I really enjoyed a recent article on CGAP (the Consultative Group to Assist the Poor). If you don't know them, CGAP is a global partnership of over 30 leading organizations that seek to advance financial inclusion. Housed at the World Bank, CGAP's mission is to improve the lives of poor people by spurring innovations and advancing knowledge and solutions that promote responsible, sustainable, inclusive financial markets.

They regularly produce research about financial inclusion that is illuminating and Pablo García Arabéhéty recently wrote an article that is worth sharing here.

“Information wants to be free.” This was the powerful motto that made hacker culture mainstream in 1984. Then the internet happened.

What if, as with information, transactions want to be free?

Could we expect a new internet-like moment for retail financial services if everyday users were given the ability to move money instantly across providers for free? Let's entertain this idea for a moment. What would it take to accomplish? What would the impact be for financial inclusion?

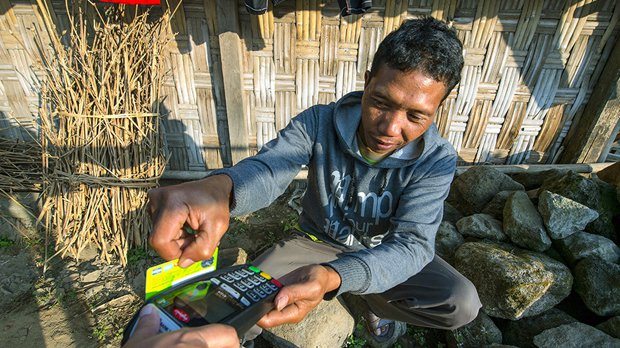

Photo credit: Ady Agustian, 2016 CGAP Photo Contest

Plenty of transactions are already offered for free. For example, I have a bank account that offers unlimited ATM withdrawals anywhere in the world at no direct cost to me. But as with lunch or instant messaging, no transaction is free. There is always someone paying. (In the case of my ATM withdrawals, sadly, I am paying through seemingly unrelated fees.)

For this reason, the question of whether it is possible to make transactions free is ultimately about business models. It is a question of whether certain players in the global retail financial services arena are positioned to move away from transaction-based revenues and cover their transactional costs by other means.

Three trends make this liberation of transactions more likely today than ever before.

- Real-time, interoperable payment and transfer infrastructure is spreading across markets. If free transactions need to be subsidized by other revenue streams, lower prices bring them closer to feasibility. In the last decade, instant, interoperable payment and transfer infrastructure has become more widely available across markets, including lower-income economies. Avoiding intermediaries to access this basic infrastructure brings operational savings, ultimately lowering costs. At the same time, open transaction exchange systems using blockchain or other distributed ledger technologies have gained some traction and could become viable alternatives to centralized payment infrastructure. (Surprisingly for some, Bitcoin can be expensive and slow on this front.)

- Transactional financial services providers are diversifying their revenue sources. Shifting away from transactional revenue requires providers to have alternative revenue streams. In the last five years, transactional businesses have started to cross-sell a broader portfolio of financial services. Kenya’s M-Pesa, which has traditionally focused on domestic transfers, launched a micro-loan service in association with a bank that reached a user base of more 12 million last year. Similarly, PayPal has been offering working capital loans since 2013. As of last year, the value of those loans had reached $2 billion.

- Analytics are becoming a key competitive advantage for cross-selling. Analytics are taking over traditional credit scoring and making it easier for providers to diversify their revenues through lending. Ant financial, a subsidiary of the Chinese retail giant Alibaba, is already offering Sesame Credit, a scoring system that taps several alternative data sources. The ability to tap richer data to offer personalized and timely products is becoming a new competitive edge for financial service providers.

These trends present financial service providers with an opportunity to move away from transactional revenues, but how willing and well equipped are they to do so?

Banks are well positioned across these three trends. They are the backbone of the instant transaction interoperable infrastructure in many markets, they know the business of cross-selling financial products, and they have been early adopters of analytics to assess credit risk. Many banks already offer free instant transfers across providers (in Brazil, for example).

Nonetheless, their payments business model — which accounts globally for a third of their overall revenue — depends heavily on transactional revenues. Opening the floodgates to more free transactions could directly impact their bottom lines in the short term, so to many it does not represent an enticing future.

On the other hand, there is another group of market players that might not be deterred by this immediate hit to the bottom line. Online retailers, instant messaging apps, social networks, online search engines, cellphone manufacturers, and a variety of fintech startups are managing to find niches at the intersection of the trends described above. They are in an unprecedented position to offset transactional costs by cross-selling products like instant credit and digital advertising to third parties. In some markets, they are connecting to the basic interoperable instant transfer infrastructure. And they are well versed in the world of analytics and deep customer insight and personalization.

Here are just a few examples of what these companies have been doing so far.

-

Alibaba is aggressively raising capital to continue its global expansion and diversification strategy. The creation of Ant Financial as the parent company for Alipay and the launch of the savings product Yu'e Bao, both in 2013, signaled the company’s expansion. Ant Financial recently won a bidding war for the acquisition of Moneygram.

-

Facebook and Whatsapp have already secured a payments license that could enable them to debit and credit any bank account in Europe once the new PSD2 payments directive is implemented in 2018. This would make it possible for bank customers to manage their finances through third parties. In India, there are reportsof Whatsapp following a similar path through the new domestic Unified Payments Interface.

-

Venmo, which is now owned by PayPal, has been offering free money transfers across wallets for a long time in the United States (as have many companies in other countries). But they can only offer free and instant transactions within their own platform; transactions across providers take one business day. It is an interesting case in which the United States' infrastructure is limiting the extent to which transactions can be made free and instant (although things are changing rapidly this year).

-

M-Pesa, the global brand for mobile money that operates in Kenya, Tanzania and India, among other developing markets, is now experimenting with free in-platform transfers for transactions of less than $1. This initiative could have implications for financial inclusion. By definition, providing transactions to low-income segments is more expensive because cash conversions are typically required, at least at the beginning or the end of each transaction cycle. M-Pesa has excelled at making cash conversion access points available (in my view this is their core innovation), but they are expensive to operate, and subsidizing their operation could be a challenge. If M-Pesa figures out a sustainable way to subsidize these transactions, it could have a significant impact on financially excluded segments.

Looking at the overall trends in the global retail financial services industry, liberating transactions seems increasingly possible. Yet the economics of innovative business models like these will ultimately determine to what extent, and for what types of transactions and use cases, free will become the new normal.

One thing is clear: If transactions do want to be free, there will be a battle of the titans to liberate them.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...