I’m running around the different areas of #Money2020, meeting folks, seeing exhibit demos, hearing track streams and listening to plenary keynotes. To be honest, the keynotes here are just product pitches so I spend most of my time in the track streams, where real dialogue occurs.

The major stream that I joined, as mentioned yesterday, is blockchain and one panel that closed the day got the most questions. The panel was all about regulating the blockchain and was a dialogue between a group of ladies.

This is fairly unusual, as most banking conferences I attend only get a token lady thrown in to demonstrate diversity. This panel was all women. But then it was about compliance, so that’s hardly surprising. The panel was made up of:

- Kathryn Haun, Former Federal Prosecutor, U.S. Department of Justice & Lecturer in Law, Stanford University

- Jamie Smith, Global Chief Communications & Marketing Officer, The Bitfury Group & CEO, Global Blockchain Business Council

- Ruth Wandhöfer, Global Head Regulatory & Market Strategy, Managing Director, Citi Transaction Services, Citigroup

- Carol Van Cleef, Partner, BakerHostetler

With the moderator being Amy Davine Kim, Global Policy Director & General Counsel, Chamber of Digital Commerce

And was described as follows:

How do you regulate blockchain, the technology that underpins not only digital currencies, but so much more? Not a trivial question. The regulation of blockchain-based applications is something governments, incumbents and other industry players debate, and there is still considerable uncertainty as governments take varied approaches. The U.S. Securities and Exchange Commission has ruled that some of the tokens offered for sale are actually securities—and are subject to the agency's regulation. Chinese regulators recently issued a ban on Initial Coin Offerings (ICOs), causing chaos among start-ups looking to raise money through the novel fund-raising approach. Meanwhile, the European Parliament has focused on discovery: rather than start with what the technology must be stopped from doing, first figure out what it can do, then help it develop and work on how to protect the consumer. This panel of experts will compare the regulatory approaches being taken in different parts of the world and explore the critical issues for regulating blockchain-based applications.

I particularly enjoyed it as there was plenty of discussion about different approaches by different geographies, from the let’s try to block any ICO or cryptocurrency activity in China to the what is this thang in the USA. In fact, the panel generally felt that America was trailing the world when it came to regulating or embracing blockchain and pointed at what was going down in Dubai and Singapore as leading edge territories.

There were also subtle nuances in the discussion, such as recognising there is a difference between a regulator and a lawmaker. Equally, there is a big difference between using blockchain for currency movements versus using blockchain for smart contracts. The latter is a big deal that governments should be implementing and trialling for passports and investments versus the former is where they have the biggest concerns over money laundering and illegal activities.

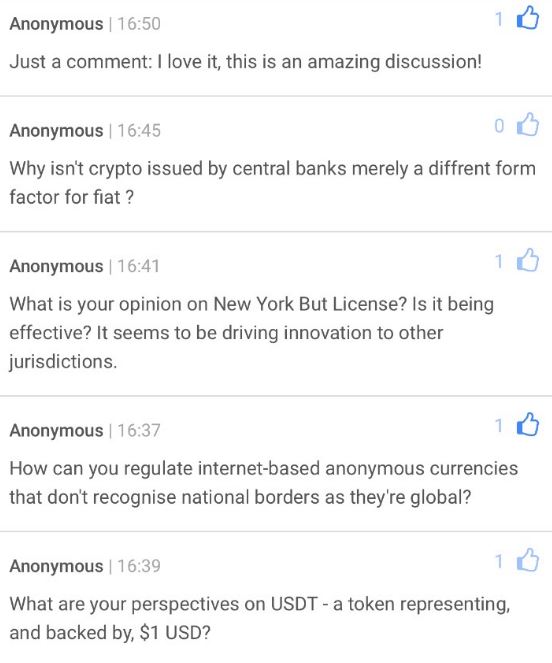

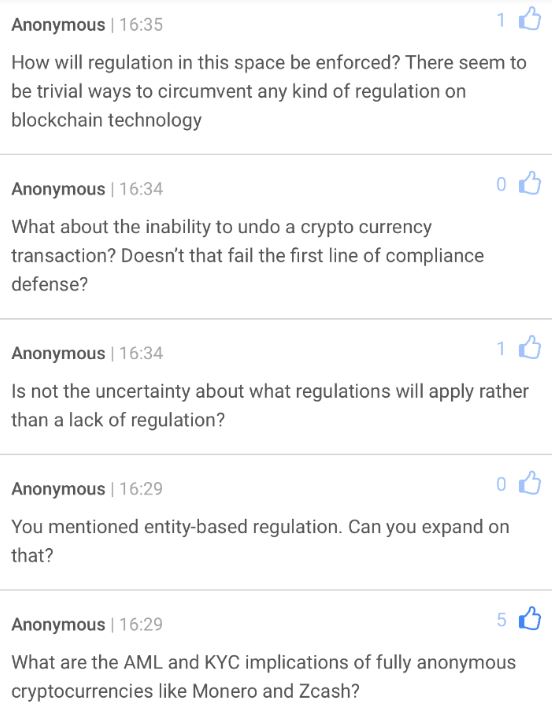

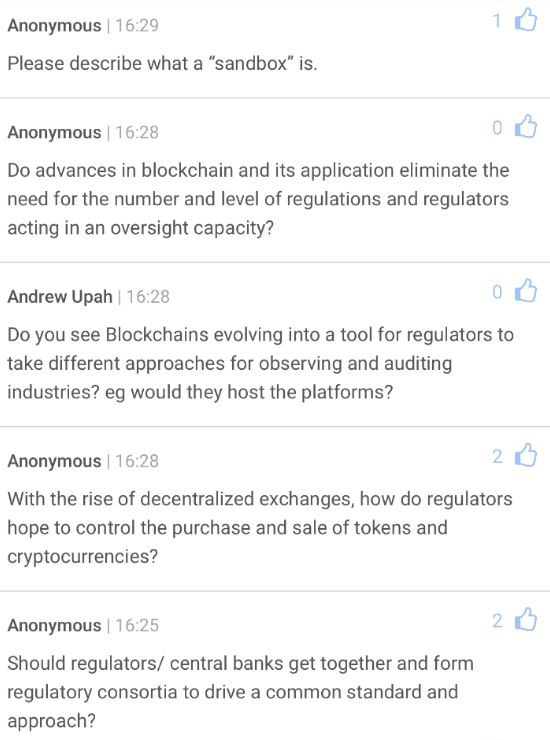

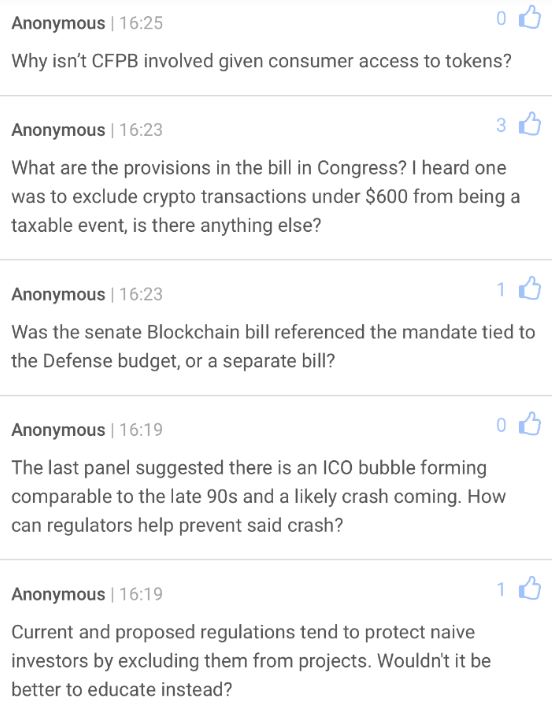

The audience clearly enjoyed the debate, as evidenced by the questions and comments:

And my takeaway was that there is the clear Jekyll and Hyde development of the internet. This had been true since the internet began and will probably stay true until the internet implodes. On the one hand, the internet is a transformational thing that brings a lot of good to a lot of people. People who are housebound can now get goods delivered to their homes, including anything from toilet paper to yoghurt. On the other hand, the internet allows criminals to engage in activity that is far darker than any activity that has gone before. The amount of paedophilia available on the dark web is more than has ever existed at any time ever before.

So, what to do?

Ban the internet due to the illegal activities of the few, or allow thee technology to thrive and prosper due to the benefits it brings to the many?

Governments always fall for the latter whilst trying to police the former. Could a government ban the internet today? Not easily, if at all. In a similar fashion, can a government stop the activity of currencies that do not recognise national boundaries? I don’t think so. But they can minimise their threat by auditing and analysing very cash in and cash out. And that’s exactly what they are doing.

Good luck to those libertarians who think they have money without government. There is no such thing.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...