The world feels fairly surreal sometimes. I watch the relentless rise in price of bitcoin, ether, litecoin and brethren, and feel it’s just a truly weird moment we’re living in. I’ve never seen assets rising 1000% of, in ether’s case, 5000% in a year. It’s crazy.

Alongside this, I see exchanges being hacked on a regular basis – the latest being Bitfinex - and ICOs appearing and disappearing almost everyday – the latest being Configo (some sort of con anyway) - and I feel a little confused. Or am I?

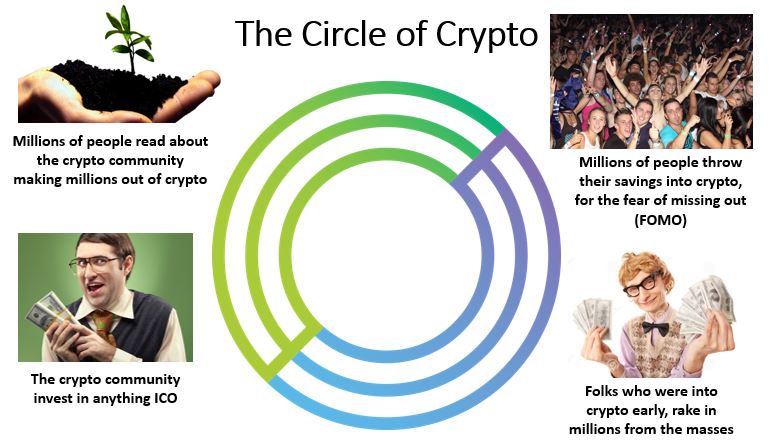

Actually, I just had this idea recently that it’s the circle of crypto, a bit like the circle of life but with money. Real money. In the circle of life, you have the death of the old refreshed with the birth of the new. With the circle of crypto, you have the death of old money with the birth of new. In this case, real US dollars, euros and yuan are being replaced with bitcoins, ether and monero.

You see, ignorant people who have no idea what these cryptocurrencies are, are now plying all their savings into buying the assets because they’re seeing 1000%+ rise in their value. But their value is only rising because millions of people who have no idea what cryptocurrencies are, are plying their savings into them.

Meanwhile, you’ve got a lot of geeks, nerds and technologists, who had large numbers of these cryptocurrencies in their earliest state. These are the guys who had 1,000 bitcoins for $2,000 at the start of the decade. They now have 1,000 bitcoins worth $6,000,000. Great. For these people, if they take $60,000 out of their bitcoin wallet and put it into Configo, it’s no big deal. And if Configo folds and disappears with their $60,000, that’s also no big deal because (a) they still have $6 million worth of bitcoin and (b) for every Configo that disappears there’s a lot of other decent ones out there, that are likely to return a further $6 million or more over the next years.

In other words, the madness of crowds has worked again but, unlike a tulip or South Sea Bubble, which was a singular asset with a binary win or lose return, the crypto bubble is very different. The circle of crypto is taking a singular asset – fiat currencies – and spreading them into 1000s of decentralised start-up systems. It is fascinating to watch, and I have no idea what the end game will be, but I am still of the view that a global network needs a global currency and one of these cryptos will be the one. In fact, there may be more than one. Watch this space.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...