I’ve been spending a lot of time travelling around the LatAm markets over the past few years. In fact, I was just at the CIAB FELBAN FIBA conference in Miami that covers this geography and this year saw many firms from Nicaragua to Honduras to Costa Rica attend. But the major markets are the competition between FinTech Mexico and FinTech Brazil.

Several studies and reports have highlighted the high growth rates of Fintech in the region, such as the 2017 LAVCA Trend Watch, which pointed out that the Fintech sector represents 25% of the venture investments in IT in the region; or the recently published Fintech Innovation in LATAM report by IDB and Finnovista, where over 700 Fintech startups were identified in Latin America.

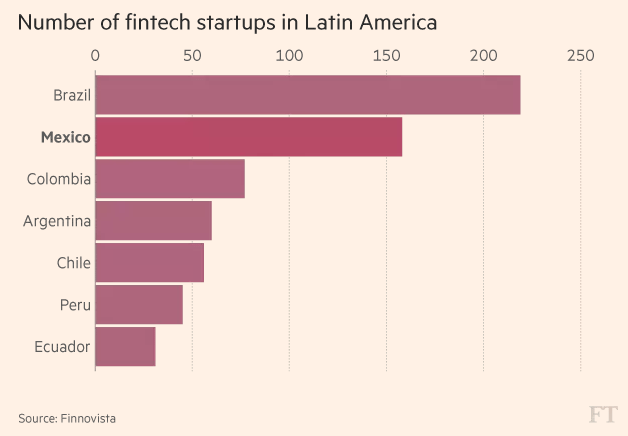

Finnovista, a LatAm start-up accelerator, believes that FinTech start-ups in Mexico could take up to 30% of Mexico’s banking market in the next decade. Some 158 fintech companies operate in Mexico, the second highest number in Latin America after Brazil.

Source: Financial Times

According to Finnovista, Mexico’s FinTech community grew by 50% in the last year to overtake Brazil’s, but the Brazilian marketplace is where the highest concentration of action has been for the last couple of years.

This is why I found it interesting when I received FinTech Lab’s detailed analysis of what’s happening in Brazil and thought it worth sharing again.

The State of FinTech in Brasil

Just as has happened in other countries, throughout the last few years Brazil has seen many changes brought about by the development of technology and the internet. Some local success stories, such as Buscapé, Hotel Urbano and Netshoes, have become pioneers in delivering services and interacting with the customer online. Parallel to the appearance of these projects, the Brazilian population is also becoming more used to using technology to manage their financial lives. For example, Internet and Mobile banking have shown very strong growth, together making up 54% of the 54 billion bank transactions made in Brazil in 2015.4However, the digitalisation of financial services has not led to systems being designed in a more user friendly way, and just a brief look at the Internet Banking services offered by major banks reveals usability issues. Some of the most notable ones, among others, are difficulties in linking payment receipts with transactions, difficulties in choosing and comparing investment options and a lack of tools for the integrated tracking of personal finances. In the B2B (business-to-business) market the scenario is much the same, with small and medium sized businesses always having had problems concerning the offering of products, high prices as well as operational difficulties, such as financial agreements.

In the payment sector there has also been a strong regulatory push in recent years aimed at incentivising competition, such as with the break in exclusivity for acquisitions in 2010 and new regulations concerning payment methods in 2013.One of the first attempts to revolutionise the local financial market was FairPlace, a company started in 2009 focused on peer-to-peer (P2P) loans. This was at a time when the financial sector was lacking in innovation, and its business model was to connect people who needed funding with people who wanted to finance them by auctioning rates. However, this soon came into conflict with traditional players and regulatory, since legislation requires that loans must be mediated by financial institutions. FairPlace only operated for a few months and, after it closed in 2009, there was a two-year hiatus before the subject was put back on the agenda with the growth of new companies.

In the last two years the Brazilian Fintech market has reached boiling point. The evolution of the FintechLab Radar proves this, with the number of mapped businesses rising from 54 in the first report in August 2015 to 244 in this edition. Supported by an ecosystem which is maturing by the day, there is no sign that this growth will slow any time soon.

If you want to know more, check out their 48 page full report here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...