I visited Tallinn towards the end of last year. If you’re not familiar it’s the capital of Estonia, a country that is the most advanced digital economy in Europe. This all began due to a hack ten years ago, when intrepid Russians were commissioned to destabilise the country’s economy. This hack led to Estonia rapidly working on a digitalisation program to avoid such a cyberattack succeeding ever again.

The country has everything from all government activities – tax, voting, customs, land registry, etc – all education, healthcare, business and more digitalised, as can be seen in this brochure.

I learnt a lot about Estonia in fact from David Piesse, Global Insurance Lead for Guardtime Ltd, an Estonian based software security company formed in 2007 to develop digital signatures using blockchain technologies. David presented at a conference I attended, and he kindly shared his presentation with me.

The presentation starts with the story of the first state-sponsored cyberattack on Estonia by Russia in 2007. If you were unaware, this happened in April 2007 and was reported in The Guardian as follows:

A three-week wave of massive cyber-attacks on the small Baltic country of Estonia, the first known incidence of such an assault on a state, is causing alarm across the western alliance, with NATO urgently examining the offensive and its implications.

While Russia and Estonia are embroiled in their worst dispute since the collapse of the Soviet Union, a row that erupted at the end of last month over the Estonians' removal of the Bronze Soldier Soviet war memorial in central Tallinn, the country has been subjected to a barrage of cyber warfare, disabling the websites of government ministries, political parties, newspapers, banks, and companies.

NATO has dispatched some of its top cyber-terrorism experts to Tallinn to investigate and to help the Estonians beef up their electronic defences.

NATO’s cybersecurity response was to make Tallinn its centre for the NATO Cooperative Cyber Defense Centre, and helped the country to set up a nationwide electronic ID system that has resulted in 100% of all health records and 100% of banking transactions all conducted online. This is why Estonia has the lowest levels of credit card fraud anywhere in Europe.

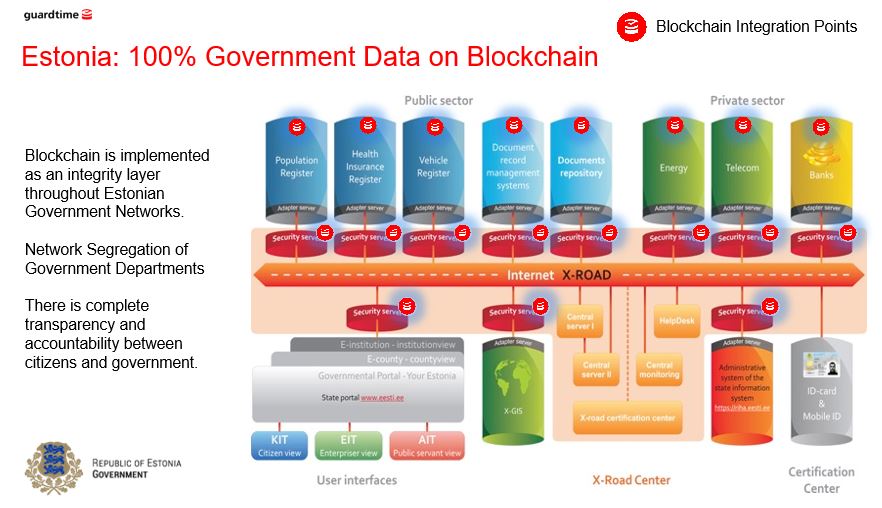

It also made radical differences to how the country operates, with 99% of state services online and 100% of government data on a shared ledger blockchain system.

In fact, Estonia’s the only country that could run on a USB stick, as the head of state could download all of the country’s data and carry it around in their pocket.

Another interesting facet of Estonia’s development is its e-residency program, where anyone can register and become a member of Estonia and set up and run a business based there, without physically having to move to the country. So far over 27,000 people from 143 countries have become e-residents, with over 4,000 businesses set up with full access to the European Union’s borderless world. In fact, more people applied to become e-residents in Estonia in 2017 than were actually born in the country. The figures from the country's official statistics bureau show that by November, 11,096 people had applied for e-residency in 2017 - that's 827 more than the number of babies born in the same period.

Just to top the whole thing off, it’s also the only country looking to transform through issuing its own cryptocurrency, must to the annoyance of the European Central Bank. Mario Draghi, president of the European Central Bank, warned Estonia when the estcoin idea was first floated that “no member state can introduce its own currency.” Even so, Estonia’s figured out a way around that challenge by creating a token for its e-residents to trade in. Amazing developments and a truly innovative country.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...