As referenced in my R3 fake news last week, there are various camps out there fighting for the cryptocurrency crown. The lead runners are bitcoin and Ethereum, and both have serious backing. However, it’s still early days. I keep stressing that we need to remember we are experimenting here, and the end game is still a ways away. The end game is that there will be a digital currency we can all buy into. Whether it’s bitcoin or bityuan or ekrona or ether or monero or any of them, who knows … it could be all. Equally, it could be none.

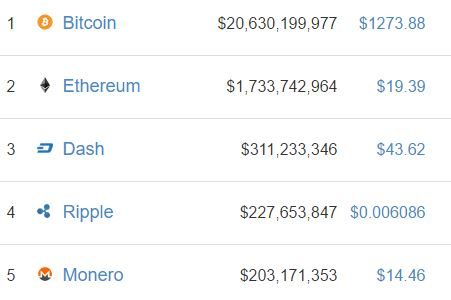

Source: Coinmarketcap

This is not a win:lose equation however, as there is a potential win:win zero sum game where several currencies and blockchains survive and thrive, with interoperability for different use cases. After all, corporates might use Ethereum whilst the general public use bitcoin. So here’s a quick low-down on how I see it.

bitcoin

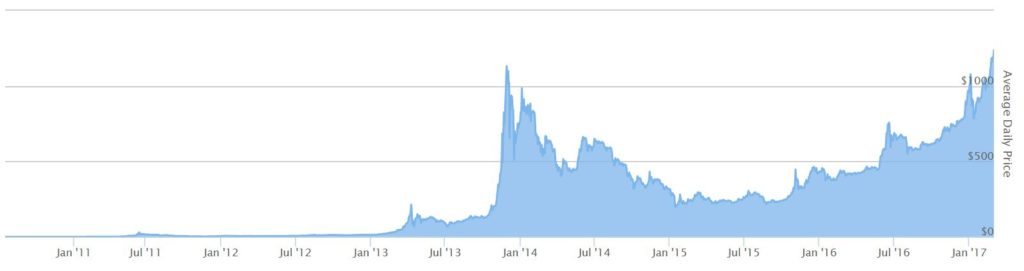

After blogging about bitcoin for six years, I’ve closely followed its peaks and troughs, ups and downs. This chart portrays the rollercoaster pretty well (you can see what was causing the peaks and troughs over at 99bitcoins):

So right now it’s peaking with a price of $1,290 per bitcoin. That makes it worth more than gold, and the bitcoinisters are all over the moon. But there’s the usual factions moving here, with the hype of the bitcoinisters versus the reality of the markets. For example, I’m pleased the price of bitcoin is way up there but (a) it’s meant to be a currency you spend, not an investment you hoard; and (b) it’s still tiny when compared with other currencies and commodities.

On the former note, I’m seeing too many people buying into bitcoin because they’re being suckered by the hype and believe it’s a good investment. It’s a currency, not an investment; or that’s what we should be thinking. On the latter, this quote from Fran Strajnar, co-founder and CEO of Brave New Coin makes sense: “The gold supply is 180,000 tonnes of 'above ground' gold, valued at $7 trillion. The bitcoin market value is $20 billion, so gold vs bitcoin is psychological more than anything."

Yep.

bitcoin has had a lot of people buying into the market, but it’s still a small $20 billion market. A long way to go before we can believe it’s mainstream, and there are plenty of competitors out there such as zCash, which claims to overcome the deficiencies in bitcoin.

It is notable that the gold rush of recent bitcoin activity is caused by a variety of factors from Japan’s legitimizing the currency to China’s outlawing it to the Winklevoss twins creating a potential SEC-approved ETF to trade in it. All of these factors, along with Brexit and the Trump, are fuelling people to invest. This then creates a virtuous circle of the more who invest, the more who invest. This may all come tumbling down quickly, or it may move mainstream. We just don’t know. What I do know is that we no longer talk about bitcoin as a Wild West, the dark net currency, ridiculous or stupid. People are taking it seriously now, and that’s probably a good thing. Even so, there are many who don’t buy into it, with the currency announced as dead 124 times to date. It’s still not dead though.

ether

ether is the currency of Ethereum, and this is proving popular with corporates. In fact, it’s so popular that the Ethereum Enterprise Alliance was announced last week, driven by Microsoft, Intel and JPMorgan. That’s’ saying something, so why is Ethereum more popular than bitcoin for corporate users? Because of Microsoft.

Microsoft saw the potential of Ethereum for Blockchain-as-a-Service using their cloud Azure platform early on, and have been driving that project forward ever since to its enterprise account base as the platform of choice. Equally, Ethereum and ether differs from Bitcoin and bitcoins (former is the infrastructure, latter is the currency), because it allows both permissioned and permissionless transactions to take place whereas Bitcoin only works in a permissionless way. For corporates, having transparency of transactions and a completely public ledger just wouldn’t work, which is why corporates and banks aren’t buying into Bitcoin.

Ethereum is not proven however, as demonstrated by the infamous DAO Hack and hard fork last year . However, it does show the nature of factions and different views when you google Ethereum fail and the top results include two next to each other:

- Why Ethereum Succeeded Where Bitcoin Failed - Motherboard

- How Bitcoin Succeeded Where Ethereum Failed - Coinjournal

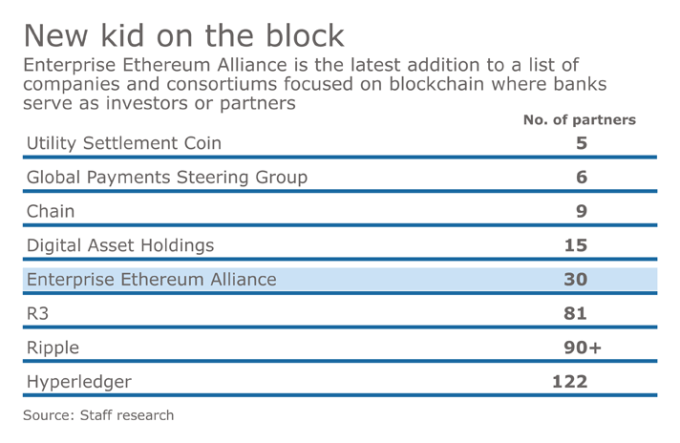

It just goes to show that there are lots of tribes fighting for survival here, and it’s not pretty. The two leading tribes are Bitcoin and Ethereum, but there are plenty of others, as I outline above. For banks this leads to choices: do we invest in Ethereum and join the Ethereum Enterprise Alliance or do we become part of R3 CEV’s consortia? It is not even as simple as that, as there are plenty of other alliances out there. This was well summarised by Penny Crossman for American Banker and, rather than repeating her wise words with my own, I’m going to cheat and cut and paste her thoughts here.

Two incumbent tech giants have positioned themselves in the middle of a frenzy of blockchain projects and partnerships designed to help financial services firms become quicker and more efficient at a plethora of things from trade finance to securities settlement to loans and debt tracking to cross-border payments.

IBM and Microsoft are taking decidedly different paths and banks will want to closely examine the technology stacks and the security and privacy decisions the two are making as they sort their own future with blockchain technology.

On February 28, Microsoft announced it’s part of a new consortium called the Enterprise Ethereum Alliance. It includes 30 technology and financial services partners including JPMorgan Chase and Intel that plan to build a blockchain based on Ethereum.

Also on February 28, the IBM-led Linux Foundation Hyperledger Project announced 11 new members, bringing its total to 122. New members include Bank of England, Bitmark, China Merchants Bank, Federal Reserve Bank of Boston, Initiative for CryptoCurrencies and Contracts (IC3), American Express and Daimler.

The good news is that banks won’t necessarily have to choose between the two — at least not for now. Plenty of companies, including Intel, JPMorgan Chase, ING, Thomson Reuters, BNY Mellon, Monax and Consensys, support both the Hyperledger Project and Ethereum-derived projects. Of course, other blockchain alliances exist, as do individual partnerships between banks and blockchain projects.

You can read more in-depth about the IBM and Microsoft approaches at The American Banker.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...