I just hosted the money2020 banking session. There’s a lot I could write about from that session, but I’m going to cherry pick a few highlights and begin with the part that got the most activity from the audience: the mobile first start-ups. This was a session where five FinTech start-ups demonstrated their wares, and the selected companies were N26, Chime, Final, Long Game and Zero. You probably don’t know who these firms are, so I’ve used summaries of their firms at the end of this blog post to enlighten you, but in short:

- N26 is one of the fastest growing new banks in Europe with 500,000 customers and opening in the USA next year;

- Chime aggregates all of your financial life into a mobile app and makes its money from interchange fees;

- Final is tokenised service to create secure and dynamic card numbers for each and every transaction you make;

- Long Game takes gaming and puts it into a financial app that’s fun for millennials; and

- Zero is a card that acts like a debit card but runs on the credit card rails and, in so doing, uses interchange fees to give cashback without having to load up with credit.

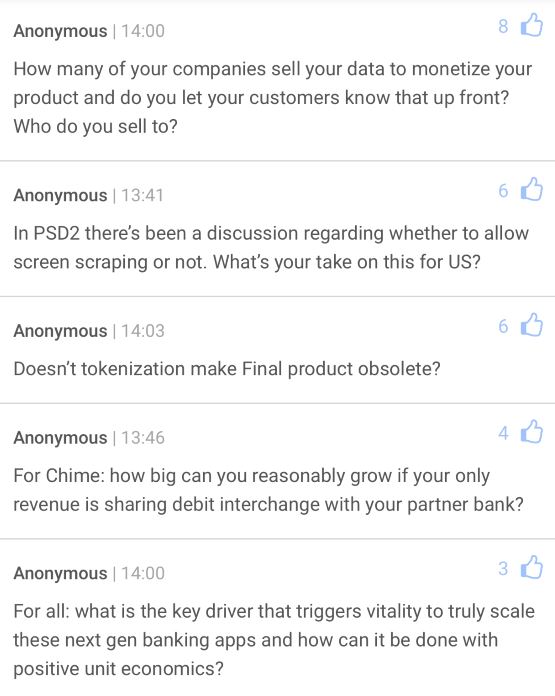

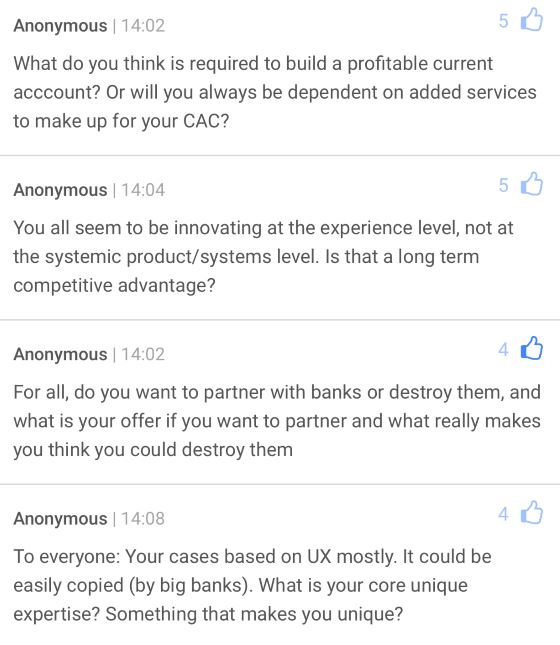

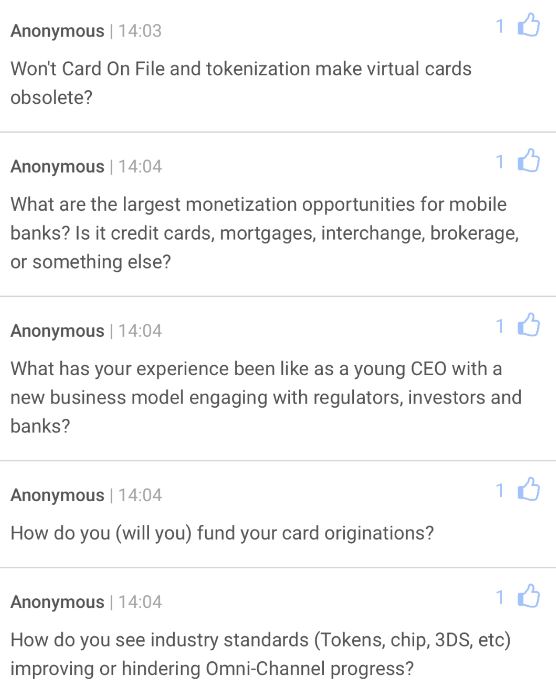

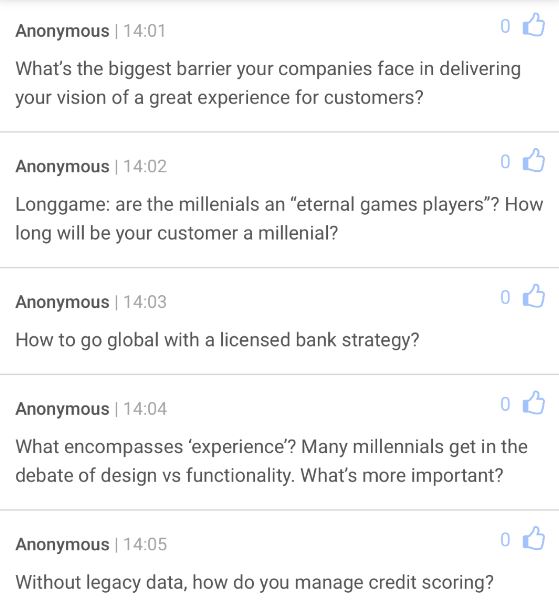

What amazed me about the session is that a torrent of questions were raised by the end, based upon the Sli.do app. Here is a shoRt, uncomprehensive list, that will give you a flavour:

I think there was quite a lot of scepticism in the audience, with the majority of questions coming down to the fact that the firms were focused upon the user experience and not product or service innovation at the back end. The companies obviously didn’t agree with this. One made the point that they’re using cloud and data analytics for cards, rather than COBOL mainframes that are used by all of the existing large, American card companies. But that’s not changing the game guys, as that’s just a different technology stack on the same product.

I think that’s where many start-ups get their views of the world wrong, as they think it’s a tech change that makes them cool. Look, we’ve added gaming to banking, isn’t this cool? It is cool, but it hasn’t changed the core bank product stack.

Quite a few attacked the idea you could make sustainable business out of taking percentage points off interchange fees, but hey, that’s how banks and card companies have made a sustainable business for the past fifty years, so you’re not getting away with that one.

What did strike me as we had all this dialogue though, is that all of the banks revenue models of payments and lending are being eaten, leaving them with pure deposits. That’s not a sustainable business model either.

All in all, I'm not saying that the firms above had nothing innovative or that banks are safe, just that it would be nice to see more companies focused upon changing the product stack than just the technology stack of financial services.

Anyways, more tomorrow. Byes for now.

Descriptions of each firm from CrunchBase:

N26 is a young company based in Berlin that aims to revolutionize the traditional banking industry and how people spend, save and send money. N26 is Europe's most modern way of banking. With N26 the current account is reinvented.

Chime (chimebank.com) is a San Francisco-based start-up with a mission to help our members lead healthier financial lives. Founded by financial and tech industry veterans Chris Britt and Ryan King, Chime is the leading branchless bank account designed to help people avoid fees, save money automatically, and improve their finances. We’ve created a new approach to banking that doesn’t rely on fees or profit from members’ misfortune or mistakes. Chime Members get a debit card, a Spending Account, a Savings Account, and a powerful app that makes financial automation simple and keeps members in control. The Chime app is available for iPhone and Android devices and has been featured as one of the best new Money Management apps on the App Store.

Final is an Oakland-based start-up focused on combating fraud online and offline, while giving consumers more control over their spending. The credit card start-up provides its users with a physical card and a mobile application that protects the user’s account from fraud, theft, breaches, and card cancellation. Through its application, the company allows its users to give a credit card number to each merchant or a disposable one-time use number for one-off purchases, and provides view of transactions and buying habits. Founded in 2014, Final is a venture-backed company that went through Y Combinator in Winter 2015.

Long Game designs fun and engaging customer experiences on top of savings products to encourage responsible financial planning. The personal finance app allows its users to play games and win cash prizes up to $1 million.

Zero is the first banking experience to combine the balance oversight of a debit card with the rewards of a credit card. Zero was built on the belief that people shouldn’t be required to take on debt just to get cash back on their spending. Zero is powered by a mobile app and Zerocard, a solid metal card that comes in four levels, varying by rewards percentage and minimum annual spend to qualify. The highest level card, Zerocard Carbon, gives customers 3% cash back on all purchases. Zero is waiving the minimum spend requirements for a limited time for people who sign up for early access at zerofinancial.com and successfully invite friends to also sign up.

Zerocard acts like a debit card, where deposits and withdrawals appear in one place in the app with a real-time, net balance. Unlike debit cards, however, it processes on credit card networks, thus allowing users to earn a flat cash back rate on all spending regardless of category. Cash rewards are unlimited and automatically deposited on a monthly basis. Zero also gives customers higher interest on deposits than leading savings accounts and has none of the typical fees charged by traditional banks. Other features include an Intelligent Advisor that forecasts balances, no ATM fees at more than 50,000 locations, and customer support via in-app live chat. Zero’s investors include ENIAC Ventures, New Enterprise Associates, Nyca Partners, Lightbank, and Middleland Capital.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...