurity software, services, and hardware by 2020, up from $73.7 billion in 2016, or a 38 percent increase. Banks and financial firms are particularly exposed, as thieves try to attack banks first because that’s where the money is. Hence, financial institutions are particularly focused upon internal and customer security, and any scheme that assists in tightening this area is worthy of consideration. However, in my own experience in talking with hackers, and I’ve talked to many, is that it is the employee of the bank that is the area of least security. This is because every hacker talks about social engineering as their key skill. They play on the natural trust of people in other people. That is the vulnerability: we naturally like to trust other people. Just read more about how thieves hack to discover what the thieves do and, nine times out of ten, it is tricking an employee into becoming part of their plan by using their trust to compromise them.

Biometrics

Talking of security, biometrics has finally reached prime time. That’s in part due to the smartphone camera, which offers a great opportunity to capture a facial recognition or iris scan. Equally, a touch screen has given us the chance to use fingerprints and palms. Adding this to a PIN or OTP (One Time Password), gives a great chance to tighten security for the consumer and overcome the issues of forgotten passwords.

Payments

The payments area of FinTech is actually an area we could talk about in its own right, as it also has grains of granularity from mobile wallets (Venmo, Alipay, Paytm, etc) to mobile payments (Square, iZettle, Sumup, etc) to online checkout (Stripe, Klarna, Adyent, etc) to digital currencies (bitcoin, ether, zCash, etc) to payments infrastructure (DAH, Setl, Ripple, etc). Therefore, I’ll probably park this one here as a major bucket of change, and follow up another day with a more in-depth analysis. Meantime, if you want to know more, you can read in-depth over here.

Neobanking

Neobanking are the new bank start-ups we see around the world and they differ considerably around the world. For example, the neobanks that have sprung out of China – YesBank and WeBank – are very different to those we see in Europe and America, because they can be. They have sprung out of other services – commerce and chat – and therefore have a different ethos and look to banks like Soon in France, from AXA Group. Equally, there is a hive of activity across Europe with new bank start-ups from Bunq in the Netherlands to Che! Banca in Italy to LunarWay in Denmark and N26 in Germany. The UK probably leads the market for neobanks however, as there are around 40 new bank start-ups offering full bank services to bank app front ends. These include:

- Atom

- Bank to the Future

- Civilised

- Fidor

- Ffrees

- Hampden & Co

- ipagoo

- Lintel

- Loot

- Metro

- Monese

- Monzo, formerly Mondo

- Neat

- Numbrs

- OakNorth

- One Savings

- Shawbrook

- Starling

- Taqanu

- Tandem

- Tide

- TSB

- William & Glyn

- Zopa

As mentioned, the banks fall into two categories: full banking services with a bank licence (like Atom and Starling) to bank app front ends like Loot. The latter neobanks is also what we see in the USA right now, such as Simple and Moven, because the USA lags the world of full serviced neobanks primarily because bank start-ups cannot get full bank licences in America. The OCC may change that, as mentioned in a previous blog, but it remains to be seen.

Platforms, Markets and Cloud

Finally, the biggest area of change in banking is the creation of new financial marketplaces. Marketplaces are where apps, APIs and analytics are deployed for many different firms to play with them. A good example is Uber, Airbnb and Facebook, where the marketplaces are their platforms and people can then use their apps and APIs to connect and play. This is why we refer to Uber as the biggest taxi firm that owns no cars; Airbnb the biggest hotel network that owns no rooms; and Facebook as the biggest media firm that creates no content.

A range of new FinTech start-ups are trying to get into this space from CBW in the USA, who partners with Moven and Simple, to WireCard in Germany who power Holvi, Loot and other neobanks. These are now being copied and competed against by firms like Solaris and Fidor in Germany; Thought Machine and ClearBank in Britain; Leveris from Ireland; and more. The biggest of these challenger markets is currently in China, where Ant Financial offer apps, APIs and analytics that are being used by more than 40 Chinese banks.

If you are interested in this area, I can recommend the following articles for more depth:

- If you want to convince the bank to change, read this blog

- A seven-year-old idea comes of age

- web 2.0 and social networks leads to web 3.0 and an internet of markets

- Building the new financial marketplace

- B2B2C off!

Internet of Things (IoT)

The world has talked about IoT for a while, and we are seeing some flavours of this coming through in particular markets like insurance, where you insure-as-you-use. This means that you can leave the house and just insure your bike and camera for 8 hours that day, rather than take out an annual policy, and the insurance firm will know where your bike and camera are going to be for the next 8 hours because they have intelligence inside, as in they are connected to the network. The IoT details relate more to the internet of value, the ValueWeb, which I’ve written a whole book about so … if you want to know more, go buy the book.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...