I mentioned in my FinTech Wave that blockchain has entered the trough of disillusionment. It’s certainly a lot quieter space this year than last. In fact, when I say blockchain today, a lot of folks turn the other way. What’s going on?

A lot of it is to do with the hype cycle, and the fact that too many players were making too much noise about the promise of this technology and none of it has been delivered. Yet. I still believe it is transformational, but let’s wait and see.

Second, there is still a huge amount of media confusion about this technology. A great example of this, and of the general trough of disillusionment, is how the news spread that R3 have ditched blockchain. It all started from a slide:

What @Corda in on a slide explained at #R3 NOT #Blockchain event #FinTech #InsTech @TeamBlockchain pic.twitter.com/WQwfyNklci

— Gary Nuttall (@gpn01) February 21, 2017

This slide is clearly positioning what Corda is and is not, and is explained in depth in Richard Gendal Brown’s white paper on the subject. In this announcement of Corda, R3 make it clear that they have developed it because blockchain technology is not the right technology for a banking system. A blockchain-inspired development was required for banks, that kept the best bits of what blockchains can do, and then add the specifics that banks need that they don’t do.

We directly apply the “authentication”, “immutability” and “uniqueness service” features of blockchains but we depart radically when it comes to the scope of “consensus” and “validation”

Unfortunately, the bitcoinisters used the slide to bang a drum of R3-hate, with Beautyon’s inaccurate tweet being picked upon by many as proof that R3 was full of it.

R3 concedes defeat: "No Block Chain, because we don't need one" pic.twitter.com/tHE3I6U8mN

GAME OVER!— Beautyon (@Beautyon_) February 21, 2017

Leading to a headline that R3 had spent $59 million on researching blockchain technologies, only to find that they didn’t need it.

The $59 million figure comes from R3's first funding round, and the headlines basically are protraying that R3 and Corda is dead, which is not true. No wonder R3 weren’t so happy about it, and tried to clamp down on the misleading coverage.

Libel threat from R3's PR company regarding this article: https://t.co/XgLFcYAze3 #bitcoin #blockchain #r3 pic.twitter.com/WjuoK8K8tr

— The Merkle (@themerklenews) February 27, 2017

But hey, the horse is out of the stable and the libertarians are taking great delight in throwing rocks at R3.

.@derosetech let's see how long it takes for my account to get suspended... @misterdna @gendal @Frances_Coppola pic.twitter.com/DAZOkZCHNg

— Cheapest Pants (@cheapest_pants) February 27, 2017

Truth be told, R3's technical guys have always talked about taking the best of blockchain and re-engineering it, as their focus. This led to the release of Corda in April 2016, with the clear positioning that it does not act as a blockchain, but as a distributed ledger. The focus has been how to take blockchain features and develop a robust version of it for the banking system, as a distributed ledger technology. That is what has led R3 to develop Corda rather than using Ethereum or something similar.

However, as pointed out by some folks, even R3's people are confused, as their marketing twitter description dates back two years to when they started (pre-Corda) and talks about blockchain rather than, as they have updated it to in the past few days, "blockchain inspired".

How to troll a $150m "consortium" of scammers, @R3CEV, into an existential crisis from your couch. An illustrated guide: pic.twitter.com/VV6uwIzZVv

— Saifedean Ammous (@saifedean) February 23, 2017

It shows the complexity and subtlety of discussion required in a blockchain versus distributed ledger dialogue is lost on most, as all they hear is headlines like blockchain is not for us.

It’s almost like the bitcoin bad, blockchain good discussion that banks have. If you haven’t noticed, many establishment figures have said death to bitcoin for years, and yet it hasn’t died. In fact it’s still going strong. In fact, bitcoin is having one its best rallies since it was launched, thanks to Japan saying they’ll legitimise it as a currency.

Meanwhile, back to the bitching about blockchain and the trough of disillusionment. For me, it is all down to too much hype and not enough understanding. There are several versions of digital currencies vying for the win: zCash, Ether, bitcoin; there are several blockchains hoping to be the one that people use the most; and there are hundreds of startups developed shared ledger models, some on blockchains and some on other platforms.

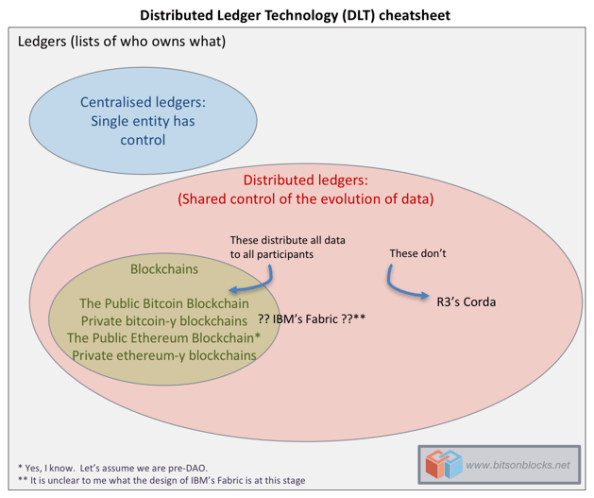

Finally, there is a big difference between blockchain and distributed ledger technology (DLT). As Antony Lewis of R3 noted:

All blockchains are distributed ledgers, but not all distributed ledgers are blockchains!

So the bottom-line here is that we have a variety of camps battling for their position as leaders, with a lot of fake news being made up to dirty the message of the other camps. Sounds like something else that recently happened in America.

Postscript:

If you have not realised yet, R3 is not acquiring Ethereum. I just made it up. Meanwhile, if you want the real low-down on what Corda is, R3's David Rutter just provided an update to clarify on the confusion above.

When is a blockchain not a blockchain

We’ve been flattered by all the attention Corda has received this past week. It’s just too bad the story isn’t a story.

The issue of semantics is always a challenge as new ideas, technologies and cultural phenomena work their way into mainstream consciousness and the media. Rewind a few years and who would have thought the Oxford English Dictionary’s definition of ‘meme’ would be updated to refer to a picture of a grumpy cat or a sad Michael Jordan on Instagram?

When we launched R3 in 2015, we were among a handful of companies inspired by the technology underpinning bitcoin, known as blockchain, and its potential application to wholesale financial markets. Conversations in boardrooms and the media revolved around blockchain, which at that point was the most pertinent example of distributed ledger technology in the mainstream consciousness.

Humans are creatures of habit. As time went on, the term blockchain came to be associated with any type of distributed ledger, even as the technology matured and evolved to meet the needs of different groups of users. This isn’t an issue unique to our space. The marketing team at Canon must have spent countless hours working out how to stop people referring to all copy machines as Xeroxs.

While we were almost certainly guilty of slipping into this semantics trap now and again, we’ve said from the beginning that Corda is a distributed ledger platform, not a traditional blockchain platform. It was never designed to be one.

At the outset our architecture team identified its first priority to be to decide whether to adopt, adapt or build. Put simply, if we found another platform currently in the market that was fit for purpose for regulated financial institutions, such as a traditional blockchain, we would have had no need to build our own and we would have gladly adopted it wholesale or adapted it as necessary.

Blockchains are specific pieces of software originally built to handle transactions of virtual currencies such as bitcoin and ether. Together with our bank members, we realised early on that this technology could not be applied blindly to wholesale financial markets without careful consideration: changes must be made to satisfy regulatory, privacy and scalability concerns. And that is what we have done with Corda.

Corda’s open source distributed ledger technology was designed from the ground up to address the specific needs of the financial services industry. It is heavily inspired by and captures the benefits of blockchain systems, but with design choices that make it able to meet the needs of regulated financial institutions.

Crucially, Corda restricts access to data within an agreement to only those explicitly entitled to it, rather than the entire network. And financial agreements on Corda are intended to be enforceable, linking business logic and data to associated legal prose in order to ensure that the financial agreements on the platform are rooted firmly in law.

Corda was designed from the ground up to address the specific needs of the financial services industry. There are currently very few tangible examples of distributed ledger platforms in the market – and none that were developed with over 70 global institutions from all corners of the financial services industry. It is unique and its launch was a landmark moment for the market.

When is a blockchain not a blockchain? When it’s Corda.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...