I finally finished writing my new book. I’m not going to say too much about it, as it now has to go through a lengthy editing cycle and will be released next year. A key theme in the new book is financial inclusion and, to those ends, I made a visit to Hangzhou, China, to meet the executive team of Ant Financial. The conclusion of that visit is a lengthy (25,000 word) review of the past, present and future of Ant Financial, which forms a critical case study in the new book. To give you a flavour of what I discovered, here’s a short summary.

“When Alipay was created, we hoped to create an equal environment in China so that everyone can have equal access to financial support. We hoped to see that every honest person, every good person, even though penniless, can create sufficient wealth and value for one’s honesty and virtues.” Jack Ma, Chairman of Alibaba and Ant Financial

As Americans struggle with the pains of Chip & PIN and Europeans embrace contactless payments, China has leap-frogged us all. In 2016, Chinese consumers spent $5.5 trillion through their mobile apps. That’s more than any other economy and many predict that China will be first major economy to be completely cashless. The chosen mobile payment system for most Chinese citizens is Alipay, and the company has recently started to expand its footprint globally. Where is it going next? During the summer, I was lucky enough to be invited to join Alibaba’s annual Netrepeneurs conference in Hangzhou, China, to find out. Netrepeneurs is where the star sellers on Alibaba’s Taobao platform are invited for a celebration of their success. I was there to find out more about Ant Financial and their mobile payments app, Alipay.

Many of you may have heard of Alipay, but it is not the Chinese version of PayPal, as many think. In fact, it bears no relationship or resemblance to anything we see in Europe or America. It is distinctly Chinese and, having been born out of a need to trade, is now moving towards global dominance. Few would have imagined this a few years ago, and yet Ant Financial’s ambition are immense. As Eric Jing, CEO, announced at Davos in January, their ambition is to reach two billion consumers by 2025. That’s some ambition for a firm that began as an offspring of Alibaba back in 2003. Back then, Alibaba had just launched Taobao, an online platform to enable small businesses to sell their goods direct to consumers in China. Think of it as a mixture of eBay and Amazon, and you get a good idea of the marketplace Taobao offers. In fact, I used Taobao whilst in Hangzhou to buy some craftworks, and they arrived at my hotel the day after ordering. Both cheap and impressive. However, unlike the American websites where consumers trusted that sellers would send the goods, Chinese consumers just didn’t believe it. In the Chinese culture, there is zero trust. It must be gained. This is unlike our Western cultures that naturally trust people to begin with, until trust is lost.

The Chinese culture of zero trust was a huge potential barrier to Taobao’s operations, as it meant no one would order anything online as they didn’t believe they would receive it. Equally, the sellers would not send anything to a buyer until they had their money. A problem. The problem was solved by telling sellers to fax their orders to Alibaba’s offices, and Alibaba would take the money in escrow. This meant that sellers could trust they would get the money, so they would send the goods. Buyers knew that their money was being held safely until they told Alibaba it was ok to pay. And it worked! Taobao’s sales grew steadily after the fax escrow service Alipay was launched, and no one has ever looked back since.

Nevertheless, the stand out part of the process for me was hearing about how archaic the original system was. Fax machines? And Alibaba had to set up links with the banks to transmit the monies manually. How far things have changed, in that today’s Alipay monitors every transaction from its 450 million users, in real-time with artificial intelligence monitors constantly searching for potentially fraudulent transactions. That is a far cry from where they started, but then the company has refreshed its systems architecture four times in the last twelve years and has just embarked in another refresh. They moved from basic escrow services to real-time payments to cloud to microservices, and are now working on their new machine learning and super intelligent structure. A structure that can process 250,000 transactions per second today, and is architecting systems that will scale to over 100 billion transactions per day. To put that in perspective, Visa and MasterCard handle just over 60 billion transactions per year combined, and average near 2,000 transactions per second. This is some operation, but the operation is different, as it is new and designed totally for customer need. There is no payment or bank thinking in Alipay and Ant, just a technology firm that wants to enable the best customer experience.

This is one key part of their thinking, and I heard this repeatedly. For example, Western media is very excited about Ant Financial’s money market fund called Yu’e Bao (Hidden Treasure). The reason they are excited is that it is the biggest money market fund in the world, exceeding $165 billion of assets under management in February when it raced past JP Morgan’s US government money market fund, which has $150 billion and was previously the largest global fund of its kind. But Yu’e Bao isn’t really a money market fund, as we think of it. It is a method for consumers to store a balance to spend on Taobao, and get some interest. Alternatively, it’s a micro savings tool in a mobile wallet that gives rural Chinese consumers a place to save their yuan. Most of these Chinese citizens had nowhere to store money before, as there were no banks in the village. This is a critical part of Alibaba and Ant’s story: the learning of how to serve the un(der)served.

Most of their customers are tiny businesses that can now sell across the world. Most of their Taobao entrepreneurs are young people with bright ideas, who can go from selling a few items online to becoming a megastore through imagination and application. All this emerging in an economy that just twenty years ago required bank tellers to take a proficiency test in using an abacus before they got the job. How fast things move in China.

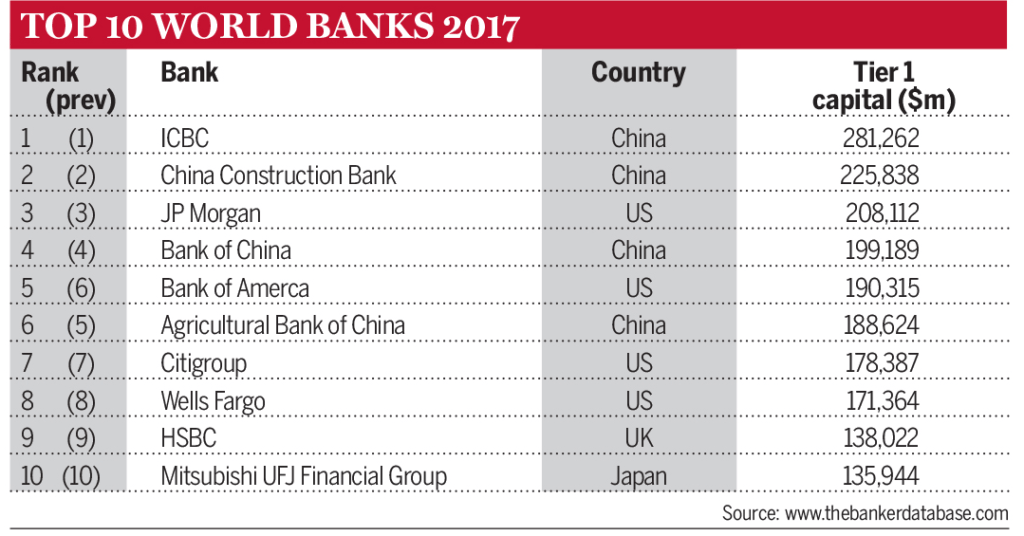

I guess we all know this though, as a decade ago I was predicting that the biggest banks in the world would be Chinese and today, they are.

Source: The Banker magazine, July 2017

Does Alipay threaten these banks? Not really, as their customers are not the customers of banks. They are the unbanked and underbanked. This is why Ant Financial is now stretching its muscles overseas, with a wave of impressive joint ventures, investments and agreements over the past year. They are the majority shareholder of Paytm in India, serving 250 million citizens today and an ambition to double that by 2020. Ant Financial acquired Lazada’s payment service called Hellopay in Singapore in April 2017. Lazada is the Amazon of South-East Asia serving Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam. A deal with Ascent Money in Thailand was agreed in November 2016, rapidly followed by a partnership with Globe Telecom’s GCash in Indonesia and Mynt in the Philippines in February 2017.

Meanwhile, Alipay has signed deals with Ingenico and Wirecard to allow their customers to use the mobile app in Europe, and similar deals in the USA with Frist Data. Finally, there’s been a big scramble to acquire MoneyGram, the global remittance service provider, which spawned a head-to-head battle with Euronet. This got nasty, with Euronet saying that Americans surely couldn’t trust a Chinese company to store their sensitive data. That misses the mark however, as Ant Financial is not so much a Chinese company, as a global one, as demonstrated in the deals made over the last twelve months.

This is Ant Financial’s stated ambition: to serve the excluded. That is what their strategy is all about: inclusiveness. In fact, I was surprised to hear the story of the Ant Forest, as it’s all about making a better planet. Ant Forest is a game, but it’s part of the Alipay mobile wallet. The idea is that every time you pay, you can offset your carbon emissions in the app and add more points towards your goal of planting a tree. You can also see how your friends are doing, and steal some of their points when they’re not looking.

The results are impressive. The program launched in the summer of 2016 and, as of April 2017, had over 220 million users. These users had already contributed carbon emission reductions of 5,000 tons per day. It has further planted a total of 8.45 million trees, which reduce carbon emissions another 2,500 tons per day.

Generally, the message sent by everyone I met in Hangzhou was that they’re trying to make a better planet and society, giving everyone the opportunity to achieve with a consciousness. This was the most surprising part of my stay with them, to be honest, as I never expected to hear about making better people, better society and a better planet, but that message was embodied in everything they do. It is a passion, and one that is exuded by the founder of all of this: Jack Ma.

Jack Ma really understands the technology platform play that is in play today. If you are not aware of the platform revolution, it is the story of the Ubers, Airbnb’s and Facebooks of the world, where you have the largest taxi firm that owns no cars, the largest hotel group that owns no hotels and the largest content firm that creates no content. This is because Uber, Airbnb and Facebook provide the platform that connects those with cars to passengers, those with rooms to tourists and those with stories to friends. This is what Alibaba is doing to commerce and Ant Financial to money. Alibaba doesn’t do commerce; it just provides the platform and, in an interview during the event, Jack Ma said the following:

“Management. The word is there for regular companies. At Alibaba, we treat it more like governing an economy, as we have to manage so many companies’ dependent upon us as partners. Any SME with an idea now has a way to realize that idea. Alibaba marketplace can find you buyers and sellers; we can provide you with computing through cloud; we can distribute and deliver your products. By 2036 we will have built an economy that can support 100 million businesses for billions of users. We won’t own that economy. We will just govern it.”

He went on to talk about the idea that things are Made In China or Made in India will become redundant soon, as there are just things that are Made Internet. Everything will be digitally distrusted and managed, with a few key platforms providing the services. Alibaba and Ant Financial will be those key platforms for money and commerce across the world, not just in China.

That was my final learning about their strategy I guess. Ant Financial does not intend to create and launch services everywhere in the world, but want to take their experiences globally and partner locally to share that knowledge and their technologies. They do not impose an Ant Financial way of doing things on their partners in India and Asia, but offer access to all of their technologies and services to those third parties, to get them up and running quicker. This was no better demonstrated than my meeting with Vijay Shekhar Sharma, the CEO and founder of Paytm.

Vijay has an amazing enthusiasm for everything, and was star struck by Alibaba and Jack Ma when he first came to see what they were doing in 2012. Now, he runs one of the largest mobile payment wallets anywhere, Paytm, and much of it is based upon the technologies and experiences of Ant Financial. I said to Vijay that it’s interesting that he’s creating the Alipay for India and he corrected me by saying that it’s not creating the Alipay for India. It’s creating the Paytm for India. This is critical to their thinking. Alibaba and Alipay are taking over the world. They’re just not doing it by owning everything, but partnering with everyone. That is what a platform player does, and it strikes to the heart of that comment from Jack Ma about Alibaba having a complex network of companies that they manage as an economy. It is not a company. It is an ecosystem. It is also a fascinating firm to watch that is already the largest payment processors on Earth by volume and, if it gets its two billion users by 2025, may well be by value too.

In conclusion, Ant Financial’s aim is inclusion. Bearing in mind that around two-thirds of the world’s population are financially excluded, that’s a laudable ambition. It’s not a charitable one though. McKinsey research published in September 2016 found that the widespread adoption and use of digital finance could increase the GDPs of all emerging economies by 6 percent, or a total of $3.7 trillion, by 2025. No wonder Ant Financial want a piece of that action.

This case study was originally published in the October edition of The Banker magazine.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...