Fintech in Rwanda: the place where Telcos are surpassing Banks in the financial sector

Last week I participated in the leading fintech conference in Africa “Dot Finance”, which took place in Kigali, capital of Rwanda. The audience of 400–500 people mainly consisted of bankers, entrepreneurs and government officials from different countries of Africa, alongside global fintech influencers Chris Skinner and David M. Brear.

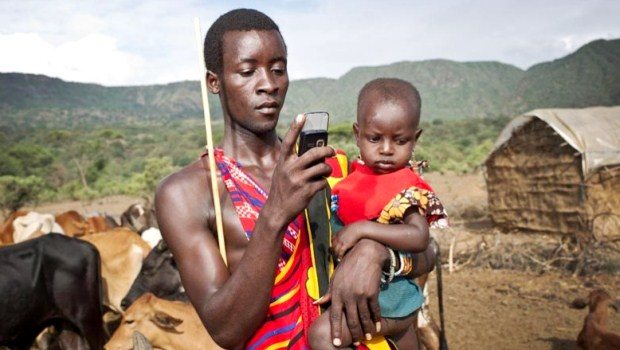

It was a lot of discussions around the future of FinTech in Africa and Rwanda in particular, where the fintech boom for financial inclusion has already started there (they estimate that 90–95% of population has access to financial services) and what is more interesting is that it’s not driven by banks or payment companies.

Fintech development in Rwanda is driven by Telcos.

There are 3 major mobile operators in Rwanda and all of them successfully launched payments and remittance services (domestic and international) for their customers:

MTN (40–50% of the market) >> MTN Mobile Money

Tigo (30–40%)>> Tigo Cash

Airtel (15–20%)->> Airtel Money

I assume most “fintechy people” kno how mobile money works, but for others I will shortly describe the user case:

Every sim-card holder in Rwanda can open a mobile wallet account and top it up. In order to load funds to your account, you need to buy a scratch card from an agent or at a telco branch (agents are people, whom you can find near almost any bus stop or shopping centre). Furthermore you can also withdraw money from these agents, so basically they are the “ATMs” of Africa.

After your wallet account is loaded, you can make payments or money transfers online (in the app or web site) or offline at the point-of-sale, where you can pay using a traditional terminal or directly to the seller (smartphone to smartphone). If your smartphone doesn’t have an NFC chip, you need to buy a small NFC-tag which you stick to the phone (I saw these with almost every smartphone there).

Interesting that mobile wallets can be of different types: from so-called “unbanked” (with light registration requirements and limited number of transactions and amounts) to “fully-banked” accounts which are quite similar to a bank current account.

Besides payments, you can make a p2p domestic transfer as well as even get international money transfers to your wallet (e.g. WorldRemit partners with MTN mobile money wallet).

Beyond payments: savings and loans

MoKash, launched by MTN in partnership with Kenya’s CBA bank (the name means “more cash”), is the extension of their product line. While MTN mobile money is the tool to pay and transfer money, MoKash is a complete banking product, which allows clients to save money with interest (7% interest for deposits) or borrow loans. Moreover it’s very convenient: fully digital and instant. You just dial *182#, follow the instructions, and your account will be quickly loaded with a small loan (up to $400 USD). Credit scoring is based on data from your MTN phone usage and Mobile Money usage history, which influences the amount of your credit limits. This means that even unbanked people have access to small loans. BTW the loan is provided by CBA bank, not by MTN itself.

Other players (non-bank and non-telco)

While mobile operators compete with each other Mobicash, which was launched in the middle of 2016 and already has several million clients, aims to complement all existing players by working with banks, payment switches, and mobile network providers and integrating them with the MobiCash platform. Through 900 MobiCash agents located countrywide, people get access to the following services:

- Top-up mobile phones of any mobile network

- Payments for utilities

- Money transfers

- Payroll service for SMEs

- e-Government services

- Tax payments

Will banks survive in this fintech red ocean? Only with open banking and a BaaS approach

I believe that banks in Africa will survive only if they will co-operate with new players, not compete with them: with telcos (like MTN and CBA), fintech startups, ecommerce players etc. However, the existing infrastructure of most of the local banks is not ready to be integrated with third-party players. Banks’ IT legacy systems, lack of resources, lack of security, overall bureaucracy and slowness are the real barriers for effective cooperation with new players.

The most effective solution to overcome these challenges is to create Bank-as-a-Service platforms with open APIs. This is how it was done in the US (Bancorp, BBVA,CBW), Europe (Wirecard, SolarisBank, Railsbank) and currently happening in Asia (Wirecard, BAASIS). A short description of Bank-as-a-Service can be found here.

During my keynote speech I talked about the South-East Asia experience, and the challenges and barriers for fintech development here, and the lessons that Africa could learn from the Asian experience in order not to repeat the same mistakes (my presentation is here on Chris's blog).

p.s. surprisingly I’ve had a really bad experience with traditional banking in Rwanda:

- I found an ATM in the convention centre which ate my card and than went out of service, so I waited several hours for support to come and return my card;

- When I went to book the famous Rwandan “Gorilla tour”, I tried to pay with my card but their terminal didn’t work due to a connection failure; and then

- When I physically went to the bank to withdraw cash, my Singaporean banking card was blocked ... in total I spent around 3–4 hours to make a simple transaction.

Maybe it’s a sign to start using some local fintech products? :)

p.p.s. I also hope to come back to Rwanda soon again — a very unique and interesting country. It’s ranked as one of the safest countries in Africa and #9 globally according to the World Economic Forum.

While there are a lot of security people with guns on streets, in general you feel really safe and comfortable there. And the natural parks are amazing, especially the famous mountain gorillas: