I’ve just spent the last three weeks travelling around too many places to mention, including Germany, UAE, UK and three very different countries: Argentina, Colombia and Pakistan.

Argentina is a huge and diverse country of over a million square miles, and a population of 40 million; Colombia is one of the world’s most ecologically diverse countries, comprising 440,000 square miles and a population approaching 50 million; and Pakistan is just over 340,000 square miles with a population bursting over 200 million people.

All three countries have one thing in common though: poverty and a largely unbanked population.

Pakistan is at one extreme, with only 13% of the population banked, dropping to just 5% for women. Colombia can claim to be better. According to the Colombia Banking Association 65% of the Colombian adult population had access to financial services in 2013, rising to 72% in 2016 and a target of 80% banked by 2018. Although other statistics do not corroborate this number, putting the levels around 40% banked and 60% unbanked, with 79% unable to get credit cards. Meanwhile, Argentina has most of its population adult banked, with just 15% unbanked, but less than 10% of adults have access to credit and 5% to savings.

Source: World Bank

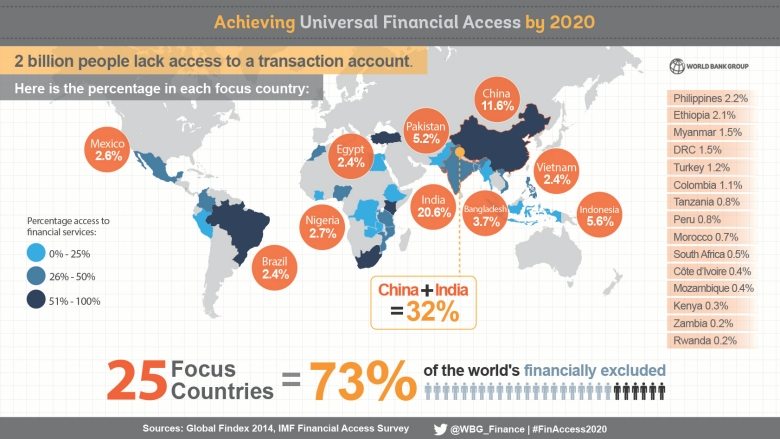

More detail about these figures can be found in the World Bank’s Global Findex report and database, which estimates that the number of people worldwide having an account equates to 62% of the world’s adult population has an account in 2014, up from 51% in 2011. In 2011, 2.5 billion adults were unbanked whilst, by 2014, 2 billion adults remain without an account. This represents a 20% decrease.

Much of the change is down to mobile wallets and basic accounts offered through banks via digital means. This is a sweeping change.

Equally, in all three countries, I heard a commitment to change.

Pakistan launched its National Financial Inclusion Strategy to achieve its financial inclusion goals in May 2015; Empresas Públicas de Medellín (EPM), the Colombian city’s utility company, launched the Financiación Social program to provide accessible credit lines for its poorest and typically unbanked client base in 2008; the City of Buenos Aires is running a variety of programs including IncuBate, IncuBA Tech, and IncuBA Social, to eradicate financial exclusion.

I was particularly impressed with Pakistan’s moves, which seek to encourage people to move away from cash and find financial inclusion, unlike India’s demonetisation which is forcing people to use less cash. Pakistan’s financial inclusion strategy focuses on four areas:

- Promoting digital transaction accounts and reaching scale through bulk payments;

- Expanding and diversifying access points;

- Improving capacity of financial service providers; and

- Increasing levels of financial awareness and capability.

This is important as over 100 million Pakistanis are unbanked, representing 5% of the world’s unbanked population. During my time there, one thing that hit me is the rising levels of mobile broadband usage amongst Pakistanis, and this has been a phenomenal change just in the last three years.

Pakistan has grown from zero mobile broadband users three years ago to 42m today pic.twitter.com/VqHgiIDJav

— Chris Skinner (@Chris_Skinner) April 12, 2017

Intriguingly, in Colombia, it is very different. Colombians don’t like using digital money and prefer cash. I think that’s a cultural thing, but it is clear that reducing cash in the economy is a much greater challenge in Latin America, where cash still rules.

Meanwhile, if you want to know what it’s like to be unbanked, this blog from a young Norwegian living in Buenos Aires gives you a glimpse:

Bills: For my health insurance bill, I print it out and take it to a RapiPago, PagoFácil, or Pago24. These are billing payment services that you can use for almost all bills, such as cell phone, medical, gas, electricity and many, many others. You usually find them inside a kiosk. They have huge networks so you can find many of them all over the city. However, there is almost always a line – so go early or try to find one that is less known. These services are of course easier than going to a bank, but they are still time consuming (in many or even most, you line up on the sidewalk to wait) and still require that you go there with your cash. Also, many kiosks need to hire a person, or two, specifically to do payments, and the margins are very low, so it is not always very profitable for the agents.

Cell phone: I usually pay this at the actual Claro store, because it is convenient and there is hardly ever a line. Also, because my cell phone is not in my name, but rather a friend’s name – it was the only way to get a plan without having a DNI, the national ID number.

Rent: To pay rent, I have to go the bank of my landlady and deposit the money into her account. Because it is not a bill, it cannot be payed in non-bank agency. These kinds of deposits, without a bank card from that particular bank, can only be done in the bank opening hours, from 10 to 15. Great! Also, each envelope cannot hold the full amount of the payment, so I have to do two transactions. (The largest denomination is a 100 pesos bill…) There is usually a line but not too bad.

Internet shopping: I don’t really do that here, but at MercadoLibre, which both businesses and individuals use to sell their goods, you can often pay in cash – i.e. you organize with the seller to pay upon pickup. I have used it to find good prices (for instance on a printer) and then simply gone to the store to buy it. That avoids the commission to MercadoLibre as well.

General shopping: I shop less than I did in the US, and one of the reasons is that I never use a card here. So if I want something, I usually have to come back with cash later on.

Security: For big purchases, I use a money belt – may seem excessive but works for me. I never carry large sums of cash in my purse, and never keep much cash at home.

Meanwhile, rather than drumming on and on and on about this stuff, here are three reports sent to me before my visits to these countries.

First, background from BBVA on Financial Inclusion in Argentina:

Second, a background on digitalisation in Pakistan by PWC:

Third, the state of financial services in Colombia as presented by the CEO of Bancolombia:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...