Another great #Money2020 day, and this one spent mainly in the blockchain stream. Adam Lutwin, CEO of Chain who I referred to recently, kicked off the day with a beginners guide to the crypto world. It was real good. That was followed by a panel moderated by Marc Hochstein, former editor of the American Banker and now with Coindesk. The sessions description was as follows:

Private & Consortium Blockchains: Collaborating to Make Blockchain Real for Enterprise

Big business--like that of big banks and tech giants--will always drive innovation, and the rise of blockchain-based smart contracts turns blockchain into a middleman to execute all manner of complex business deals, legal agreements and automated exchanges of data. Companies such as Microsoft and IBM are using their cloud infrastructure to build custom (or “private”) blockchains for customers. Further, blockchain “consortiums” are proliferating that engage in blockchain standard-setting activities, partner with startups and experiment with their own use cases. What problems are they solving? When are private blockchains the most applicable technology? Hear some of the key participants in these cross-industry partnerships discuss how collaboration is shaping the future of blockchain technology.

With panellists debating the above including:

- Amber Baldet, Executive Director, Blockchain Program Lead, JPMorgan Chase

- Marley Gray, Principal Program Manager, Azure Blockchain Engineering, Microsoft

- David Huseby, Security Maven, Hyperledger

- Todd McDonald, Co-Founder & Head of Partnerships, R3

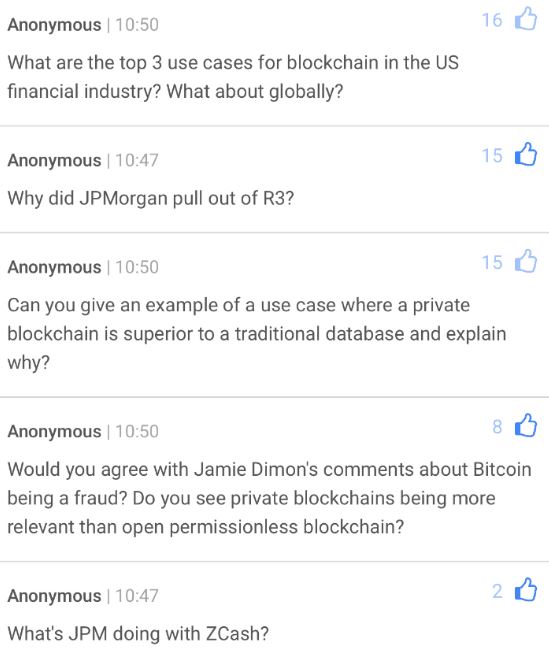

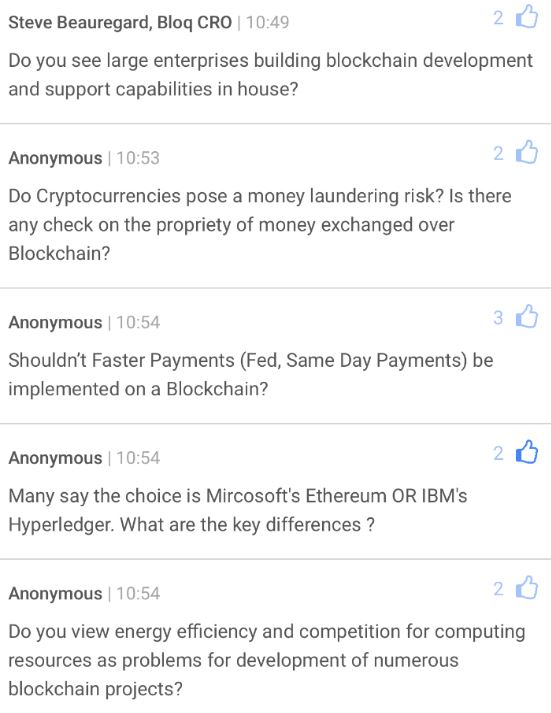

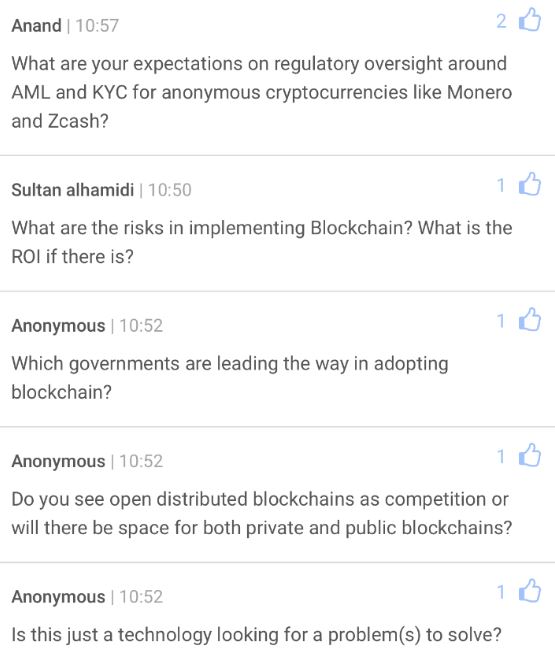

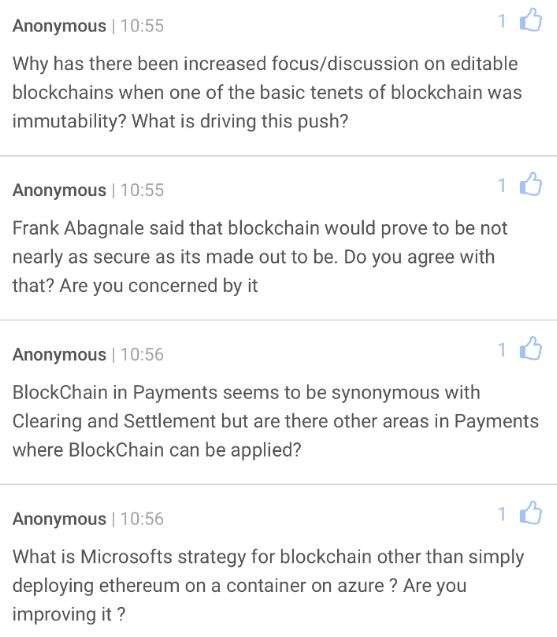

What piqued my interest here was the debate, but also what the audience would want to know and Slido didn’t let me down. There were many questions flying in, most of them asking what Jamie Dimon really thought and whether Amber agreed with him. She deflected that question quite well, by saying that there were many nuances to bitcoin and blockchain and, as Jamie was being asked almost every day what he thought of bitcoin, he decided to try to deflate that argument and was maybe misunderstood. Nice, diplomatic answer.

Then there were questions about why JPM left the R3 consortia, what they were doing with ZCash and quite a few other points raised specifically about JPM’s strategy.

These questions were touched upon but not really answered. There were then a long list of other questions:

Obviously, people are still keen to learn about this developing area.

For me, the two key questions were around how the consortia’s, of which there are many now, are working; and when will blockchain become mainstream.

On the first, the answer was that consortia’s are hard and, as Todd pointed out, they are not just hard to create but also to maintain, which is why some members leave. However, consortia’s are needed to tackle industry wide issues like clearing and settlement. That is why these things take time.

That led to the second point around when things will be mainstream and the panel agreed unanimously that we are in an experimentation phase right now. Sure, things will move along from proofs of concept to pilot schemes to production schemes, but it’s going to take time. Five years or more seemed to be the common view, which fits with my prediction that it would take ten years for blockchain to become mainstream (made two years ago).

Meantime, the questions about use cases surprised me as I’ve been blogging about those two for a while:

discussion of the use cases for blockchain and ledgers. This started with a blog update back in March:

- The five major use cases for financial blockchains

- Applying Blockchain to Clearing and Settlement

- 6 Standout Start-ups Focused Upon Blockchain Clearing and Settlement

- Applying Blockchain to Trade Finance

- 5 Standout Start-Ups Focused Upon Blockchain Trade Finance

- Applying Blockchain to Payments

- 9 Standout Start-ups Focused Upon Blockchain Payments

- Applying Blockchain to Identity

- 12 Standout Start-ups Focused Upon Blockchain Identity

- How much is being invested in blockchain start-ups?

Ah well, I guess not everyone at Money2020 reads my blog.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...