Building on my challenger bank discussions, there’s some interesting points coming out of a new report by Price Waterhouse Coopers (or Playing the Wrong Cards as they’re now called, after the Oscars) on challenger banking. It’s well worth a read, especially as they found that having branches is more important than mobile apps. The survey showed that 68% of consumers thought a bank branch was essential when opening a new current account, compared with 25% who favoured a mobile app.

Hmmmm … never ask the customer what they want, as their answer will be a faster horse methinks or, in this case, I still want a branch as that’s what I know.

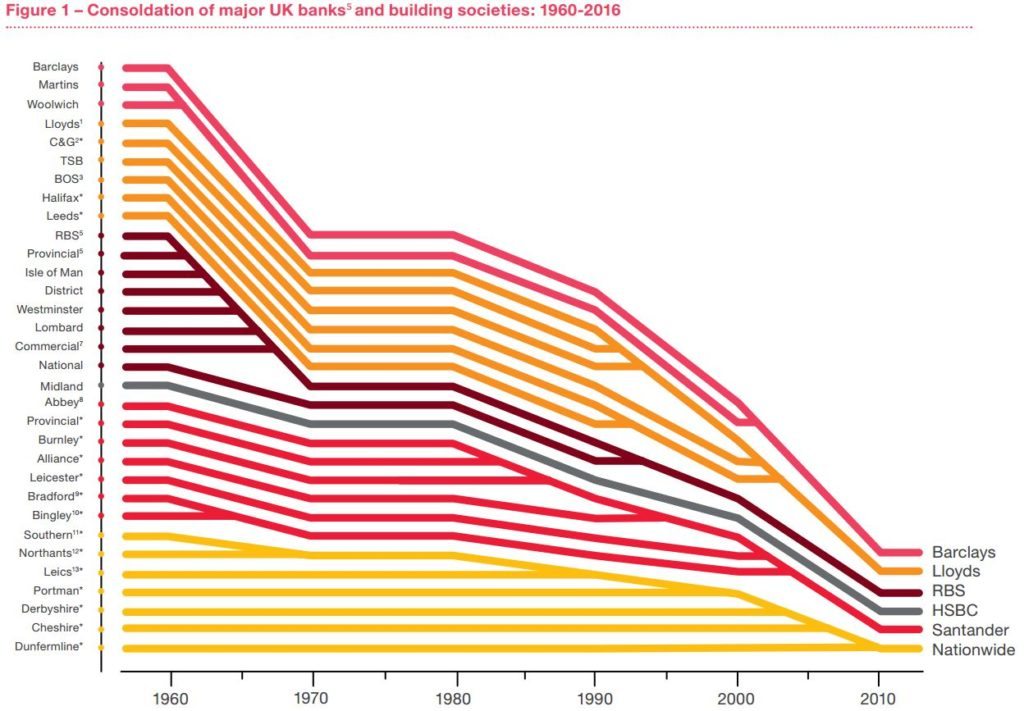

Anyways, there is some key metric data in the report. For example, it shows that the UK retail banking market place has become a dull playground thanks to mergers and acquisitions over the past half century:

As a result, the six large banking groups held an 89% market share of the current account market. The regulator has tried to encourage more competition in the sector by implying the process to launch a new bank, a challenger bank. Since 2010, 19 new retail and commercial banking licenses have been issued, with at least eight more pending as at January 2017. These new entrants join a number of more established mid-sized full service banks, such as CYBG (the owner of Clydesdale Bank and Yorkshire Bank brands) as well as other smaller, specialist players such as Aldermore (founded in 2009) and Secure Trust (operating since 1954).

Many challenger banks don’t anchor their propositions around current accounts, as they recognise that customers are willing to multi-bank.

“We’re happy being customers’ second bank. We don’t want to be their primary bank and we don’t offer current accounts for this reason; current accounts are a dated product.”

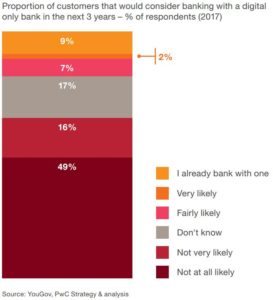

To corroborate this statement, PwC with YouGov polled more than 2000 British consumers in January 2017 on their awareness of and preference for different types of banks, banking products and services. Asked to choose between two ideal banking scenarios, the majority of respondents (54%) said they would prefer to bank with multiple providers with the best offer for the products they have, compared to only 30% of customers who would bank with just one provider.

Challengers are still frustrated by regulations however, and wish that regulators would harmonise rules:

- reducing the disparity in capital treatment;

- improving regulatory proportionality;

- increasing access to payment systems; and

- increasing transparency of products to improve customer understanding of product value.

The first point – capital – is a critical issue as many banks believe these requirements place them at a structural disadvantage. For example, UK banks are split into Internal-Ratings Based (IRB) and Standardised Approach (SA) banks under the Capital Requirements Regulation (575/2013) (CRR). Under these designations, the capital requirements are higher for SA banks relative to IRB banks. All the six main high street banking groups are IRB approved, but it is currently difficult for many other banks to follow suit because of the data requirements and significant costs of obtaining and maintaining approval. In other words, capital requirements play into the hands of the large incumbent banks when it comes to major products like mortgages. For example, on a less than 50% loan-to-value buy-to-let mortgage, average IRB weights are 7.8% and current standardised weights are 35%. Some banks using the standardised approach therefore argue that they must hold almost five times as much capital for the same loan.

Additionally, due to the Minimum Requirement for own funds and Eligible Liabilities rules (MREL), regulatory capital requirements rise sharply once a bank provides or services more than 40,000 deposit accounts.

“The most important structural issue the bank faces is the disproportionate application of capital requirements. The current capital regime has significantly influenced decisions on banks’ business model, such as the decision not to launch mortgage products due to the prohibitive capital requirements.”

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...